Question: please solve, will upvote ! Problem 3A-5 Transaction Analysis [LO3-5] Star Videos, Inc., produces short musical videos for sale to retail outlets. The company's balance

![please solve, will upvote ! Problem 3A-5 Transaction Analysis [LO3-5] Star Videos,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eb1a1dbd1d1_67766eb1a1d486b2.jpg)

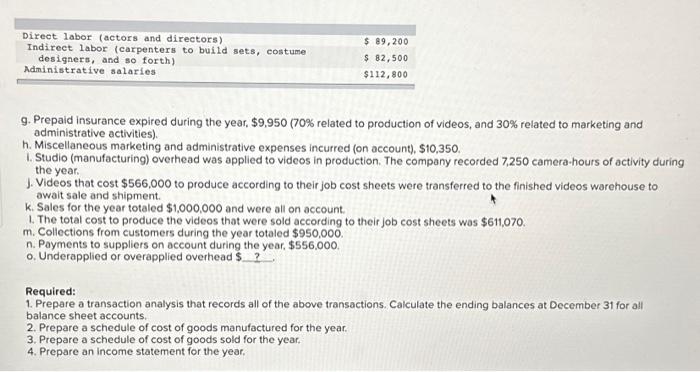

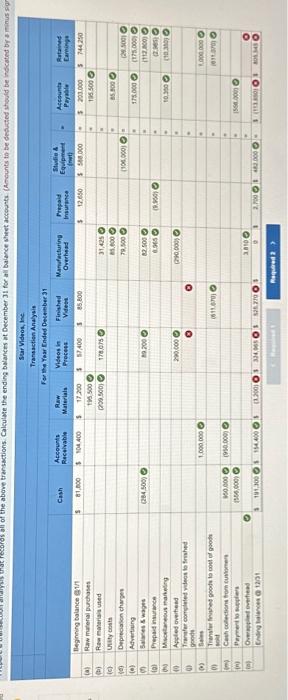

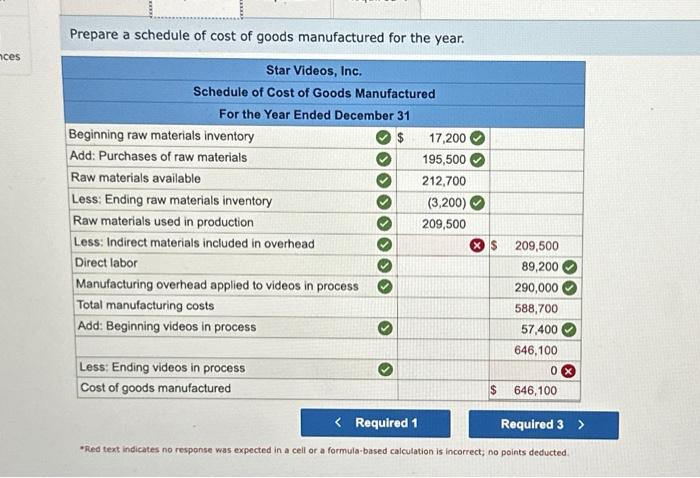

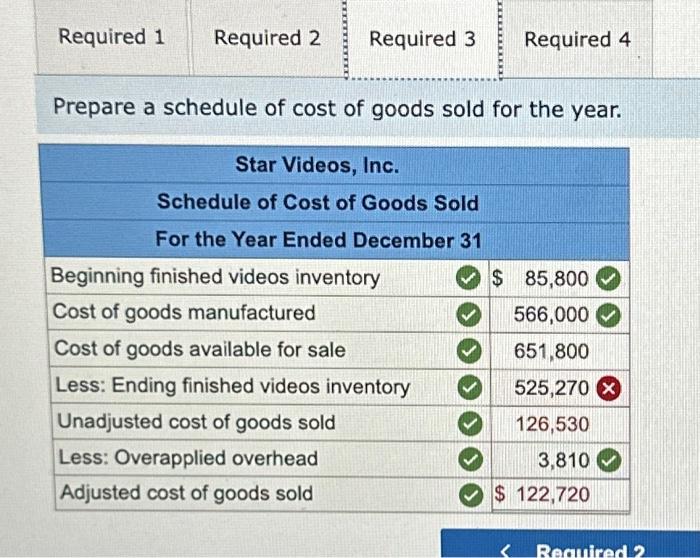

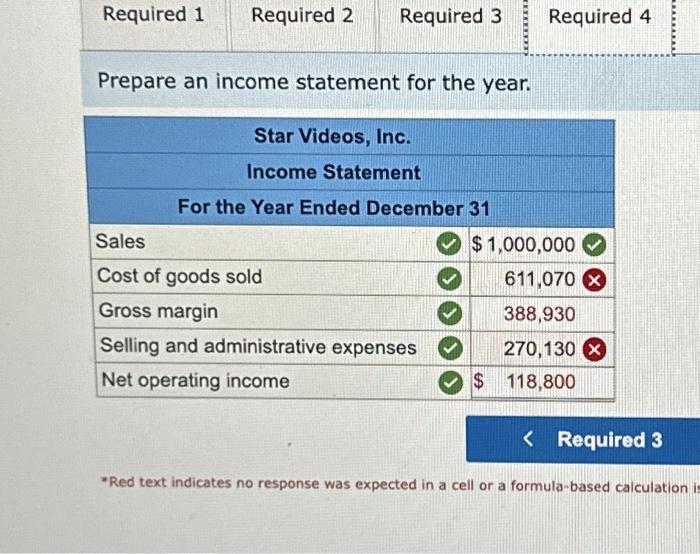

Problem 3A-5 Transaction Analysis [LO3-5] Star Videos, Inc., produces short musical videos for sale to retail outlets. The company's balance sheet accounts as of January 1 are given below. Because the videos differ in length and in complexity of production, the company uses a job-order costing system to determine the cost of each video produced. Studio (manufacturing) overhead is charged to videos on the basis of camera-hours of activity. The company's predetermined overhead rate for the year ( $40 per camera-hour) is based on a cost formula that estimated $280,000 in manufacturing overhead for an estimated allocation base of 7,000 camera-hours. Any underapplied or overapplied overhead is closed to cost of goods sold. The following transactions were recorded for the year: a. Film, costumes, and similar raw materials purchased on account, $195,500. b. Film, costumes, and other raw materials issued to production, $209,500(85% of this material was considered direct to the videos in production, and the other 15% was considered indirect). c. Utility costs incurred (on account) in the production studio, $85,800. d. Depreciation recorded on the studio, cameras, and other equipment, $106,000. Three-fourths of this depreciation related to actual production of the videos, and the remainder related to equipment used in marketing and administration. e. Advertising expense incurred (on account), $175,000. f. Salaries and wages paid in cash as follows: Prepare a schedule of cost of goods sold for the year. -Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted Prepare an income statement for the year. -Red text indicates no response was expected in a cell or a formula-based calculation 9. Prepaid insurance expired during the year, $9,950(70% related to production of videos, and 30% related to marketing and administrative activities). h. Miscellaneous marketing and administrative expenses incurred (on account), $10,350. 1. Studio (manufacturing) overhead was applied to videos in production. The company recorded 7,250 camera-hours of activity during the year. J. Videos that cost $566,000 to produce according to their job cost sheets were transferred to the finished videos warehouse to await sale and shipment. k. Sales for the year totaled $1,000,000 and were all on account. 1. The total cost to produce the videos that were sold according to their job cost sheets was $611,070. m. Collections from customers during the year totaled $950,000. n. Payments to suppliers on account during the year, $556,000. o. Underapplied or overapplied overhead \$? Required: 1. Prepare a transaction analysis that records all of the above transactions. Calculate the ending balances at December 31 for all balance sheet accounts. 2. Prepare a schedule of cost of goods manufactured for the year. 3. Prepare a schedule of cost of goods sold for the year. 4. Prepare an income statement for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts