Question: please solve with very detailed steps. correct answer is provided solve all parts of 16 A company purchased a rope-braiding machine for $190,000. The machine

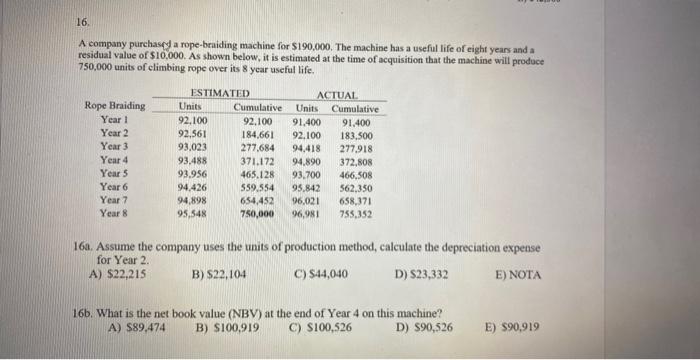

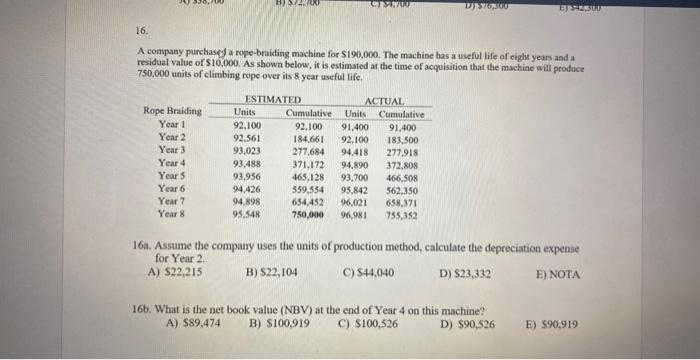

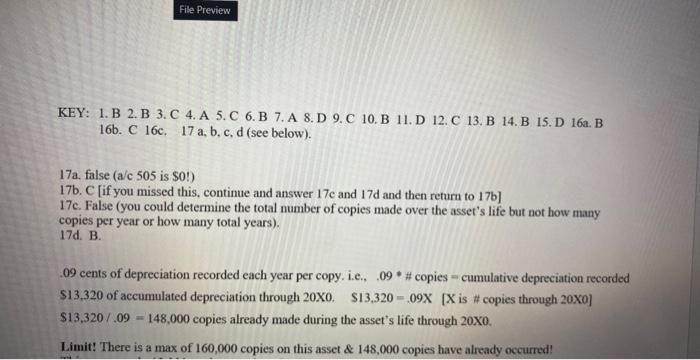

A company purchased a rope-braiding machine for $190,000. The machine has a useful life of eight years and a residual value of $10,000. As shown below, it is estimated at the time of acquisition that the machine will prodoce 750,000 units of climbing rope over its 8 year useful life. 16a. Assume the company uses the units of production method, calculate the depreciation expense for Year 2. A) $22,215 B) $22,104 C) $44,040 D) $23,332 E) NOTA 166. What is the net book value (NBV) at the end of Year 4 on this machine? A) $89,474 B) $100,919 C) $100,526 D) $90,526 E) $90,919 A company purchasy a rope-braiding machine for $190,000. The machine has a usefil life of eight yean and a residual value of $10,000. As shown below, it is estimated at the time of acquisition that the machine will produce 750,000 units of climbing rope over its 8 year useful life. 16a. Assume the company uses the units of production method, calculate the depreciation expense for Year 2. A) $22,215 B) $22,104 C) $44,040 D) $23,332 E) NOTA 16b. What is the net book value (NBV) at the end of Year 4 on this machine? A) 589,474 B) $100,919 C) $100,526 D) $90,526 E) $90,919 17a. false (a/c505 is $0!) 17b. C [if you missed this, continue and answer 17c and 17d and then return to 17b] 17c. False (you could determine the total number of copies made over the asset's life but not how many copies per year or how many total years). 17d. B. .09 cents of depreciation recorded each year per copy. i.e., .09 \# copies - cumulative depreciation recorded $13,320 of accumulated depreciation through 20X0. $13,320=,09X [X is \# copies through 20X0] $13,320/.09=148,000 copies already made during the asset's life through 20X0. Limit! There is a max of 160,000 copies on this asset \& 148,000 copies have already occurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts