Question: Please someone answer this right and complete. already posted more than once and was given wrong and incomplete answers Blank Corporation acquired 100 percent of

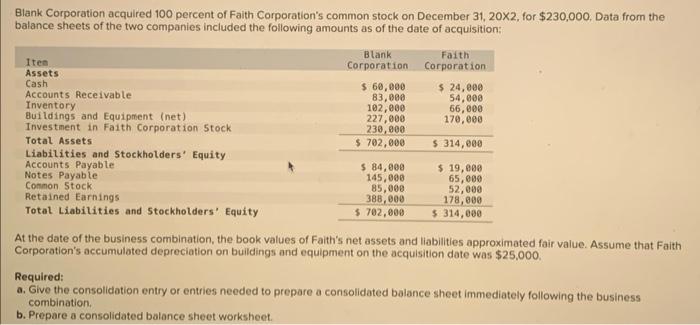

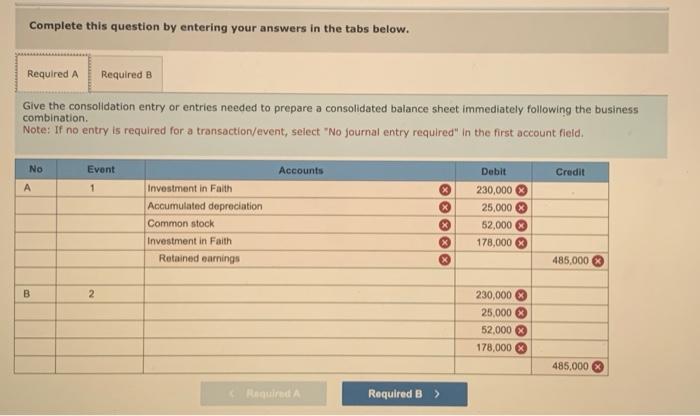

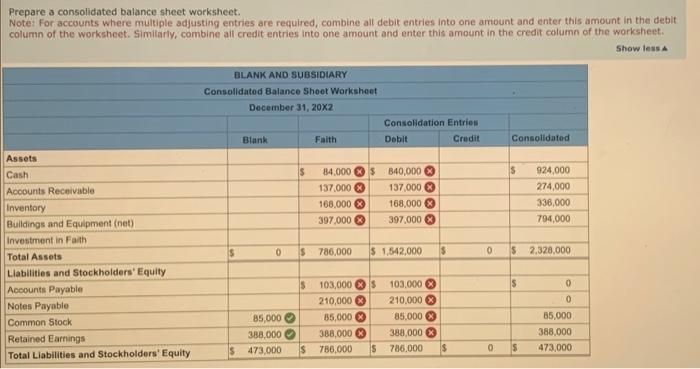

Blank Corporation acquired 100 percent of Faith Corporation's common stock on December 31,202, for $230,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: At the date of the business combination, the book values of Faith's net assets and liabilities approximated fair value. Assume that Faith Corporation's accumulated depreciation on buildings and equipment on the acquisition date was $25,000. Required: a. Give the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination. b. Prepare a consolidated balance sheet worksheet. Complete this question by entering your answers in the tabs below. Give the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare a consolidated balance sheet worksheet. column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Show leus A Blank Corporation acquired 100 percent of Faith Corporation's common stock on December 31,202, for $230,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: At the date of the business combination, the book values of Faith's net assets and liabilities approximated fair value. Assume that Faith Corporation's accumulated depreciation on buildings and equipment on the acquisition date was $25,000. Required: a. Give the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination. b. Prepare a consolidated balance sheet worksheet. Complete this question by entering your answers in the tabs below. Give the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare a consolidated balance sheet worksheet. column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Show leus A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts