Question: Please solve using paper, therefore I will be able to have a fully detailed answer!! Thanks so much in advance er S have an equity

Please solve using paper, therefore I will be able to have a fully detailed answer!! Thanks so much in advance

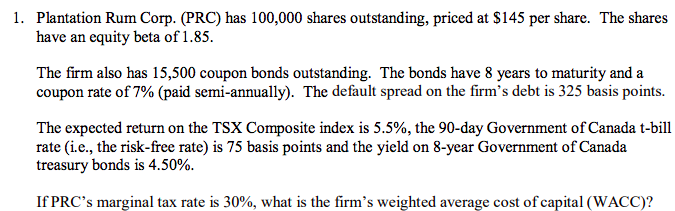

er S have an equity beta of 1.85. The firm also has 15,500 coupon bonds outstanding. The bonds have 8 years to maturity and a coupon rate of 7% (paid semi-annually). The default spread on the firm's debt is 325 basis points. The expected return on the TSX Composite index is 5.5%, the 90-day Government of Canada t-bill rate (i.e., the risk-free rate) is 75 basis points and the yield on S-year Government of Canada treasury bonds is 4.50%. If PRC's marginal tax rate is 30%, what is the firm's weighted average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts