Question: please solve using formulas no excel please thank you so much! QUESTION 6 Depreciation, taxes and source of finance Compute the first two years of

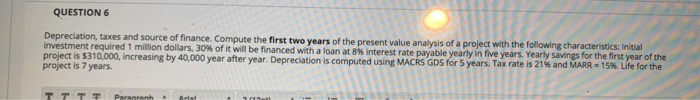

QUESTION 6 Depreciation, taxes and source of finance Compute the first two years of the present value analysis of a project with the following characteristics: Initial investment required 1 million dollars, 30% of it will be financed with a loan at 8% Interest rate payable yearly in five years. Yearly savings for the first year of the project is $310,000, increasing by 40,000 year after year. Depreciation is computed using MACRS GDS for 5 years. Tax rate is 21% and MARR = 15%. Life for the project is 7 years QUESTION 6 Depreciation, taxes and source of finance Compute the first two years of the present value analysis of a project with the following characteristics: Initial investment required 1 million dollars, 30% of it will be financed with a loan at 8% Interest rate payable yearly in five years. Yearly savings for the first year of the project is $310,000, increasing by 40,000 year after year. Depreciation is computed using MACRS GDS for 5 years. Tax rate is 21% and MARR = 15%. Life for the project is 7 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts