Question: please solve with very detailed steps. correct answer is provided Solve for 17 and 18 17. Continue with the facts provided for Narrow Corporation and

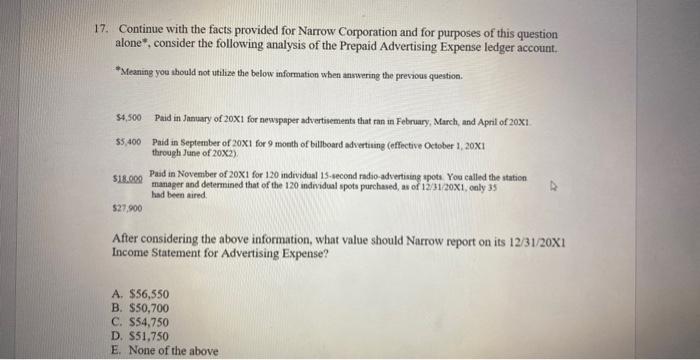

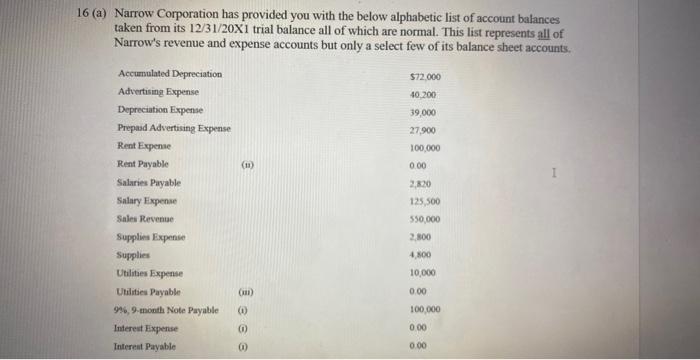

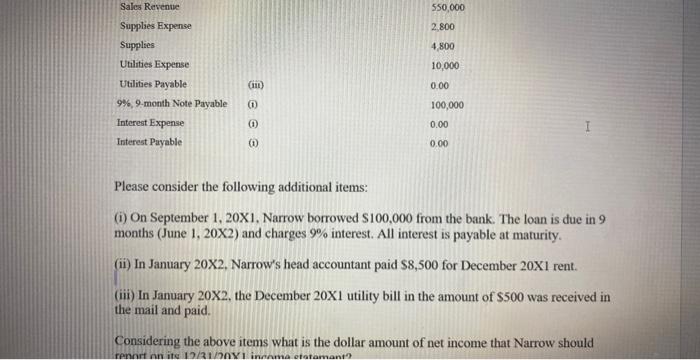

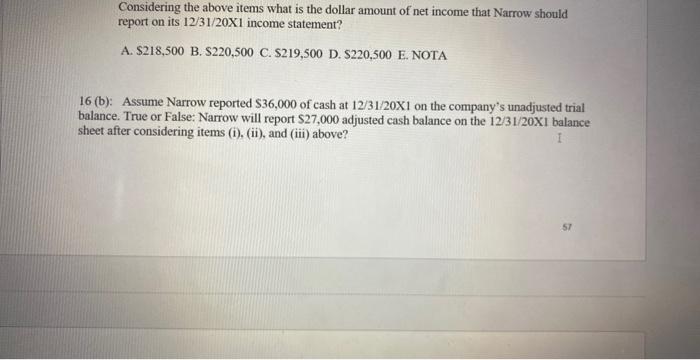

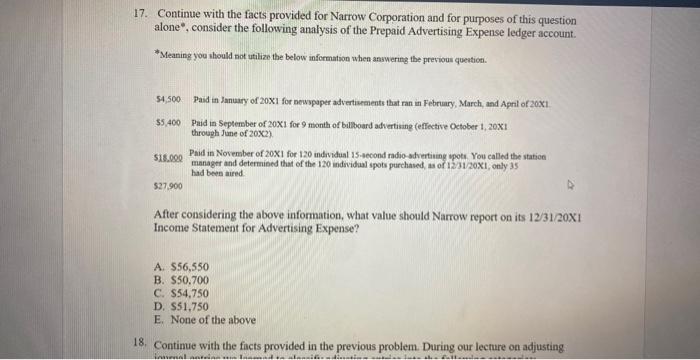

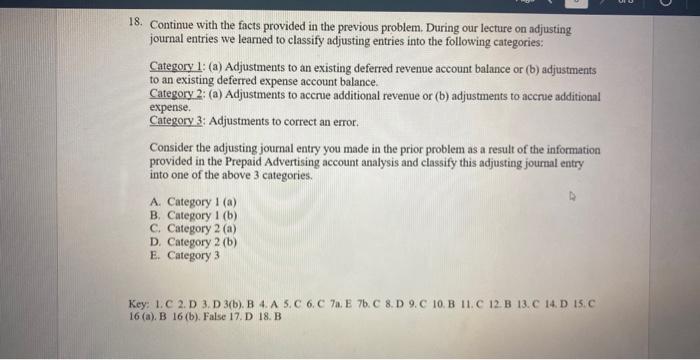

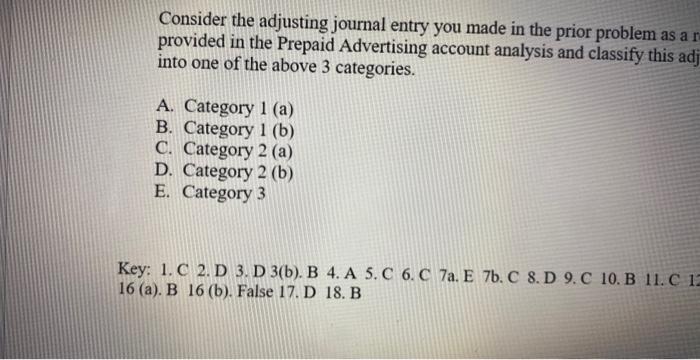

17. Continue with the facts provided for Narrow Corporation and for purposes of this question alone*, consider the following analysis of the Prepaid Advertising Expense ledger account. "Meaning you should not utilize the below information when answering the previous question. 54,500 Paid in January of 20X1 for newspaper advetivements that ran in February, March, and Apnl of 20X1. 55,400 Paid in September of 20X1 for 9 month of billboard advertiing (effective October 1, 20X1 through Jane of 202 ). 518.00e Paid in November of 201 for 120 indrividual 15 - second nadio-adventising apote You called the station manaper and determined that of the 120 indwidual spots purchased, as of 12/31/201, caly 35 527,900 After considering the above information, what value should Narrow report on its 12/31/20X1 Income Statement for Advertising Expense? A. $56,550 B. $50,700 C. 554,750 D. $51,750 E. None of the above 6 (a) Narrow Corporation has provided you with the below alphabetic list of account balances taken from its 12/31/20X1 trial balance all of which are normal. This list represents all of Narrow's revenue and expense accounts but only a select few of its balance sheet accounts. Please consider the following additional items: (i) On September 1,20X1, Narrow borrowed $100,000 from the bank. The loan is due in 9 months (June 1, 20X2) and charges 9% interest. All interest is payable at maturity. (ii) In January 20X2, Narrow's head accountant paid \$8,500 for December 20X1 rent. (iii) In January 20X2, the December 20X1 utility bill in the amount of $500 was received in the mail and paid. Considering the above items what is the dollar amount of net income that Narrow should Considering the above items what is the dollar amount of net income that Narrow should report on its 12/31/20X1 income statement? A. $218,500 B. $220,500 C. $219,500 D. $220,500 E. NOTA 16 (b): Assume Narrow reported $36,000 of cash at 12/31/20X1 on the company's unadjusted trial balance. True or False: Narrow will report $27,000 adjusted cash balance on the 12/31/20XI balance sheet after considering items (i), (ii), and (iii) above? 17. Continue with the facts provided for Narrow Corporation and for purposes of this question alone*", consider the following analysis of the Prepaid Advertising Expense ledger account. Teaning you should not utilize the below information when answering the precious queatiot. 54,500 Paid in Wanuary of 201 for newypaper advertisements that ran in February, March, and April of 201. 55.400 Paid in September of 201 for 9 mionth of billsoard advertising (effective Qetober 1,201 through June of 20x2 ). 518.002. Phid in November of 20X1 for 120 individual s5-3econd radio-sdvertising upoti. You called the station manager and determined that of the 120 indsidial spots purchased, as of 12.31/201, only 35 . had been aired. 527900 After considering the above information, what value should Narrow report on its 12/31/201 Income Statement for Advertising Expense? A. $56,550 B. $50.700 C. $54,750 D. $51,750 E. None of the above 18. Contimue with the facts provided in the previous problem. During our lecture on adjusting 18. Continue with the facts provided in the previous problem. During our lecture on adjusting journal entries we learned to classify adjusting entries into the following categories: Category 1: (a) Adjustments to an existing deferred revenue account balance or (b) adjustments to an existing deferred expense account balance. Category 2: (a) Adjustments to accrue additional revenue or (b) adjustments to accrue additional expense. Category 3: Adjustments to correct an error. Consider the adjusting journal entry you made in the prior problem as a result of the information provided in the Prepaid Advertising account analysis and classify this adjusting journal entry into one of the above 3 categories. A. Category 1 (a) B. Category 1 (b) C. Category 2 (a) D. Category 2 (b) E. Category 3 Key: 1. C 2. D 3. D 3(b). B 4. A 5. C 6. C 7a. E 7b. C 8. D 9. C 10. B 11. C 12. B 13. C 14. D 15.C 16 (a). B 16 (b). False 17. D 18. B Consider the adjusting journal entry you made in the prior problem as a provided in the Prepaid Advertising account analysis and classify this adj into one of the above 3 categories. A. Category 1 (a) B. Category 1 (b) C. Category 2 (a) D. Category 2 (b) E. Category 3 Key: 1. C 2. D 3. D 3(b). B 4. A 5. C 6. C 7a. E 7b. C 8. D 9.C 10. B 11. C 1 16 (a). B 16 (b). False 17. D 18. B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts