Question: PLEASE SOLVING MATHEMATICAL MODELS AND LP EXCELL SOLVER PLEASE. I NEED IT QUICKLY. THANK YOU. Fox Enterprises is considering six projects for possible construction over

PLEASE SOLVING MATHEMATICAL MODELS AND LP EXCELL SOLVER PLEASE. I NEED IT QUICKLY. THANK YOU.

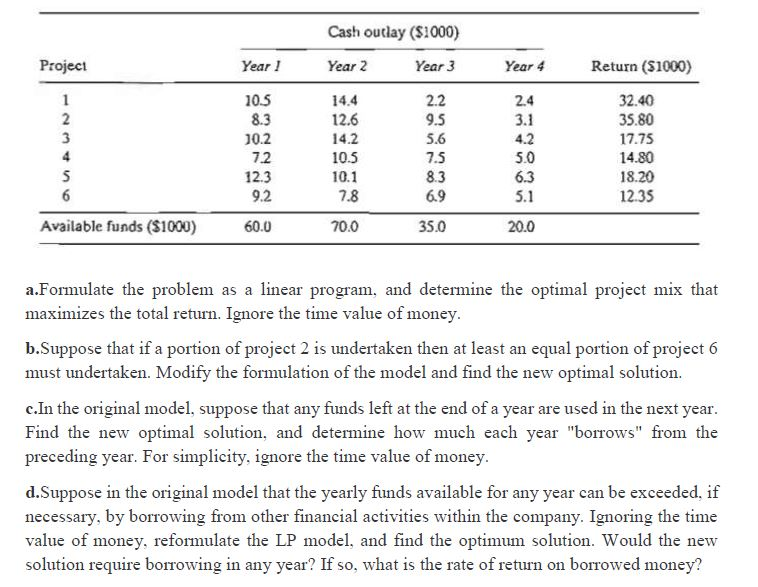

Fox Enterprises is considering six projects for possible construction over the next four years. The expected (present value) returns and cash outlays for the projects are given below. Fox can undertake any of the projects partially or completely. A partial undertak-ing of a project will prorate both the return and cash outlays proportionately.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts