Question: please solve using excel Treasury notes and bonds. Use the information in the following table: Assume a $100,000 par value. What is the yield to

please solve using excel

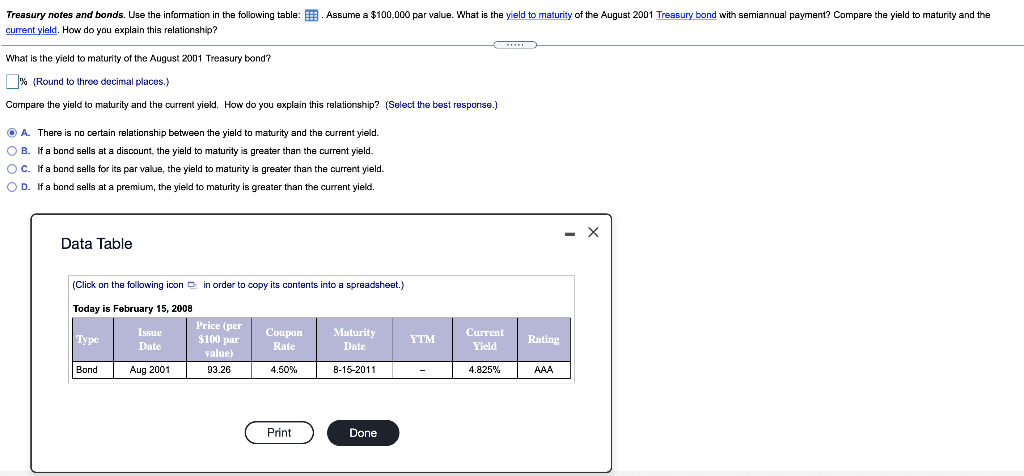

Treasury notes and bonds. Use the information in the following table: Assume a $100,000 par value. What is the yield to maturity of the August 2001 Treasury bond with semiannual payment? Compare the yield to maturity and the current yleld. How do you explain this relationship? What is the yield to maturity of the August 2001 Treasury bond? % (Round to three decimal places.) Compare the yield to maturity and the current yield. How do you explain this relationship? (Select the best response.) O A. There is no certain relationship between the yield to maturity and the current yield. OB. If a bond sells at a discount, the yield to maturity is greater than the current yield. OC. If a bond sells for its par value, the yield to maturity is greater than the current yield. OD. If a bond sells at a premium, the yield to maturity is greater than the current yield. Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Price (per Issue Type $100 par Date Falue) Bond Coupon Rate Maturity Date YTM Current Yield Rating Aug 2001 93.26 4.50% B-15-2011 - 4.825% AAA Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts