Question: Please someone help me with this :) Able Ltd purchased machinery on 1 November 2016 for $194,500. The estimated useful life of the machinery is

Please someone help me with this :)

Please someone help me with this :)

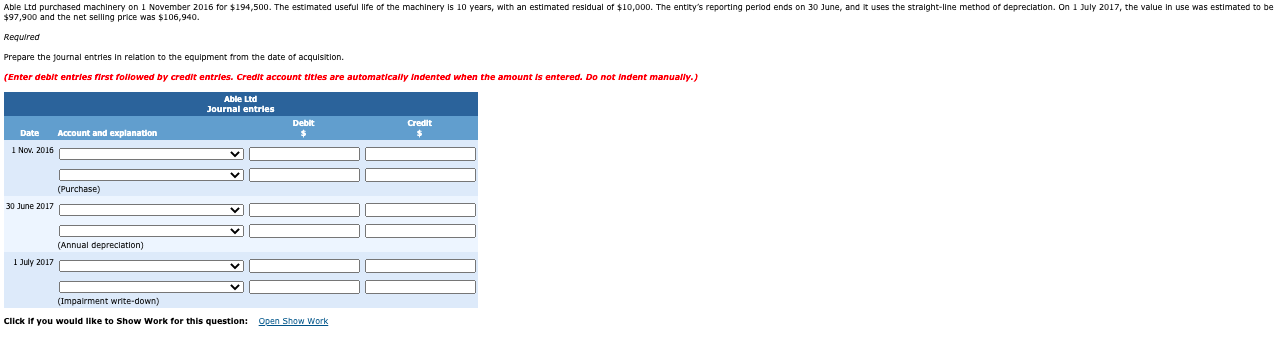

Able Ltd purchased machinery on 1 November 2016 for $194,500. The estimated useful life of the machinery is 10 years, with an estimated residual of $10,000. The entity's reporting period ends on 30 June, and it uses the straight-line method of depreciation. On 1 July 2017, the value in use was estimated to be $97,900 and the net selling price was $106,940. Required Prepare the journal entries in relation to the equipment from the date of acquisition. (Enter debit entries first followed by credit entries. Credit account titles are automatically Indented when the amount is entered. Do not indent manually.) Able Ltd Journal entries Debit Credit $ Date Account and explanation I Nov. 2016 v (Purchase) 30 June 2017 (Annual depreciation) V (Impairment write-down) Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts