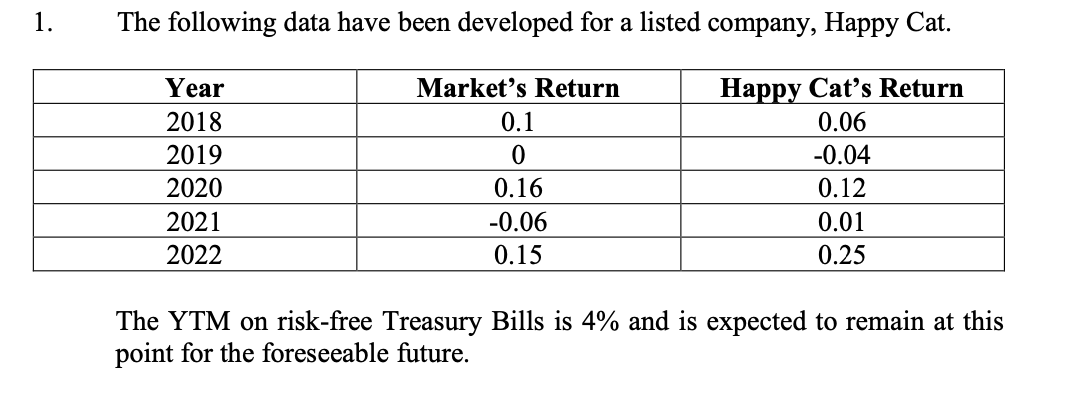

Question: Please specify the calculation and calculation formula 1. The following data have been developed for a listed company, Happy Cat. The YTM on risk-free Treasury

Please specify the calculation and calculation formula

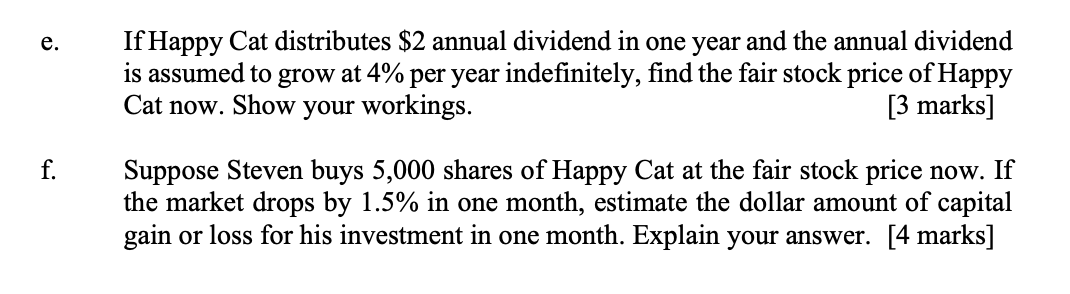

1. The following data have been developed for a listed company, Happy Cat. The YTM on risk-free Treasury Bills is 4% and is expected to remain at this point for the foreseeable future. If Happy Cat distributes $2 annual dividend in one year and the annual dividend is assumed to grow at 4% per year indefinitely, find the fair stock price of Happy Cat now. Show your workings. [3 marks] Suppose Steven buys 5,000 shares of Happy Cat at the fair stock price now. If the market drops by 1.5% in one month, estimate the dollar amount of capital gain or loss for his investment in one month. Explain your answer. [4 marks] 1. The following data have been developed for a listed company, Happy Cat. The YTM on risk-free Treasury Bills is 4% and is expected to remain at this point for the foreseeable future. If Happy Cat distributes $2 annual dividend in one year and the annual dividend is assumed to grow at 4% per year indefinitely, find the fair stock price of Happy Cat now. Show your workings. [3 marks] Suppose Steven buys 5,000 shares of Happy Cat at the fair stock price now. If the market drops by 1.5% in one month, estimate the dollar amount of capital gain or loss for his investment in one month. Explain your answer. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts