Question: Please state the answers clearly as I sometimes cannot figure it Prepare a schedule to compute the difference between book value of equity and the

Please state the answers clearly as I sometimes cannot figure it

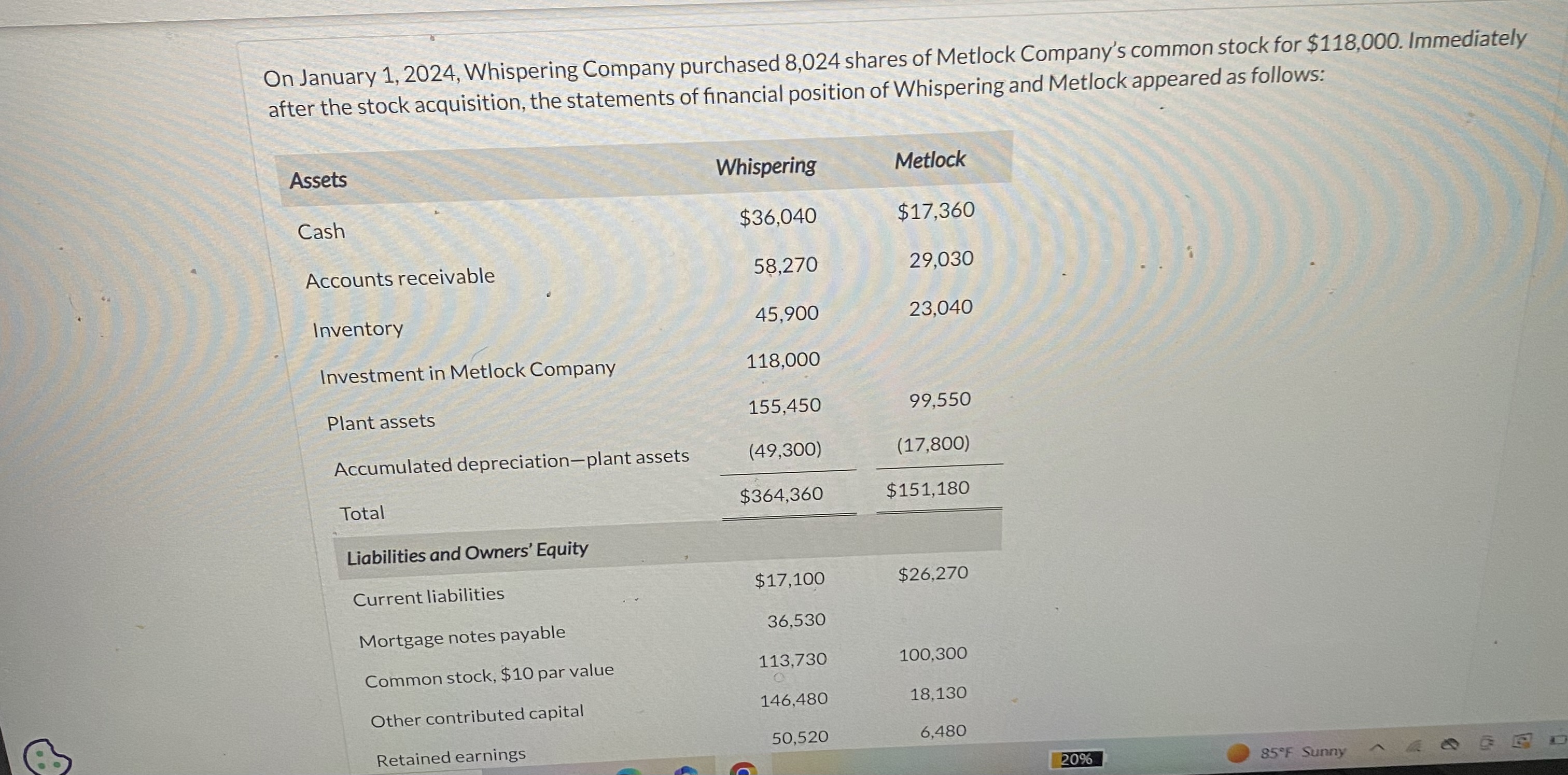

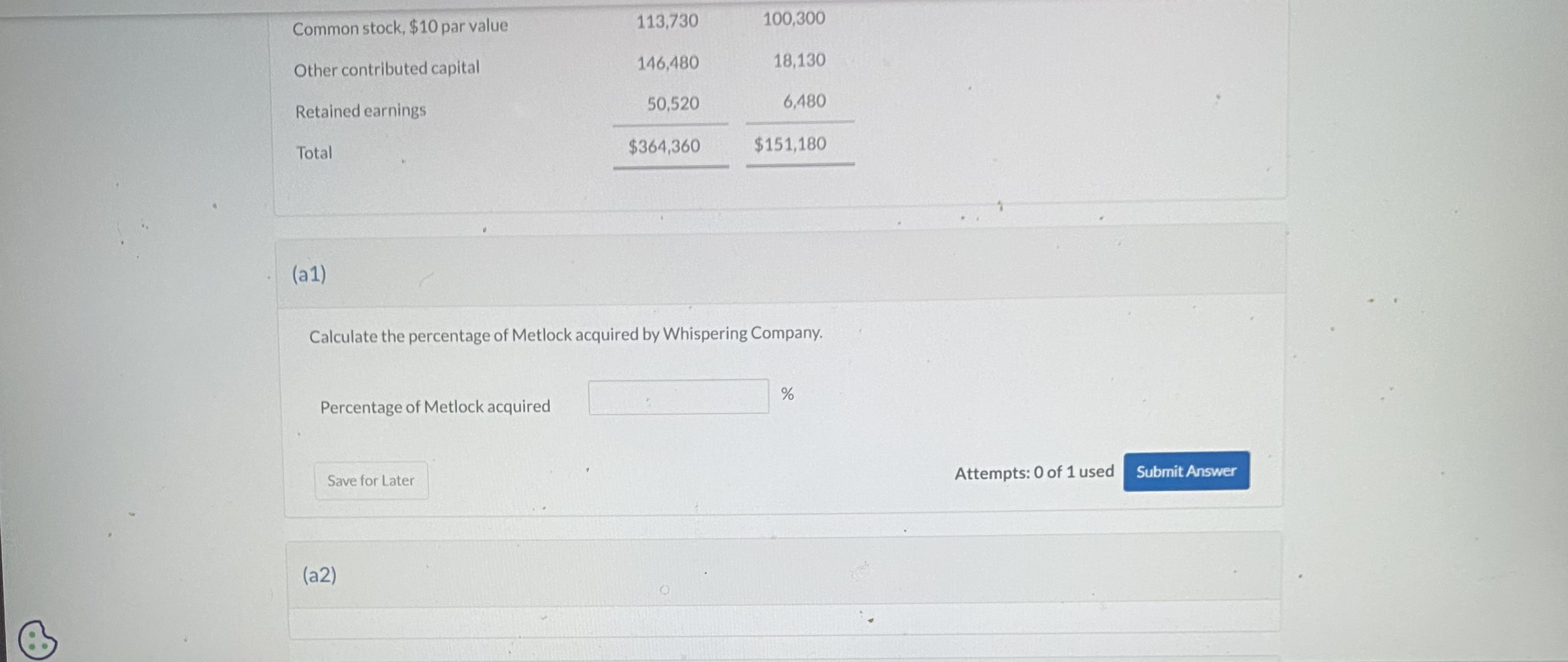

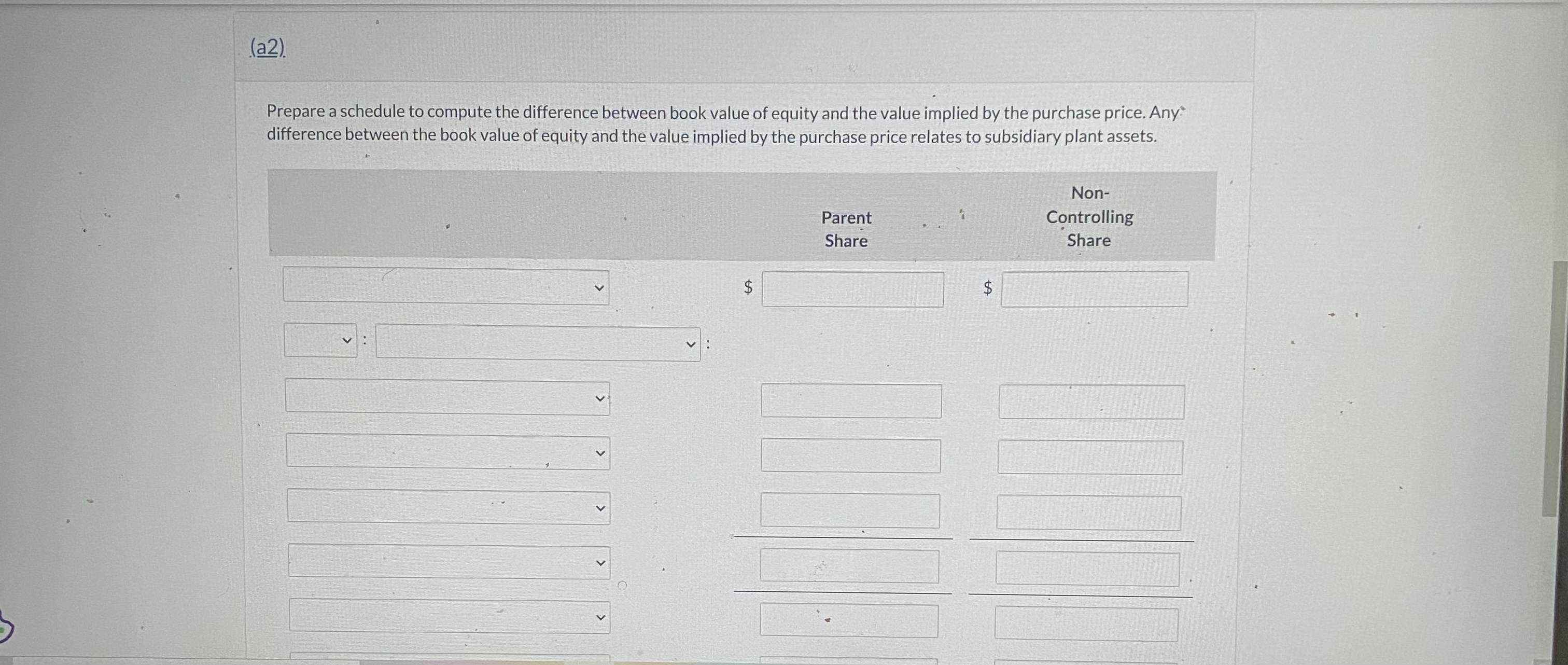

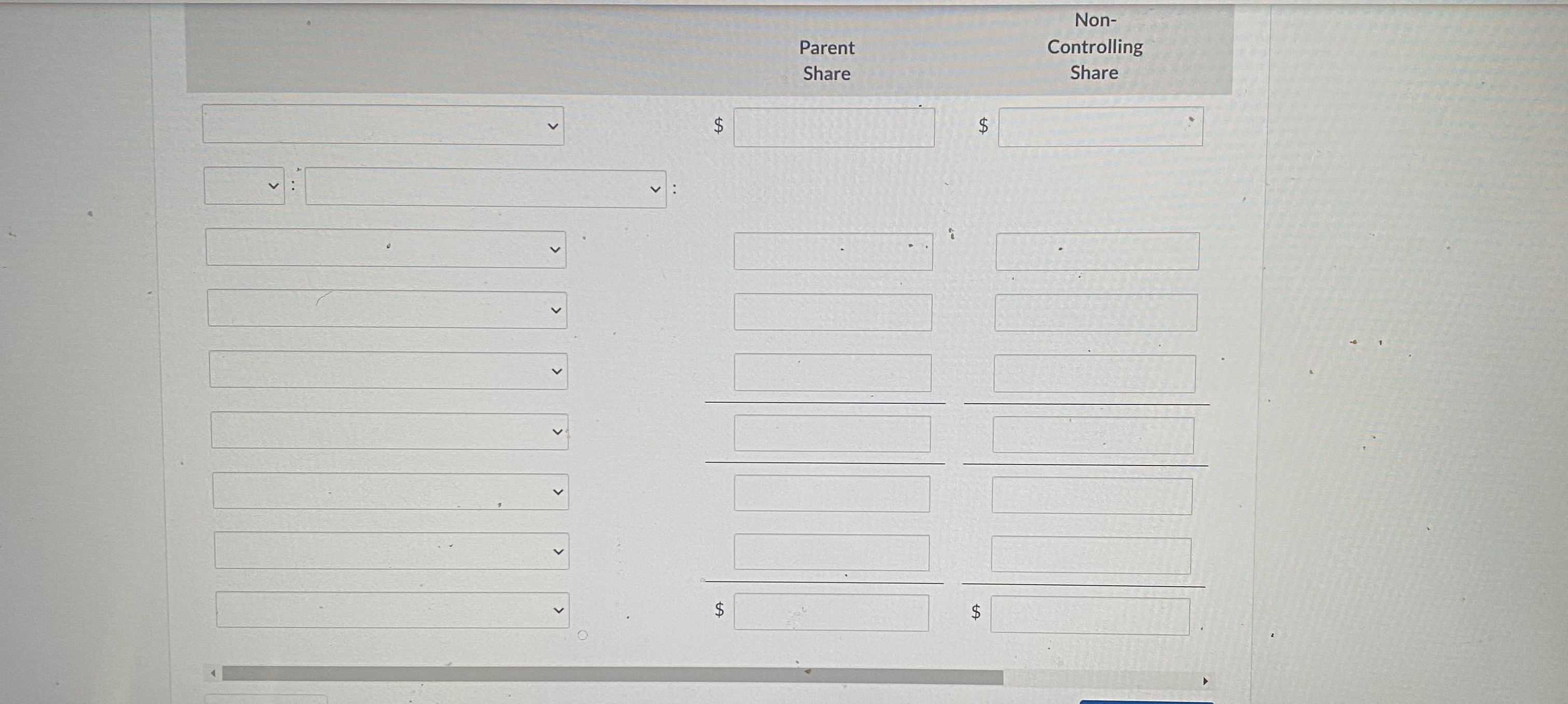

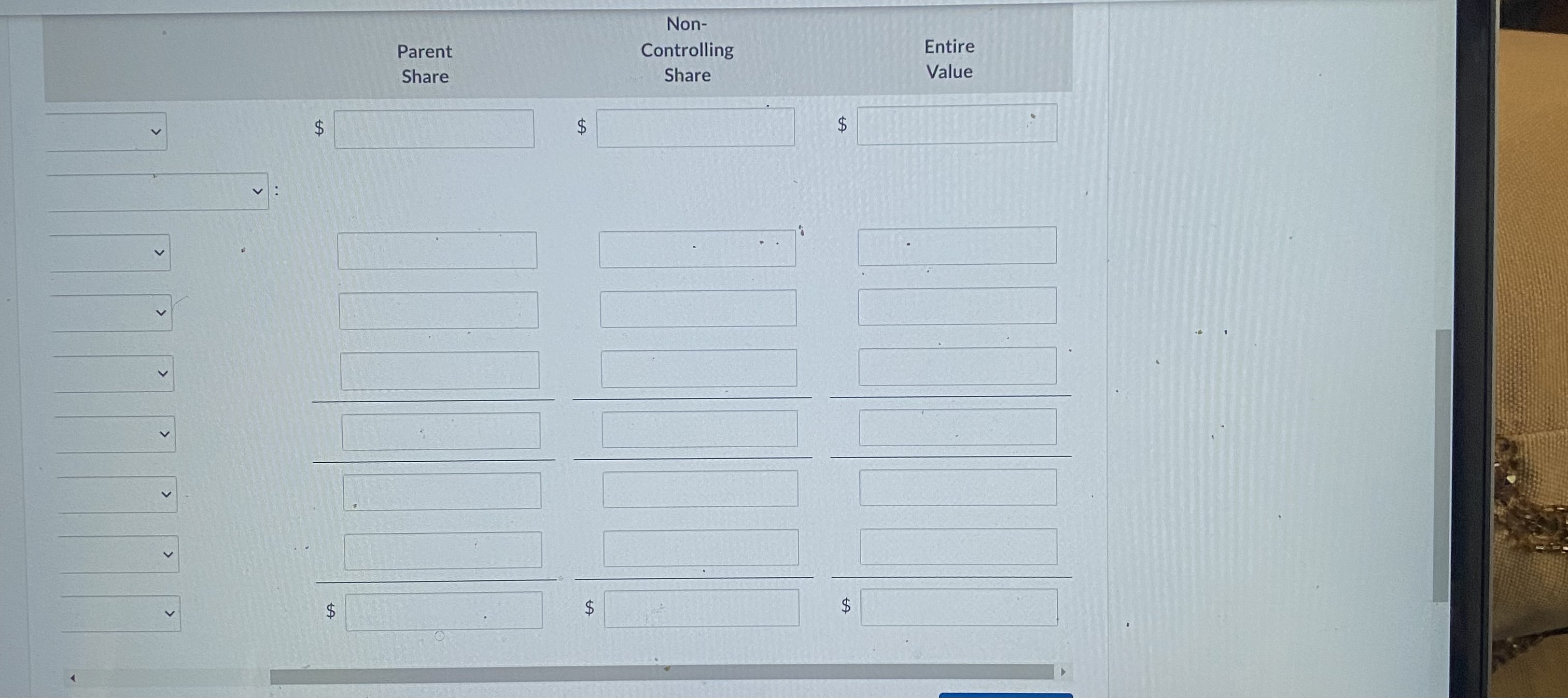

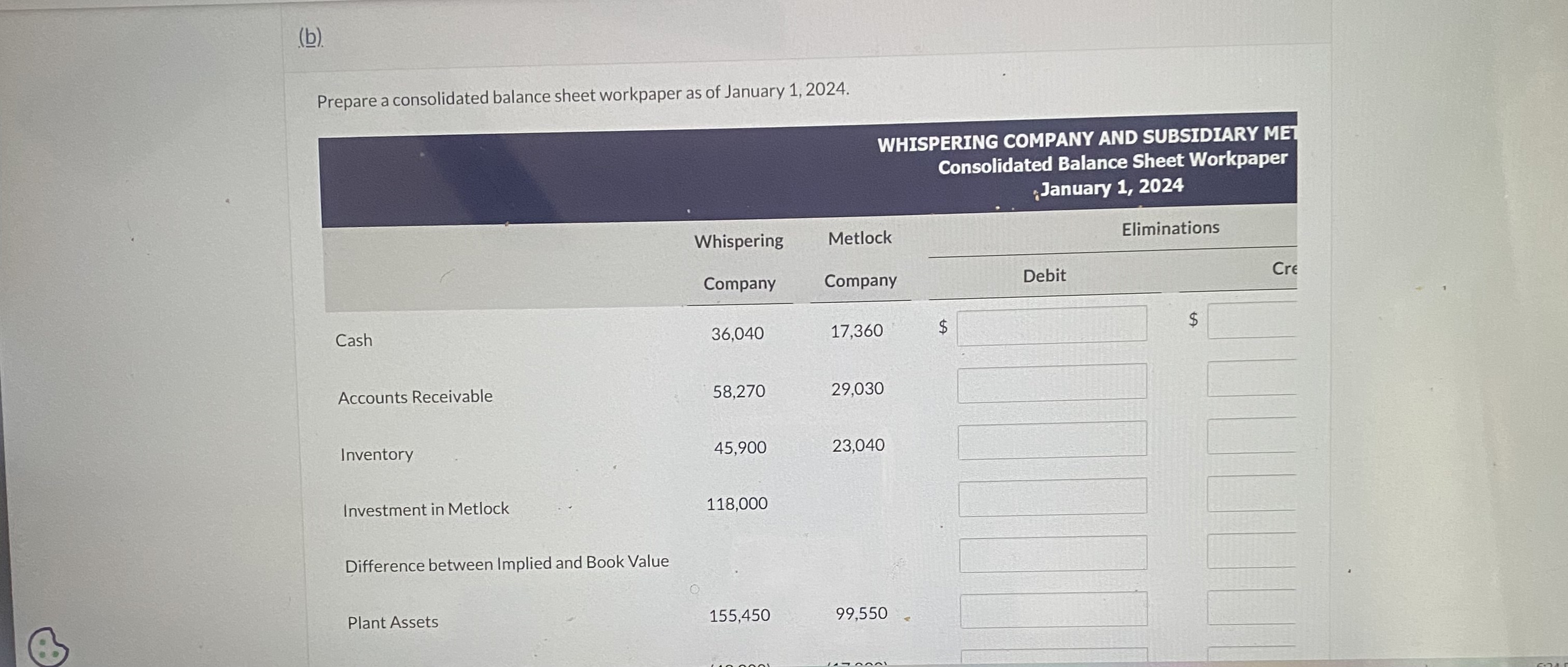

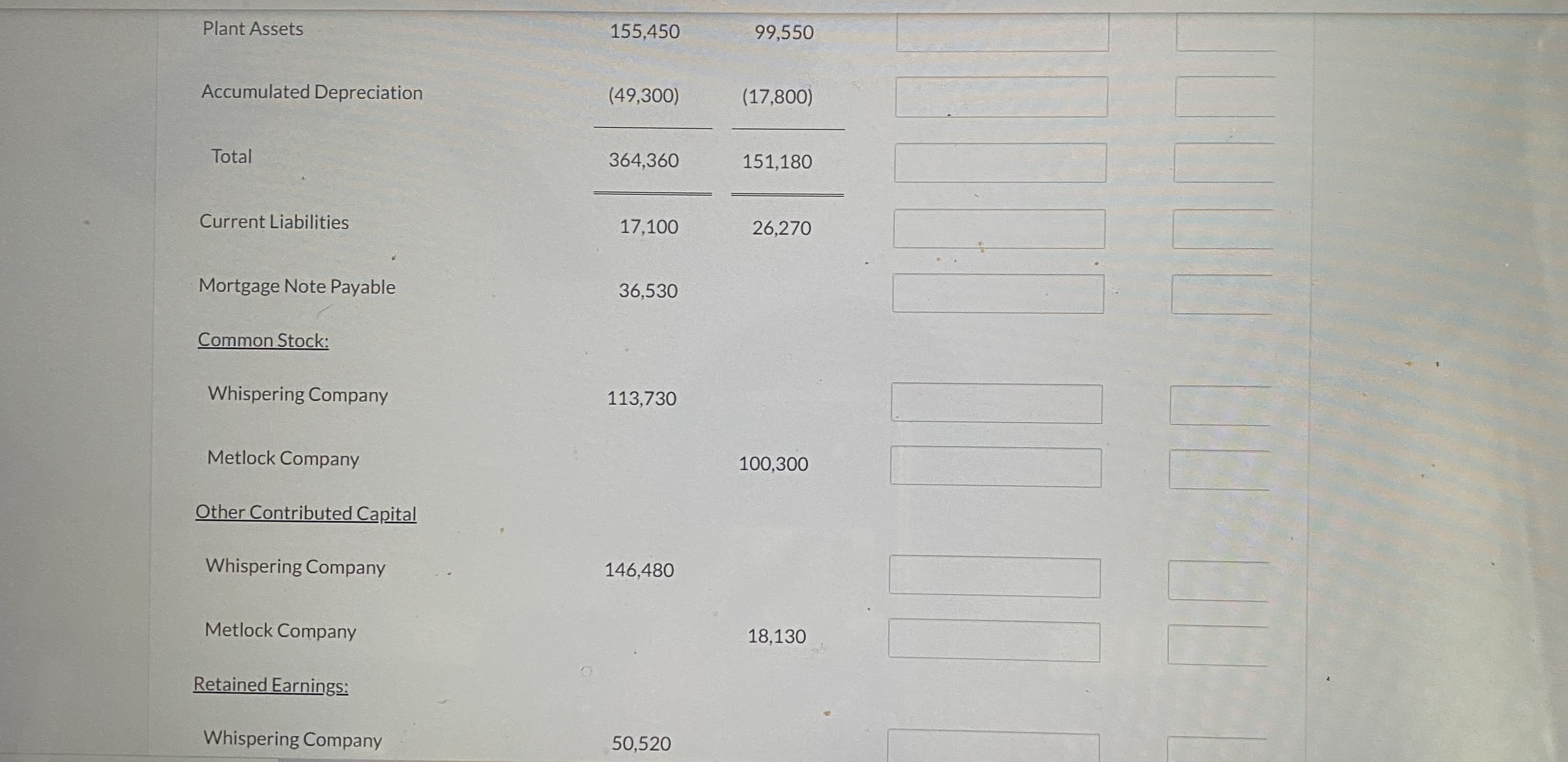

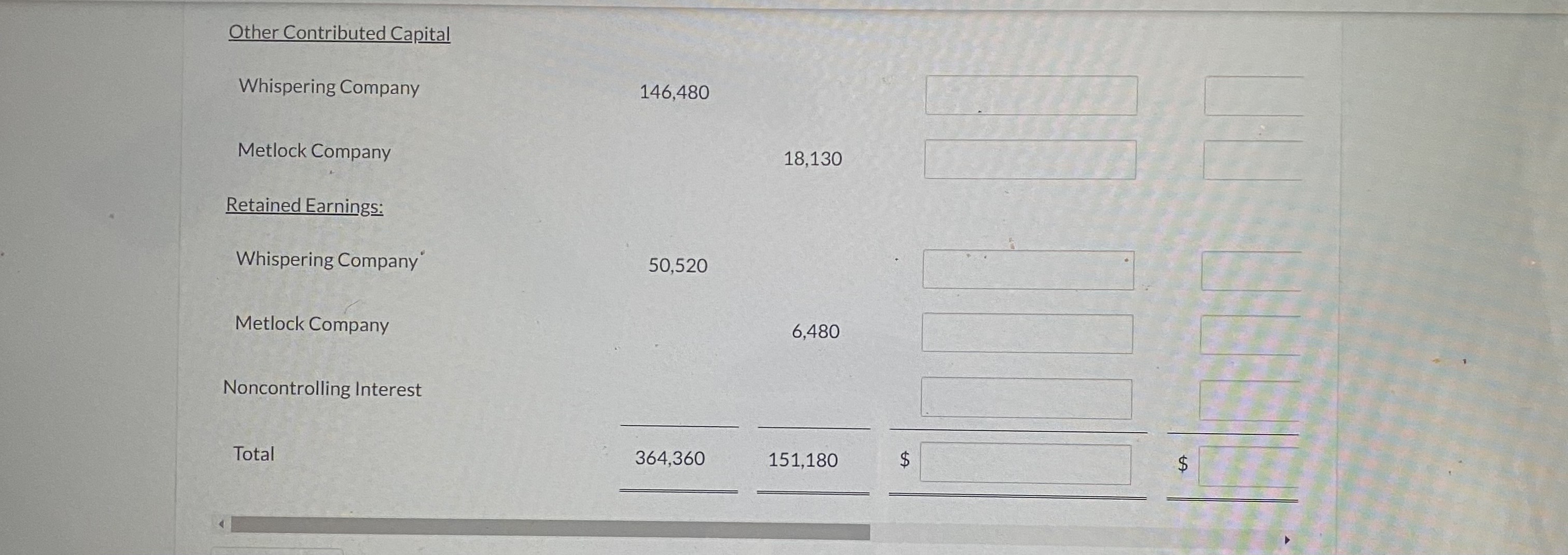

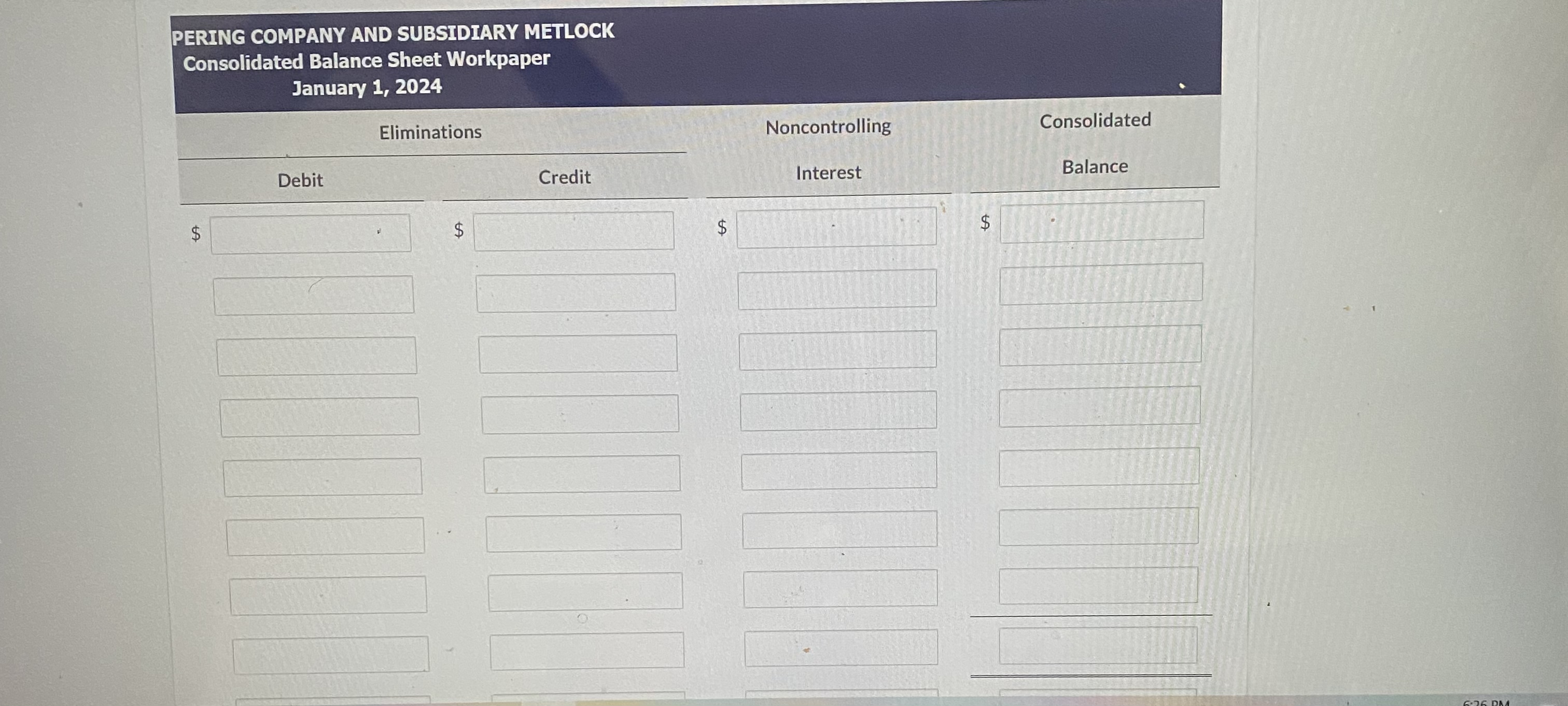

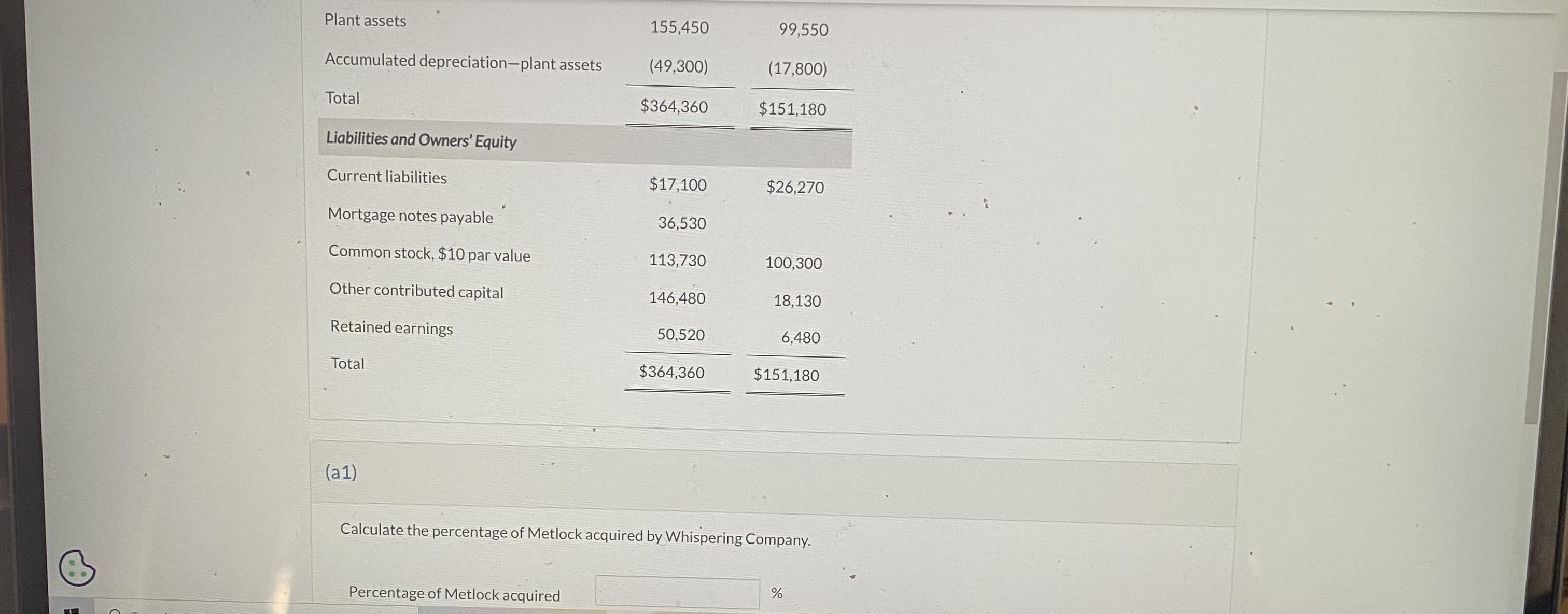

Prepare a schedule to compute the difference between book value of equity and the value implied by the purchase price. Any: difference between the book value of equity and the value implied by the purchase price relates to subsidiary plant assets. Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired On January 1, 2024, Whispering Company purchased 8,024 shares of Metlock Company's common stock for $118,000. Immediately after the stock acquisition, the statements of financial position of Whispering and Metlock appeared as follows: Prepare a consolidated balance sheet workpaper as of January 1, 2024. Plant Assets Accumulated Depreciation Total Current Liabilities Mortgage Note Payable Common Stock: Whispering Company Metlock Company Other Contributed Capital Whispering Company Metlock Company Retained Earnings: 155,45099,550 \( \frac{\frac{(49,300)}{364,360} \frac{(17,800)}{151,180}}{\hline \frac{26,270}{17,100}} \) 36,530 113,730 100,300 146,480 18,130 50,520 Other Contributed Capital Whispering Company Metlock Company Retained Earnings: Whispering Company Metlock Company Noncontrolling Interest Total 146,480 18,130 50,520 6,480 Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired PERING COMPANY AND SUBSIDIARY METLOCK Consolidated Balance Sheet Workpaper January 1, 2024 Consolidated $ Prepare a schedule to compute the difference between book value of equity and the value implied by the purchase price. Any: difference between the book value of equity and the value implied by the purchase price relates to subsidiary plant assets. Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired On January 1, 2024, Whispering Company purchased 8,024 shares of Metlock Company's common stock for $118,000. Immediately after the stock acquisition, the statements of financial position of Whispering and Metlock appeared as follows: Prepare a consolidated balance sheet workpaper as of January 1, 2024. Plant Assets Accumulated Depreciation Total Current Liabilities Mortgage Note Payable Common Stock: Whispering Company Metlock Company Other Contributed Capital Whispering Company Metlock Company Retained Earnings: 155,45099,550 \( \frac{\frac{(49,300)}{364,360} \frac{(17,800)}{151,180}}{\hline \frac{26,270}{17,100}} \) 36,530 113,730 100,300 146,480 18,130 50,520 Other Contributed Capital Whispering Company Metlock Company Retained Earnings: Whispering Company Metlock Company Noncontrolling Interest Total 146,480 18,130 50,520 6,480 Calculate the percentage of Metlock acquired by Whispering Company. Percentage of Metlock acquired PERING COMPANY AND SUBSIDIARY METLOCK Consolidated Balance Sheet Workpaper January 1, 2024 Consolidated $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts