Question: Please solve using hand not excel if possible thank you very much A car parts manufacturing company is considering investing in the development of a

Please solve using hand not excel if possible thank you very much

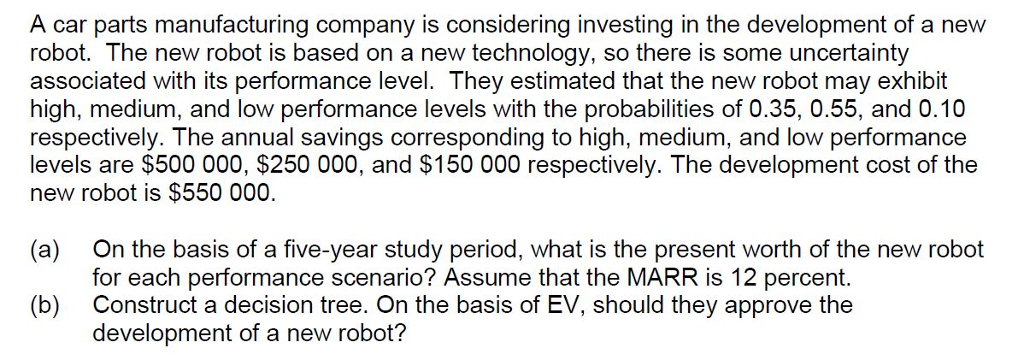

A car parts manufacturing company is considering investing in the development of a new robot. The new robot is based on a new technology, so there is some uncertainty associated with its performance level. They estimated that the new robot may exhibit high, medium, and low performance levels with the probabilities of 0.35, 0.55, and 0.10 respectively. The annual savings corresponding to high, medium, and low performance levels are $500 000, $250 000, and $150 000 respectively. The development cost of the new robot is $550 000. (a) On the basis of a five-year study period, what is the present worth of the new robot for each performance scenario? Assume that the MARR is 12 percent. (b) Construct a decision tree. On the basis of EV, should they approve the development of a new robot? A car parts manufacturing company is considering investing in the development of a new robot. The new robot is based on a new technology, so there is some uncertainty associated with its performance level. They estimated that the new robot may exhibit high, medium, and low performance levels with the probabilities of 0.35, 0.55, and 0.10 respectively. The annual savings corresponding to high, medium, and low performance levels are $500 000, $250 000, and $150 000 respectively. The development cost of the new robot is $550 000. (a) On the basis of a five-year study period, what is the present worth of the new robot for each performance scenario? Assume that the MARR is 12 percent. (b) Construct a decision tree. On the basis of EV, should they approve the development of a new robot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts