Question: Please solve with excel formulas that would properly fill out this table. The Lunch Counter is expanding and expects operating cash flows of $62,100 a

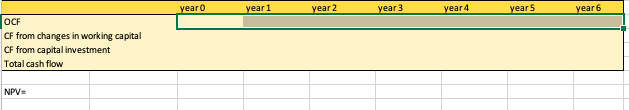

Please solve with excel formulas that would properly fill out this table.

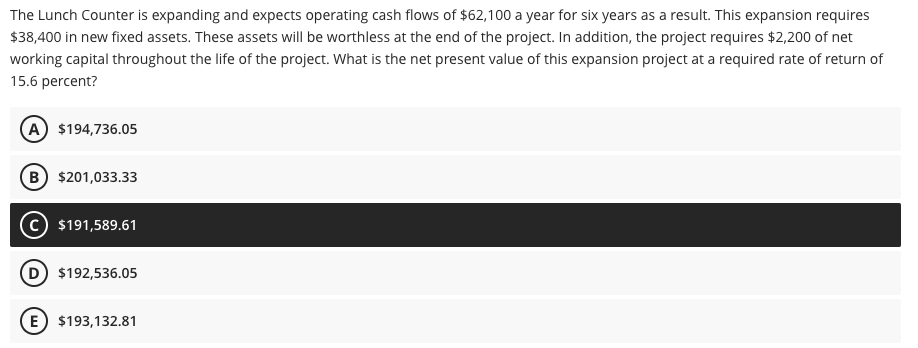

The Lunch Counter is expanding and expects operating cash flows of $62,100 a year for six years as a result. This expansion requires $38,400 in new fixed assets. These assets will be worthless at the end of the project. In addition, the project requires $2,200 of net working capital throughout the life of the project. What is the net present value of this expansion project at a required rate of return of 15.6 percent? A $194,736.05 B $201,033.33 $191,589.61 $192,536.05 E $193,132.81 year o year 1 year 2 year 3 year 4 year 5 year 6 OCF CF from changes in working capital CF from capital investment Total cash flow NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts