Question: please solve with steps A: A 5-year bond has an 8.88 percent coupon rate and a $1,000 face value. If the yield to maturity on

please solve with steps

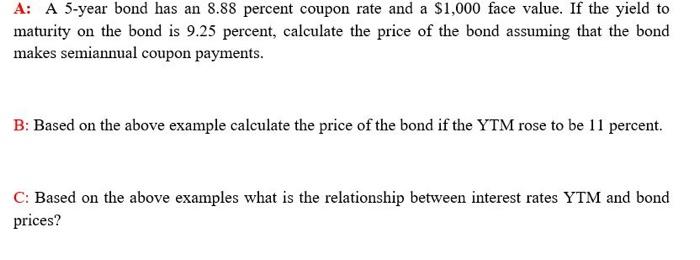

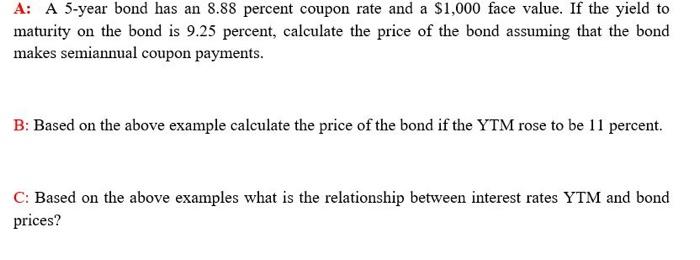

A: A 5-year bond has an 8.88 percent coupon rate and a $1,000 face value. If the yield to maturity on the bond is 9.25 percent, calculate the price of the bond assuming that the bond makes semiannual coupon payments. B: Based on the above example calculate the price of the bond if the YTM rose to be 11 percent. C. Based on the above examples what is the relationship between interest rates YTM and bond prices

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock