Question: please sove the required questions PROBLEMS: 1. Accounting for Bonds Payable (16 points): Castaldini Corporation issued a $20,000 bond paying 4% coupon annually for 5

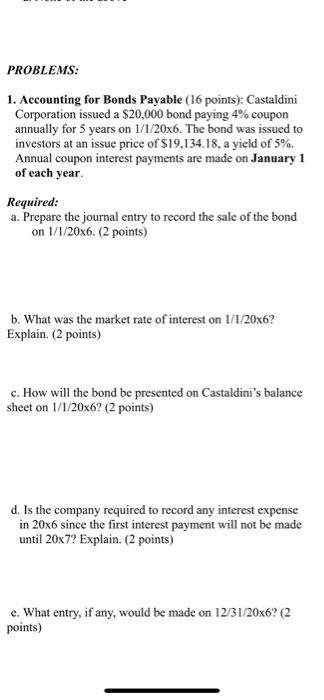

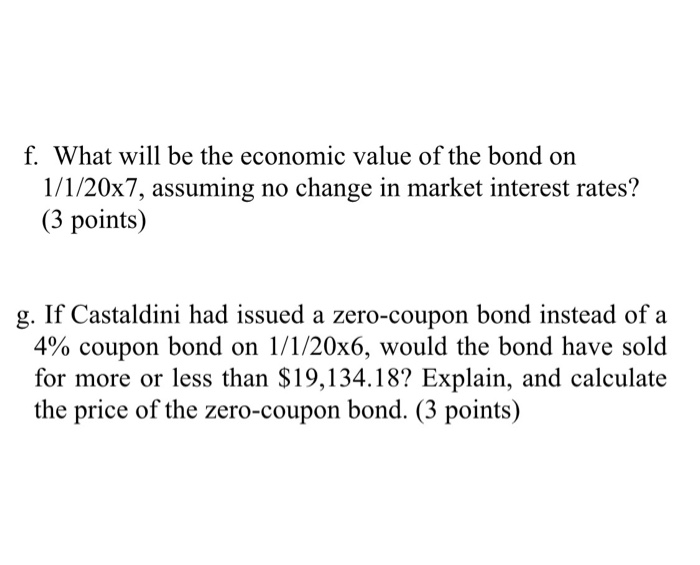

PROBLEMS: 1. Accounting for Bonds Payable (16 points): Castaldini Corporation issued a $20,000 bond paying 4% coupon annually for 5 years on 1/1/20x6. The bond was issued to investors at an issue price of $19,134.18, a yield of 5%. Annual coupon interest payments are made on January 1 of each year. Required: a. Prepare the journal entry to record the sale of the bond on 1/1/20x6. (2 points) b. What was the market rate of interest on 1/1/20x6? Explain. (2 points) c. How will the bond be presented on Castaldini's balance sheet on 1/1/20x6? (2 points) d. Is the company required to record any interest expense in 20x6 since the first interest payment will not be made until 20x7? Explain. (2 points) e. What entry, if any, would be made on 12/31/20x6? (2 points) f. What will be the economic value of the bond on 1/1/20x7, assuming no change in market interest rates? (3 points) g. If Castaldini had issued a zero-coupon bond instead of a 4% coupon bond on 1/1/20x6, would the bond have sold for more or less than $19,134.18? Explain, and calculate the price of the zero-coupon bond. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts