Question: please someone help me this 5 Questions On August 1, Year 16 in Company borowed $50,000 cash. The one-year note caried a 6% rate of

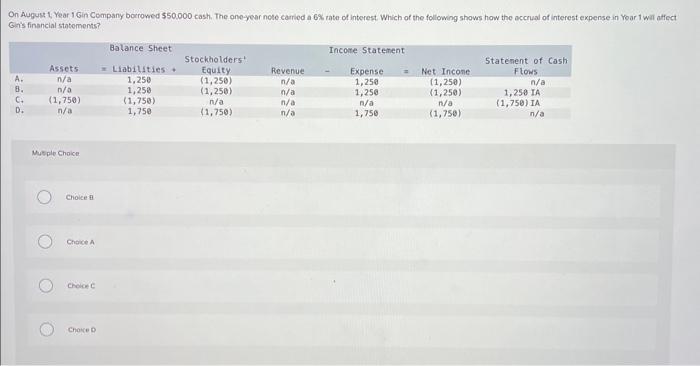

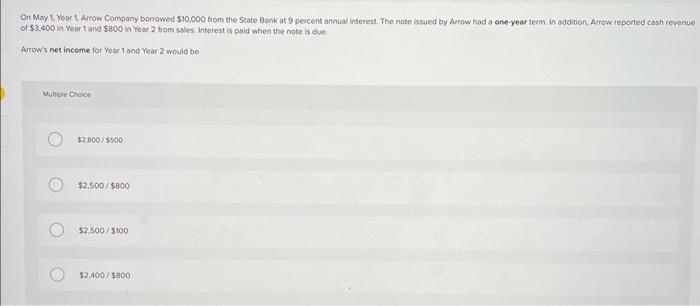

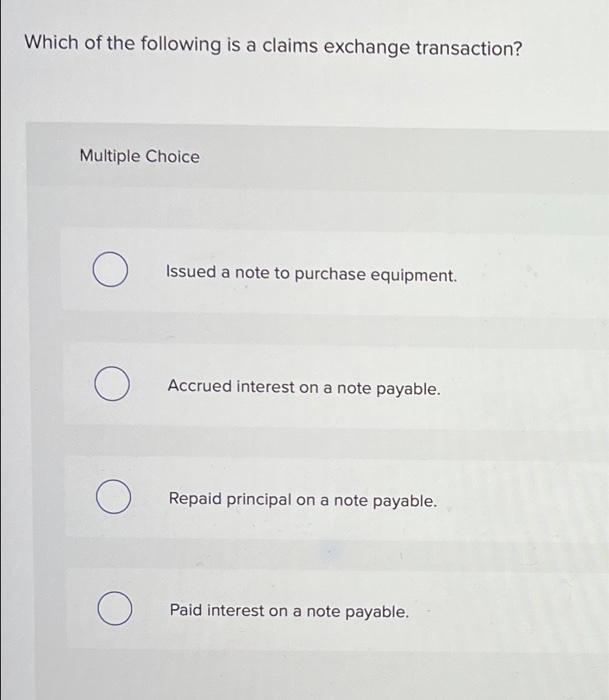

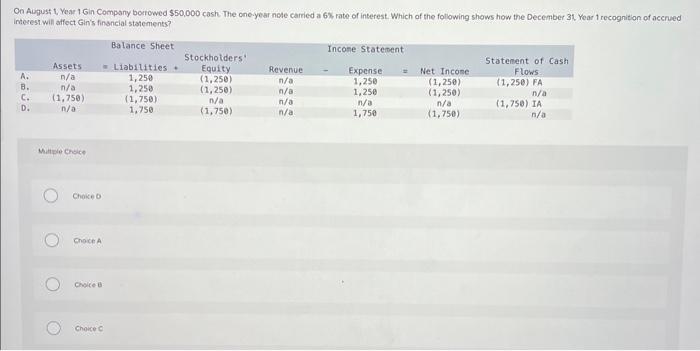

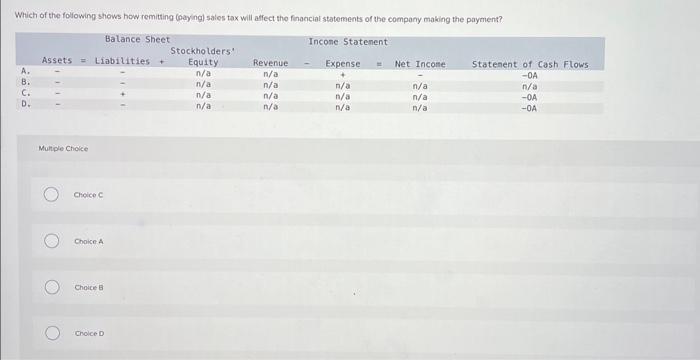

On August 1, Year 16 in Company borowed $50,000 cash. The one-year note caried a 6% rate of interest. Which of the following shows how the accrual of interest expense in Yoar 1 wal atfect Gin's financial sthtements? Mutple choice choice 81 Chased A Cheices C Chove 0 On May 1, Year 1 Arrow Company borrowed $10.000 from the State Bank at 9 percent annual interest. The note issued by Arrow had a one-year tein in addition, Arrow reported cash revenue of $3,400in Year 1 and $800 in Yesr 2 trom sales. Interest is paid when the note is due. Arrow's net income for Yoar 1 and Year 2 would be Mubple chotice $2.000/5500 $2,500$800 $2.500/5100 $2,400/$300 Which of the following is a claims exchange transaction? Multiple Choice Issued a note to purchase equipment. Accrued interest on a note payable. Repaid principal on a note payable. Paid interest on a note payable. On Avjpust t, Year 16 in Company borrowed $50,000 cash. The one-year note carried a 6% rate of interest. Which of the following shows how the December 31 , Year 1 recognition of acenved intesest will affect Gin's finsncial statements? Miltwet Chice Chake 0 Croce A chise Choice C Which of the following shows how remitting (gayingl sales tax will affect the financial statements of the company making the payment? Multple Chicke Creice C Choice A Choice B Cholce D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts