Question: please solve with excel! Based on the expectations above of the real rates and the inflation rates for each of the next 5 years, you

please solve with excel!

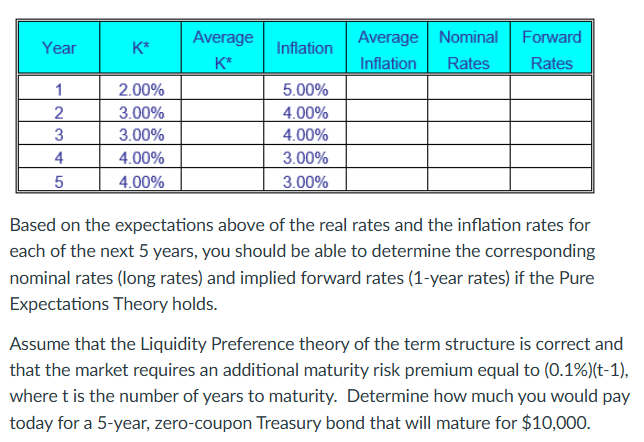

Based on the expectations above of the real rates and the inflation rates for each of the next years, you should be able to determine the corresponding nominal rates long rates and implied forward rates year rates if the Pure Expectations Theory holds.

Assume that the Liquidity Preference theory of the term structure is correct and that the market requires an additional maturity risk premium equal to t where t is the number of years to maturity. Determine how much you would pay today for a year, zerocoupon Treasury bond that will mature for $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock