Question: please some do this calculation for me. Part Two: Problems (60 marks; 15 marks for each problem) Problem 1-Financial Planning (15 Marks) The financial statements

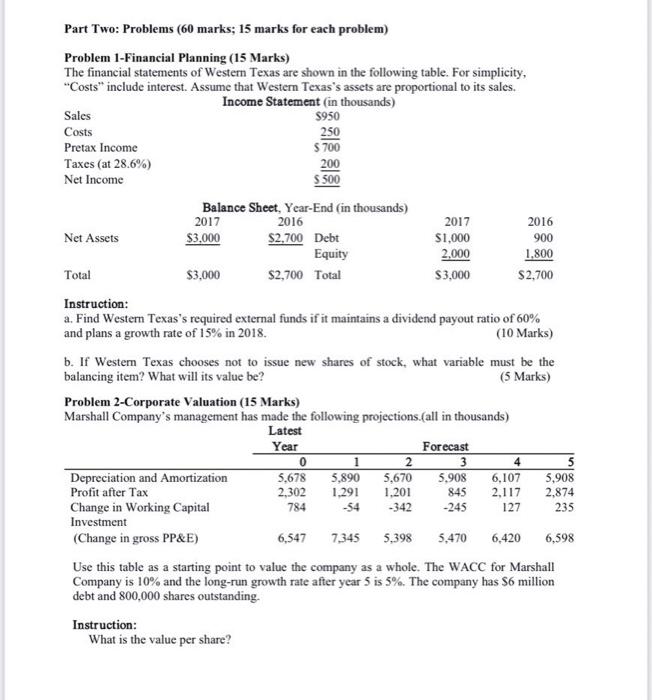

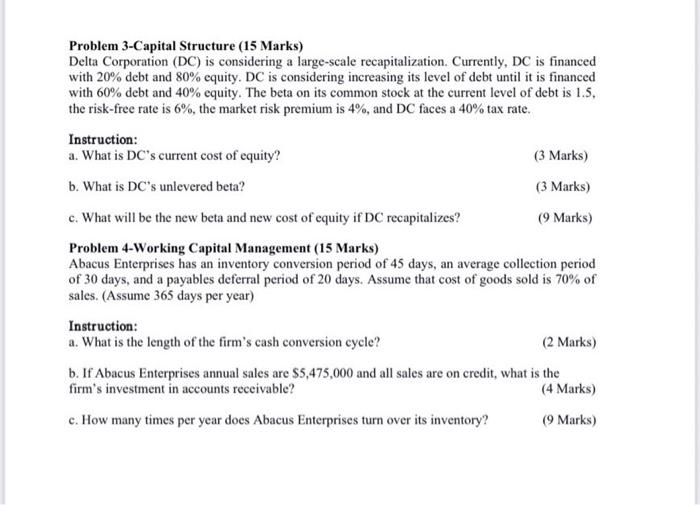

Part Two: Problems (60 marks; 15 marks for each problem) Problem 1-Financial Planning (15 Marks) The financial statements of Western Texas are shown in the following table. For simplicity, "Costs" include interest. Assume that Western Texas's assets are proportional to its sales. Income Statement (in thousands) Sales $950 Costs 250 Pretax Income $700 200 Taxes (at 28.6%) Net Income $500 Balance Sheet, Year-End (in thousands) 2017 2016 2017 2016 Net Assets $3,000 $2,700 Debt $1,000 900 Equity 2,000 1,800 Total $3,000 $2,700 Total $3,000 $2,700 Instruction: a. Find Western Texas's required external funds if it maintains a dividend payout ratio of 60% and plans a growth rate of 15% in 2018. (10 Marks) b. If Western Texas chooses not to issue new shares of stock, what variable must be the balancing item? What will its value be? (5 Marks) Problem 2-Corporate Valuation (15 Marks) Marshall Company's management has made the following projections.(all in thousands) Latest Year Forecast 3 0 1 2 4 Depreciation and Amortization 5,678 5,890 5,670 5,908 6,107 5,908 Profit after Tax 2,302 1,291 1,201 845 2,117 2,874 784 -54 -342 -245 127 235 Change in Working Capital Investment (Change in gross PP&E) 6,547 7,345 5,398 5,470 6,420 6,598 Use this table as a starting point to value the company as a whole. The WACC for Marshall Company is 10% and the long-run growth rate after year 5 is 5%. The company has $6 million debt and 800,000 shares outstanding. Instruction: What is the value per share? 5 Problem 3-Capital Structure (15 Marks) Delta Corporation (DC) is considering a large-scale recapitalization. Currently, DC is financed with 20% debt and 80% equity. DC is considering increasing its level of debt until it is financed with 60% debt and 40% equity. The beta on its common stock at the current level of debt is 1.5. the risk-free rate is 6%, the market risk premium is 4%, and DC faces a 40% tax rate. Instruction: a. What is DC's current cost of equity? (3 Marks) (3 Marks) b. What is DC's unlevered beta? c. What will be the new beta and new cost of equity if DC recapitalizes? (9 Marks) Problem 4-Working Capital Management (15 Marks) Abacus Enterprises has an inventory conversion period of 45 days, an average collection period of 30 days, and a payables deferral period of 20 days. Assume that cost of goods sold is 70% of sales. (Assume 365 days per year) Instruction: a. What is the length of the firm's cash conversion cycle? (2 Marks) b. If Abacus Enterprises annual sales are $5,475,000 and all sales are on credit, what is the firm's investment in accounts receivable? (4 Marks) c. How many times per year does Abacus Enterprises turn over its inventory? (9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts