Question: please solve with excel. Problem The following is the payoff matrix for two alternate plans. Assume the probability of the market being receptive is known

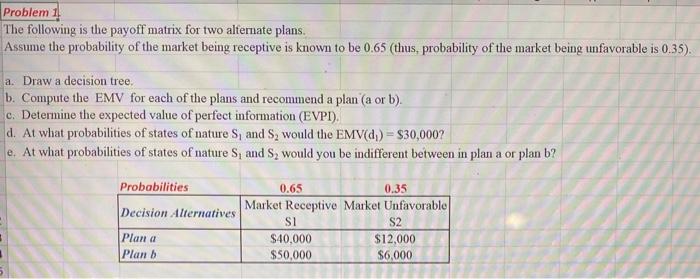

Problem The following is the payoff matrix for two alternate plans. Assume the probability of the market being receptive is known to be 0.65 (thus, probability of the market being unfavorable is 0.35). a. Draw a decision tree. b. Compute the EMV for each of the plans and recommend a plan (a or b). c. Determine the expected value of perfect information (EVPT). d. At what probabilities of states of nature S, and S, would the EMV(d) = $30,000? e. At what probabilities of states of nature S, and S, would you be indifferent between in plan a or plan b? Probabilities 0.65 0.35 Decision Alternatives Market Receptivo Market Unfavorable SI S2 Plan a $40,000 $12,000 Plan b $50,000 $6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts