Question: please solve with R and provide the codes too! A financial advising firm has devised an investment template for clients at various stages in their

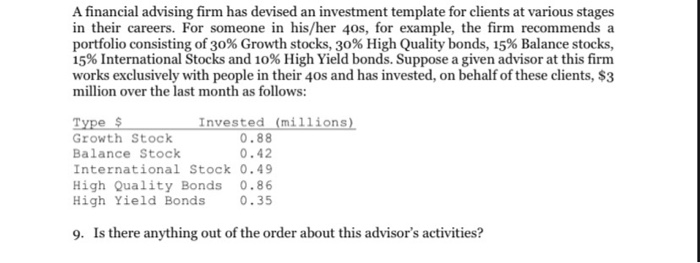

A financial advising firm has devised an investment template for clients at various stages in their careers. For someone in his/her 40s, for example, the firm recommends a portfolio consisting of 30% Growth stocks, 30% High Quality bonds, 15% Balance stocks, 15% International Stocks and 10% High Yield bonds. Suppose a given advisor at this firm works exclusively with people in their 40s and has invested, on behalf of these clients, $3 million over the last month as follows Type $ Invested (millions) Growth Stock 0.88 Balance Stock 0.42 International Stock 0.49 High Quality Bonds 0.86 High Yield Bonds 0.35 9. Is there anything out of the order about this advisor's activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts