Question: Please solve with excel solver!!!!! The A company. plans to evaluate project alternatives by concerning net present values (NPV), the capital requirements and the available

Please solve with excel solver!!!!!

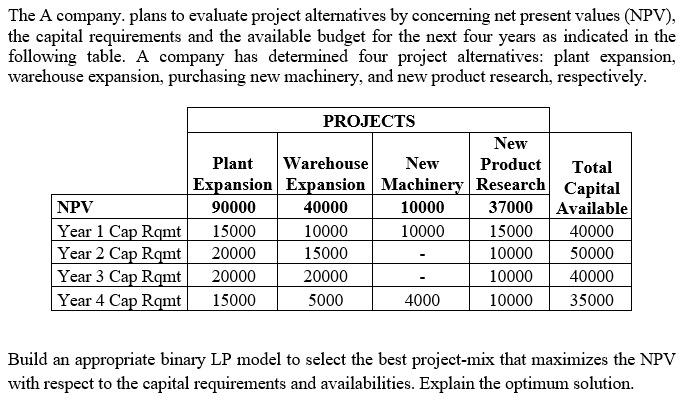

The A company. plans to evaluate project alternatives by concerning net present values (NPV), the capital requirements and the available budget for the next four years as indicated in the following table. A company has determined four project alternatives: plant expansion, warehouse expansion, purchasing new machinery, and new product research, respectively. PROJECTS New Plant Warehouse New Product Total Expansion Espansion Machinery Research Capital NPV 90000 40000 10000 37000 Available Year 1 Cap Rqmt 15000 10000 10000 15000 40000 Year 2 Cap Rqmt 20000 15000 10000 50000 Year 3 Cap Rqmt 20000 20000 10000 40000 Year 4 Cap Rqmt 15000 5000 4000 10000 35000 Build an appropriate binary LP model to select the best project-mix that maximizes the NPV with respect to the capital requirements and availabilities. Explain the optimum solutionStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock