Question: Please step by Step include formulas that were used. Thank You !! Odd process) Lel overning w. 11/ (Expected Ito) Consider an asset whose price

Please step by Step include formulas that were used.

Thank You !!

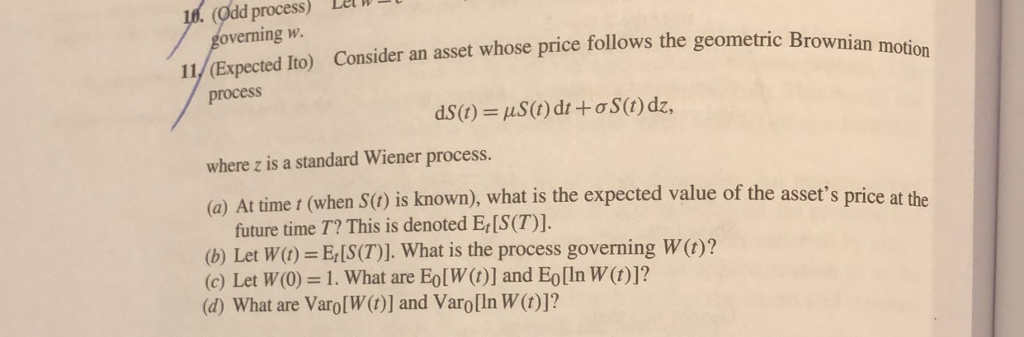

Odd process) Lel overning w. 11/ (Expected Ito) Consider an asset whose price follows the geometric Brownian process dS(t) S(t) dt + S(t) dz, where z is a standard Wiener proce (a) At time t (when SC) is known), what is the expected value of the asset's price at the ss future time T? This is denoted E, [S(T)]. (b) Let WO) EIS(T)]. What is the process governing W (1)? (c) Let W(O) = 1. What are EolW(t)] and E0 [In W(t))? d) What are VarolW()] and Varo[In W(t)]? Odd process) Lel overning w. 11/ (Expected Ito) Consider an asset whose price follows the geometric Brownian process dS(t) S(t) dt + S(t) dz, where z is a standard Wiener proce (a) At time t (when SC) is known), what is the expected value of the asset's price at the ss future time T? This is denoted E, [S(T)]. (b) Let WO) EIS(T)]. What is the process governing W (1)? (c) Let W(O) = 1. What are EolW(t)] and E0 [In W(t))? d) What are VarolW()] and Varo[In W(t)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts