Question: Please solve using Microsoft Excel Bianca takes out a 30 -year mortgage of $400,000 at an effective annual interest rate of i. However, after making

Please solve using Microsoft Excel

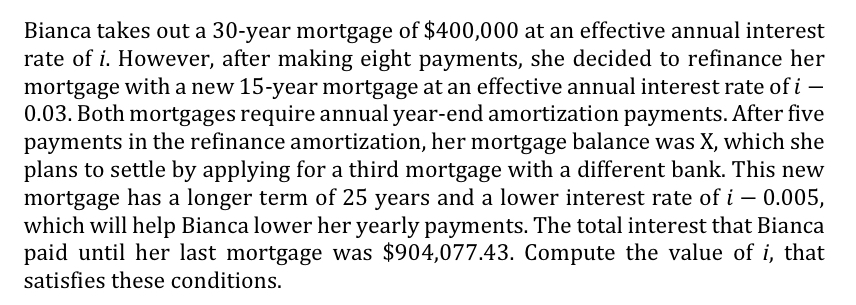

Bianca takes out a 30 -year mortgage of $400,000 at an effective annual interest rate of i. However, after making eight payments, she decided to refinance her mortgage with a new 15-year mortgage at an effective annual interest rate of i 0.03 . Both mortgages require annual year-end amortization payments. After five payments in the refinance amortization, her mortgage balance was X, which she plans to settle by applying for a third mortgage with a different bank. This new mortgage has a longer term of 25 years and a lower interest rate of i0.005, which will help Bianca lower her yearly payments. The total interest that Bianca paid until her last mortgage was $904,077.43. Compute the value of i, that satisfies these conditions. Bianca takes out a 30 -year mortgage of $400,000 at an effective annual interest rate of i. However, after making eight payments, she decided to refinance her mortgage with a new 15-year mortgage at an effective annual interest rate of i 0.03 . Both mortgages require annual year-end amortization payments. After five payments in the refinance amortization, her mortgage balance was X, which she plans to settle by applying for a third mortgage with a different bank. This new mortgage has a longer term of 25 years and a lower interest rate of i0.005, which will help Bianca lower her yearly payments. The total interest that Bianca paid until her last mortgage was $904,077.43. Compute the value of i, that satisfies these conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts