Question: Please solve utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you. uppose the expected returns and standard deviations of Stocks

Please solve utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you.

Please solve utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you.

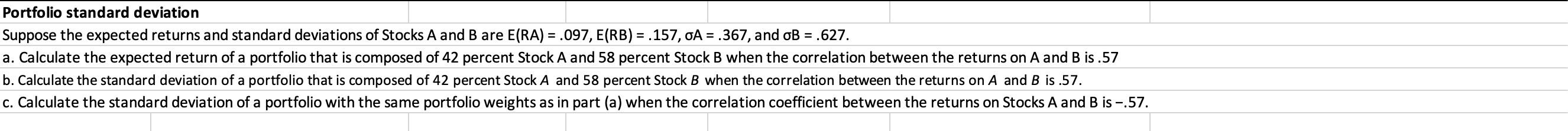

uppose the expected returns and standard deviations of Stocks A and B are E(RA)=.097,E(RB)=.157,A=.367, and B=.627. . Calculate the expected return of a portfolio that is composed of 42 percent Stock A and 58 percent Stock B when the correlation between the returns on A and B is .57 . Calculate the standard deviation of a portfolio that is composed of 42 percent Stock A and 58 percent Stock B when the correlation between the returns on A and B is .57. Calculate the standard deviation of a portfolio with the same portfolio weights as in part (a) when the correlation coefficient between the returns on Stocks A and B is -.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts