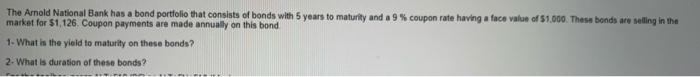

Question: please solve without using Excel The Arnold National Bank has a bond portfolio that consists of bonds with 5 years to maturity and a 9%

The Arnold National Bank has a bond portfolio that consists of bonds with 5 years to maturity and a 9% coupon rate having a face value of 51.000. These bands are selling in the market for $1,126. Coupon payments are made annually on this bond 1. What is the yield to maturity on these bonds? 2. What is duration of these bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts