Question: please solve with solutions 34-38 Please solve the following with its corresponding solutions for each number 34. Using the straight-line method, how much is the

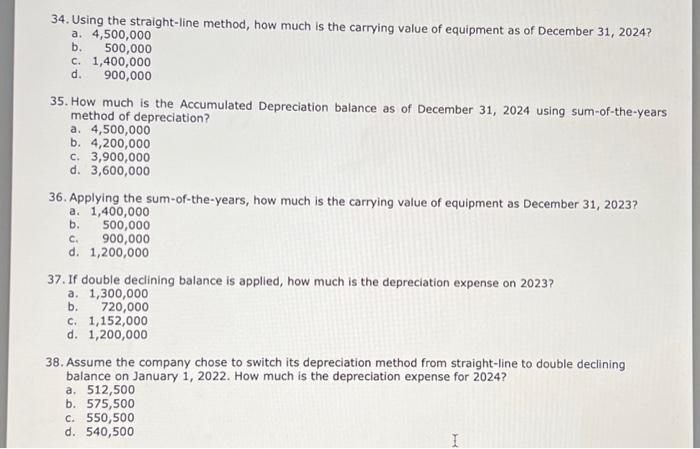

34. Using the straight-line method, how much is the carrying value of equipment as of December 31,2024 ? a. 4,500,000 b. 500,000 c. 1,400,000 d. 900,000 35. How much is the Accumulated Depreciation balance as of December 31,2024 using sum-of-the-years method of depreciation? a. 4,500,000 b. 4,200,000 c. 3,900,000 d. 3,600,000 36. Applying the sum-of-the-years, how much is the carrying value of equipment as December 31,2023 ? a. 1,400,000 b. 500,000 c. 900,000 d. 1,200,000 37. If double declining balance is applied, how much is the depreciation expense on 2023? a. 1,300,000 b. 720,000 c. 1,152,000 d. 1,200,000 38. Assume the company chose to switch its depreciation method from straight-line to double declining balance on January 1, 2022. How much is the depreciation expense for 2024? a. 512,500 b. 575,500 c. 550,500 d. 540,500 34. Using the straight-line method, how much is the carrying value of equipment as of December 31,2024 ? a. 4,500,000 b. 500,000 c. 1,400,000 d. 900,000 35. How much is the Accumulated Depreciation balance as of December 31,2024 using sum-of-the-years method of depreciation? a. 4,500,000 b. 4,200,000 c. 3,900,000 d. 3,600,000 36. Applying the sum-of-the-years, how much is the carrying value of equipment as December 31,2023 ? a. 1,400,000 b. 500,000 c. 900,000 d. 1,200,000 37. If double declining balance is applied, how much is the depreciation expense on 2023? a. 1,300,000 b. 720,000 c. 1,152,000 d. 1,200,000 38. Assume the company chose to switch its depreciation method from straight-line to double declining balance on January 1, 2022. How much is the depreciation expense for 2024? a. 512,500 b. 575,500 c. 550,500 d. 540,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts