Question: Please solve using formulas and not excell or financial calculator and show steps as well please Use the following to answer questions 1-5 The Whilst

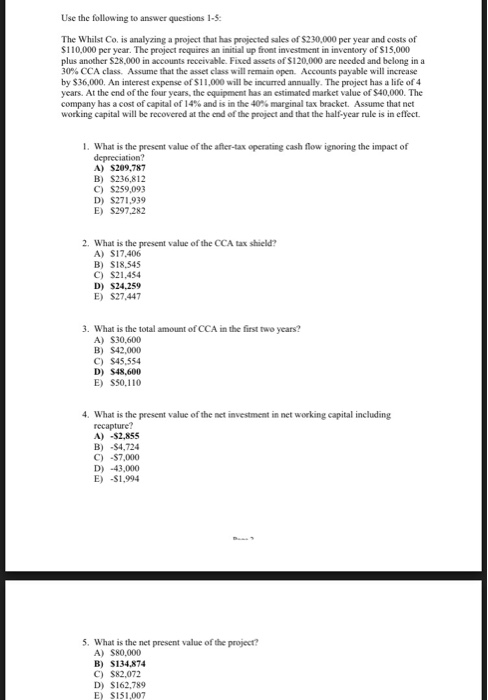

Use the following to answer questions 1-5 The Whilst Co, is analyzing a project that has projected sales of $230,000 per year and costs of $110,000 per year. The project requires an initial up front investment in inventory of S15,000 plus another $28,000 in accounts receivable. Fixed assets of $120,000 are needed and belong in a 30% CCA class. Assume that the asset class will remain open. Accounts payable will increase by $36,000, An interest expense of $11,000 will be incurred annually. The project has a life of 4 years. At the end of the four years, the equipment has an estimated market value of $40,000. The company has a cost of capital of 14% and is in the 40% marginal tax bracket. Assume that net working capital will be recovered at the end of the project and that the half-year rule is in effect. 1. What is the present value of the after-tax operating cash flow ignoring the impact of A) $209,787 B) $236,812 C) $259,093 D) $271,939 E) $297.282 2. What is the present value of the CCA tax shield? A) $17.406 B) S18,545 C) S21,454 D) $24,259 E) $27,447 3. What is the total amount of CCA in the first two years? A) S30,600 B) $42,000 C) $45,554 D) $48,600 E) S50,110 What is the present value of the net investment in net working capital including A) -$2,855 B) -$4,724 C) -$7,000 D) -43,000 E) -$1.994 5. What is the net present value of the project? A) $80,000 B) $134,874 C) $82,072 D) $162,789 E) S151,007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts