Question: please somebody help me do 5 to 9. Project A Project B -$200 -$200 100 100 100 1. IRR/NPV. If the opportunity cost of capital

please somebody help me do 5 to 9.

please somebody help me do 5 to 9.

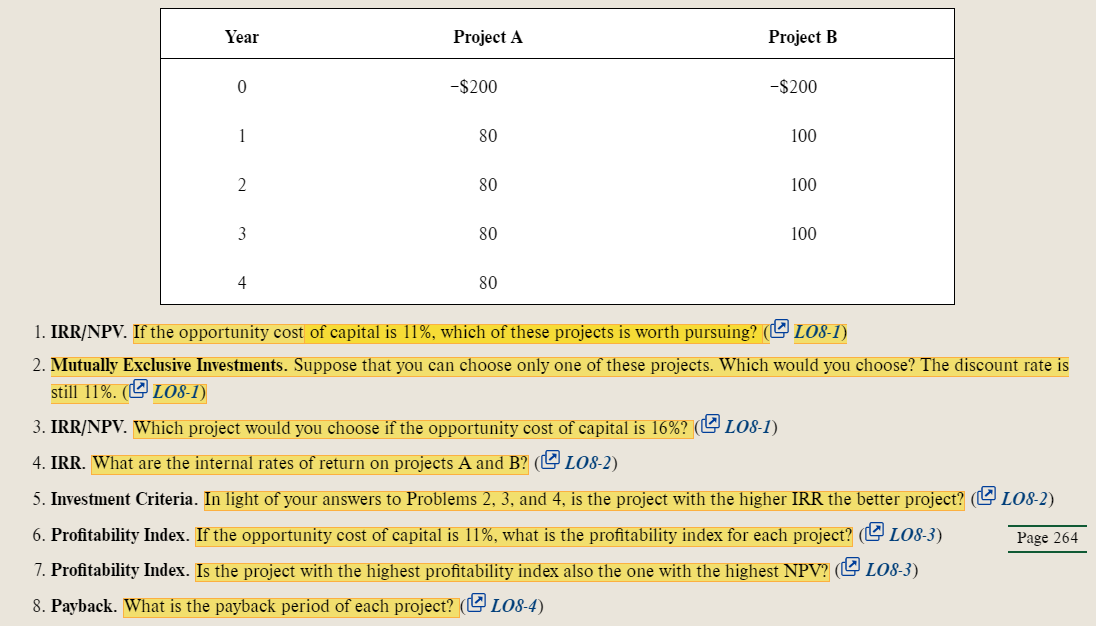

Project A Project B -$200 -$200 100 100 100 1. IRR/NPV. If the opportunity cost of capital is 11%, which of these projects is worth pursuing? (CL08-1) 2. Mutually Exclusive Investments. Suppose that you can choose only one of these projects. Which would you choose? The discount rate is still 11%. ( L08-1) 3. IRR/NPV. Which project would you choose if the opportunity cost of capital is 16%? ( L08-1) 4. IRR. What are the internal rates of return on projects A and B? CLO8-2) 5. Investment Criteria. In light of your answers to Problems 2, 3, and 4, is the project with the higher IRR the better project? L08-2) 6. Profitability Index. If the opportunity cost of capital is 11%, what is the profitability index for each project? (C L08-3) Page 264 L08-3) 7. Profitability Index. Is the project with the highest profitability index also the one with the highest NPV? (C 8. Payback. What is the payback period of each project? (QL08-4) LO8-2) Page 264 5. Investment Criteria. In light of your answers to Problems 2, 3, and 4, is the project with the higher IRR the better project? C 6. Profitability Index. If the opportunity cost of capital is 11%, what is the profitability index for each project? (Q L08-3) 7. Profitability Index. Is the project with the highest profitability index also the one with the highest NPV? (C L08-3) 8. Payback. What is the payback period of each project? Q L08-4) Project A Project B -$200 -$200 100 100 100 1. IRR/NPV. If the opportunity cost of capital is 11%, which of these projects is worth pursuing? (CL08-1) 2. Mutually Exclusive Investments. Suppose that you can choose only one of these projects. Which would you choose? The discount rate is still 11%. ( L08-1) 3. IRR/NPV. Which project would you choose if the opportunity cost of capital is 16%? ( L08-1) 4. IRR. What are the internal rates of return on projects A and B? CLO8-2) 5. Investment Criteria. In light of your answers to Problems 2, 3, and 4, is the project with the higher IRR the better project? L08-2) 6. Profitability Index. If the opportunity cost of capital is 11%, what is the profitability index for each project? (C L08-3) Page 264 L08-3) 7. Profitability Index. Is the project with the highest profitability index also the one with the highest NPV? (C 8. Payback. What is the payback period of each project? (QL08-4) LO8-2) Page 264 5. Investment Criteria. In light of your answers to Problems 2, 3, and 4, is the project with the higher IRR the better project? C 6. Profitability Index. If the opportunity cost of capital is 11%, what is the profitability index for each project? (Q L08-3) 7. Profitability Index. Is the project with the highest profitability index also the one with the highest NPV? (C L08-3) 8. Payback. What is the payback period of each project? Q L08-4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts