Question: Please specify the answer for each box shown in the picture. thanks in advance. Fantastic Fashions has just completed its first quarter of operations. Below

Please specify the answer for each box shown in the picture. thanks in advance.

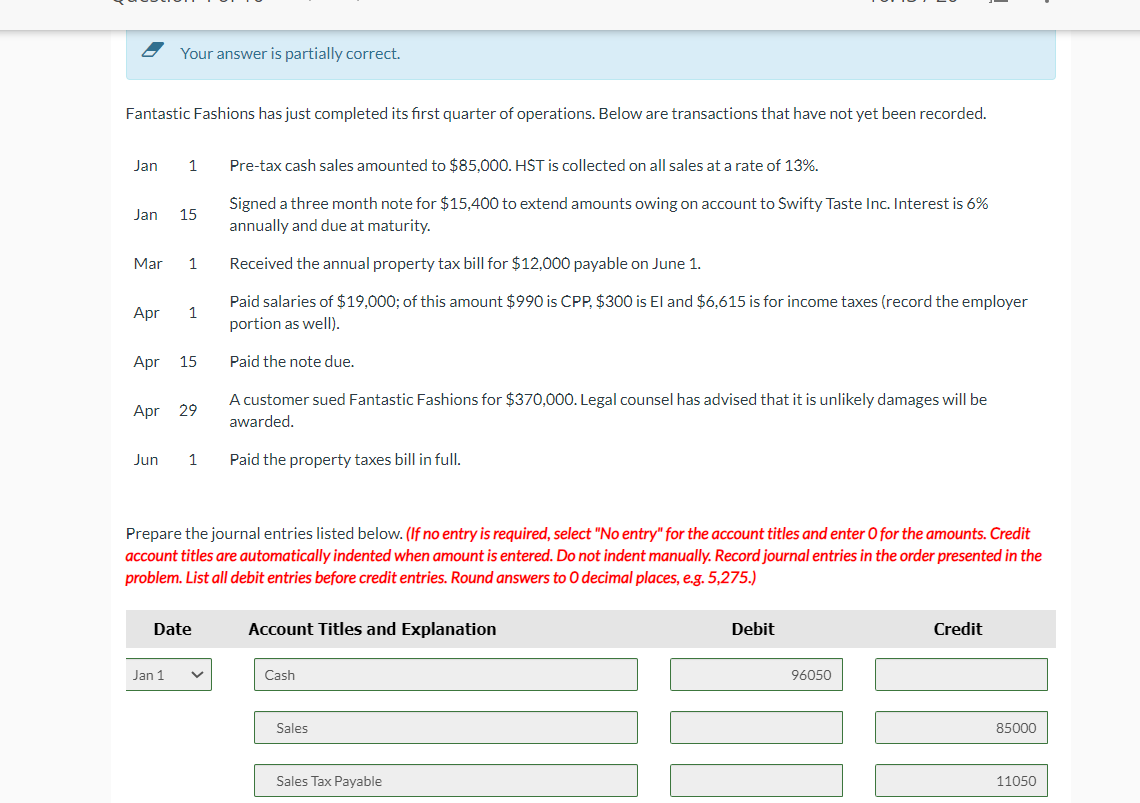

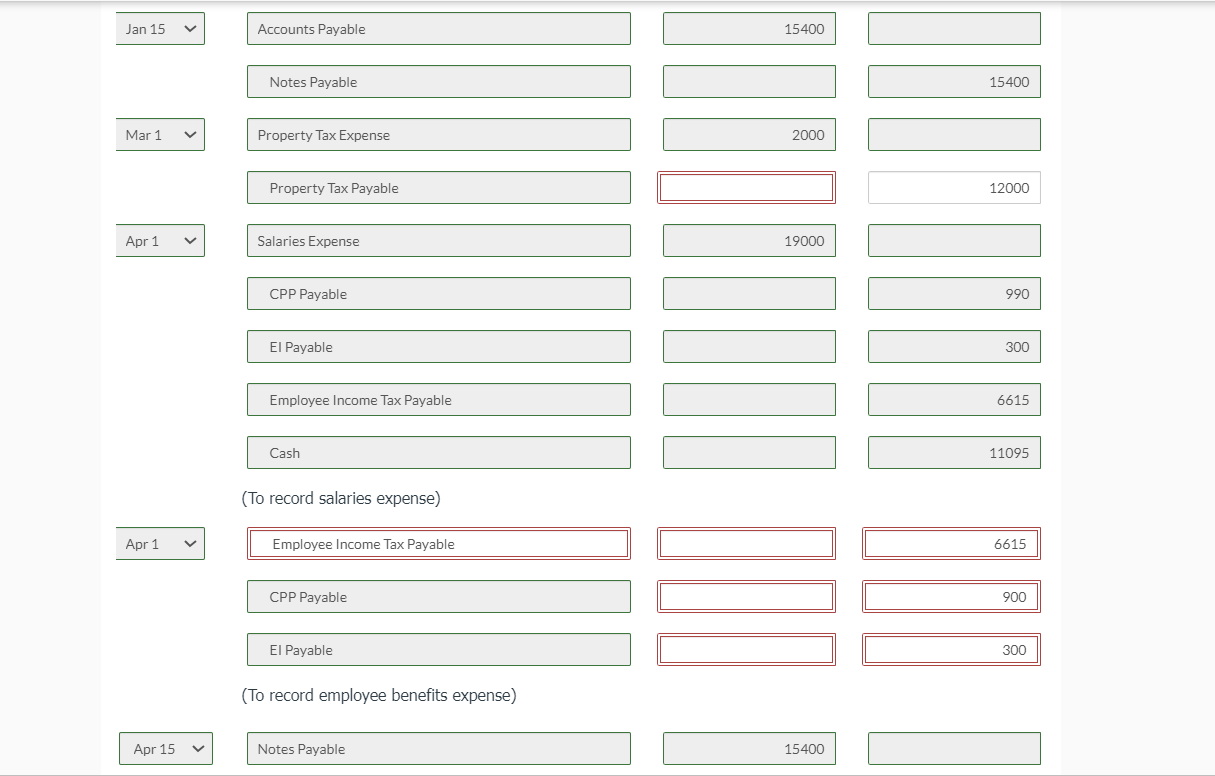

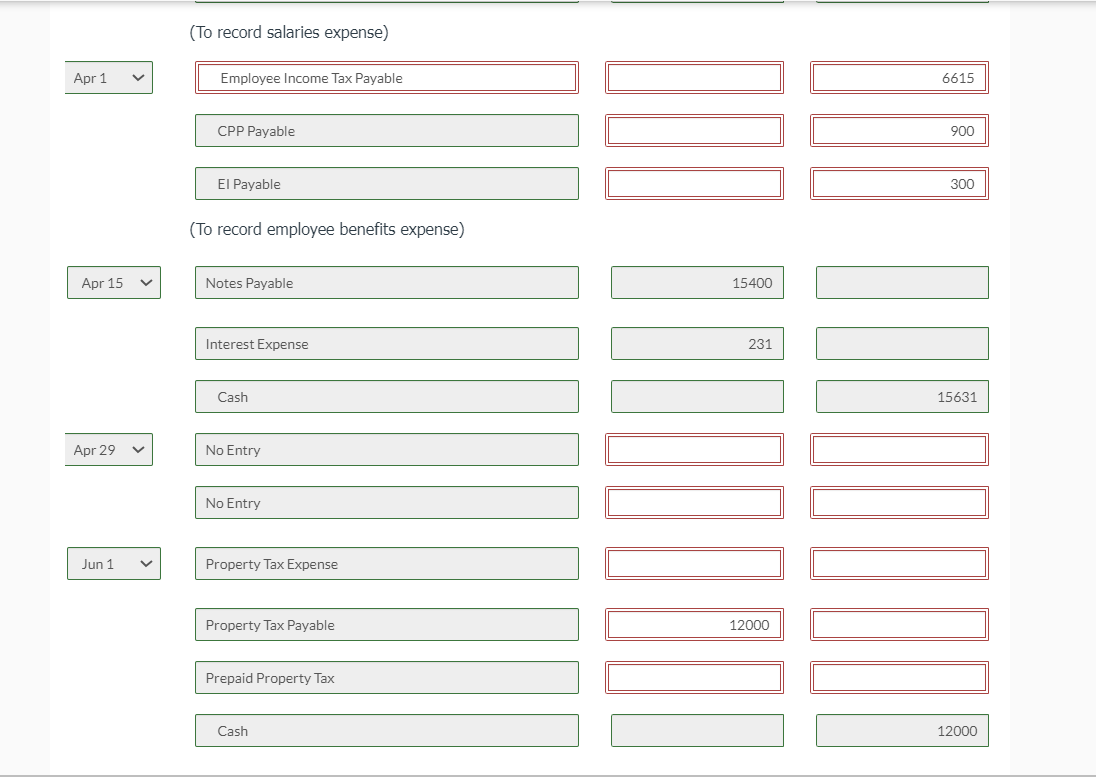

Fantastic Fashions has just completed its first quarter of operations. Below are transactions that have not yet been recorded. Jan 1 Pre-tax cash sales amounted to $85,000. HST is collected on all sales at a rate of 13%. Jan 15 Signed a three month note for \$15,400 to extend amounts owing on account to Swifty Taste Inc. Interest is 6% annually and due at maturity. Mar 1 Received the annual property tax bill for $12,000 payable on June 1. Apr 1 Paid salaries of $19,000; of this amount $990 is CPP, $300 is El and $6,615 is for income taxes (record the employer portion as well). Apr 15 Paid the note due. Apr 29 A customer sued Fantastic Fashions for $370,000. Legal counsel has advised that it is unlikely damages will be awarded. Jun 1 Paid the property taxes bill in full. Prepare the journal entries listed below. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275 .) (To record salaries expense) Apr15 Apr 29 Interest Expense Cash No Entry No Entry Jun 1 Property Tax Expense Property Tax Payable Prepaid Property Tax Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts