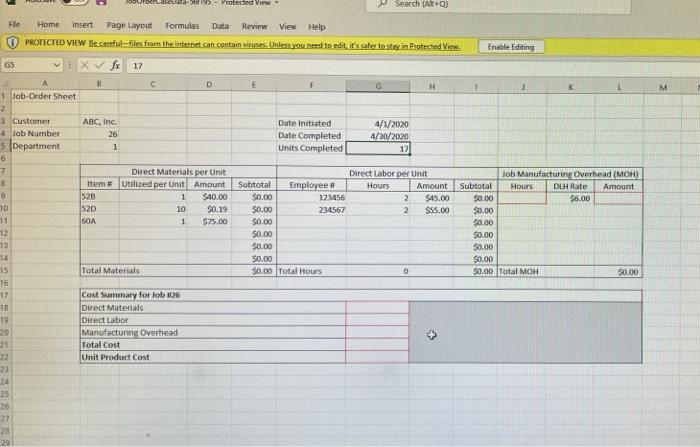

Question: Please specify each question :) 2. Manufacturing Overhead: Review the manufacturing overhead rate in cell K9 of the job-order spreadsheet and observe how the manufacturing

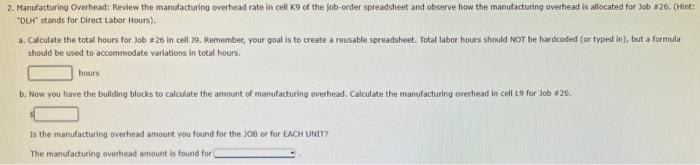

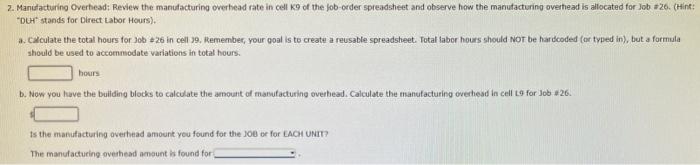

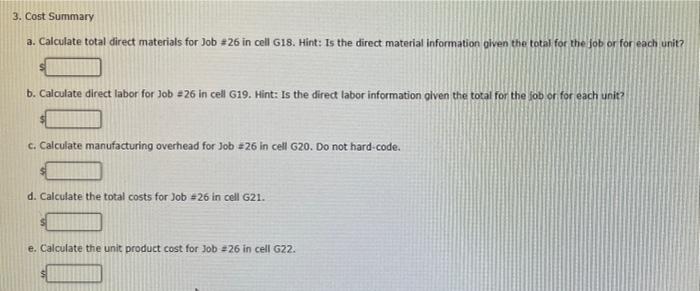

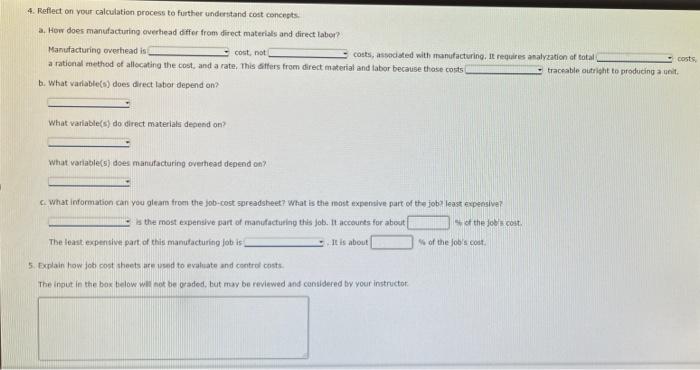

2. Manufacturing Overhead: Review the manufacturing overhead rate in cell K9 of the job-order spreadsheet and observe how the manufacturing overtiead is allocated for Job #26. (Hint: DU stands for Direct Labor Hours). Calculate the total hours for 10b+26 in cell 19. vemember, your goal is to create a reusable spreadsheet. Total labor hours should not be hardcoded for typed in), but a formula should be used to accommodate variations in total hours. hours b. Now you have the building blocks to calculate the amount of manufacturing overhead. Calculate the manufacturing overhead in cell Lg for Job #26. Is the manufacturing overhead amount you found for the 208 or for EACH UNIT? The manufacturing overhead amount found for 3. Cost Summary a. Calculate total direct materials for Job #26 in cell G18. Hint: Is the direct material information given the total for the fob or for each unit? b. Calculate direct labor for Job #26 in cell G19. Hint: Is the direct labor information given the total for the job or for each unit? c. Calculate manufacturing overhead for Job #26 in cell G20. Do not hard-code. d. Calculate the total costs for Job +26 in cell G21. e. Calculate the unit product cost for Job #26 in cell G22. 4. Reflect on your calculation process to further understand cost concepts a. How does manufacturing overhead differ from direct materials and direct labor? Manufacturing overhead is cost, not costs, associated with manufacturing, It requires analyzation of total a rational method of allocating the cost, and a rate. This differs from direct material and taber because these costs traceable outright to producing a git b. What vadable(s) does direct labor depend on? costs What variable(s) do direct materials depend on? what variable(s) does manufacturing overhead depend on? What information can you gleam from the job-cost spreadsheet? What is the most expensive part of the job least expensive? is the most expensive part of manufacturing this job. It accounts for about of the job.com The lost expensive part of this manufacturing job is It is about of the Joe's cost 5. Explain how job cost sheets are used to evaluate and control costs. The input in the box below will not be graded, but may be reviewed and considered by your instructor - - Protected View Search (ta) File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Editing GS i Xv ft 17 G R M Date Initiated Date Completed Units Completed 4/1/2020 4/30/2020 12 Direct Labor per Unit Hours Amount 2 $45.00 2. $55.00 52D A 3 D 1 Job-Order Sheet 2 Customer ABC, Inc. 4 Job Number 26 5 Department 1 6 7 Direct Materials per Unit 8 Item# utilized per Unit Amount 9 52B 1 S40.00 10 10 $0.19 11 60A 1 $75.00 12 13 14 15 Total Materials 56 17 Cost Summary for lob 1126 10 Direct Materials 19 Direct Labor 20 Manufacturing Overhead 21 Total Cost 22 Unit Product Cost 2 24 25 Subtotal Employee $0.00 123456 $0.00 234567 50.00 $0.00 50.00 $0.00 30.00 Total Hours Job Manufacturing Overhead (MOH) Subtotal Hours DLH Rate Amount $0.00 $6.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Total MOH $0.00 27 2. Manufacturing Overhead: Review the manufacturing overhead rate in cell K9 of the job-order spreadsheet and observe how the manufacturing overtiead is allocated for Job #26. (Hint: DU stands for Direct Labor Hours). Calculate the total hours for 10b+26 in cell 19. vemember, your goal is to create a reusable spreadsheet. Total labor hours should not be hardcoded for typed in), but a formula should be used to accommodate variations in total hours. hours b. Now you have the building blocks to calculate the amount of manufacturing overhead. Calculate the manufacturing overhead in cell Lg for Job #26. Is the manufacturing overhead amount you found for the 208 or for EACH UNIT? The manufacturing overhead amount found for 3. Cost Summary a. Calculate total direct materials for Job #26 in cell G18. Hint: Is the direct material information given the total for the fob or for each unit? b. Calculate direct labor for Job #26 in cell G19. Hint: Is the direct labor information given the total for the job or for each unit? c. Calculate manufacturing overhead for Job #26 in cell G20. Do not hard-code. d. Calculate the total costs for Job +26 in cell G21. e. Calculate the unit product cost for Job #26 in cell G22. 4. Reflect on your calculation process to further understand cost concepts a. How does manufacturing overhead differ from direct materials and direct labor? Manufacturing overhead is cost, not costs, associated with manufacturing, It requires analyzation of total a rational method of allocating the cost, and a rate. This differs from direct material and taber because these costs traceable outright to producing a git b. What vadable(s) does direct labor depend on? costs What variable(s) do direct materials depend on? what variable(s) does manufacturing overhead depend on? What information can you gleam from the job-cost spreadsheet? What is the most expensive part of the job least expensive? is the most expensive part of manufacturing this job. It accounts for about of the job.com The lost expensive part of this manufacturing job is It is about of the Joe's cost 5. Explain how job cost sheets are used to evaluate and control costs. The input in the box below will not be graded, but may be reviewed and considered by your instructor - - Protected View Search (ta) File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Editing GS i Xv ft 17 G R M Date Initiated Date Completed Units Completed 4/1/2020 4/30/2020 12 Direct Labor per Unit Hours Amount 2 $45.00 2. $55.00 52D A 3 D 1 Job-Order Sheet 2 Customer ABC, Inc. 4 Job Number 26 5 Department 1 6 7 Direct Materials per Unit 8 Item# utilized per Unit Amount 9 52B 1 S40.00 10 10 $0.19 11 60A 1 $75.00 12 13 14 15 Total Materials 56 17 Cost Summary for lob 1126 10 Direct Materials 19 Direct Labor 20 Manufacturing Overhead 21 Total Cost 22 Unit Product Cost 2 24 25 Subtotal Employee $0.00 123456 $0.00 234567 50.00 $0.00 50.00 $0.00 30.00 Total Hours Job Manufacturing Overhead (MOH) Subtotal Hours DLH Rate Amount $0.00 $6.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Total MOH $0.00 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts