Question: please stop giving me the same wrong answer Cupcakes -R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, whi

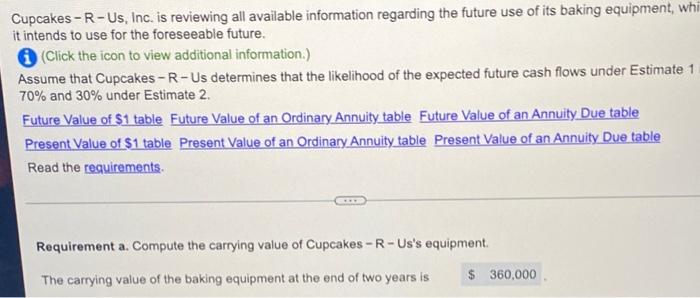

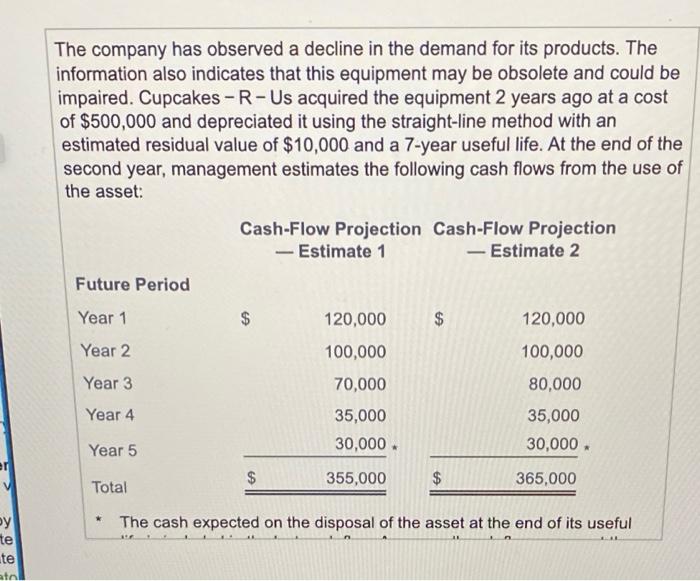

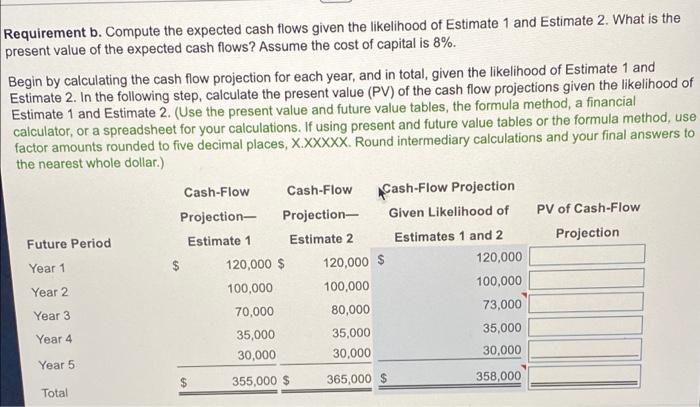

Cupcakes -R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, whi it intends to use for the foreseeable future. (Click the icon to view additional information.) Assume that Cupcakes -R-Us determines that the likelihood of the expected future cash flows under Estimate 1 70% and 30% under Estimate 2. Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements Requirement a. Compute the carrying value of Cupcakes -R-Us's equipment The carrying value of the baking equipment at the end of two years is $ 360,000 The company has observed a decline in the demand for its products. The information also indicates that this equipment may be obsolete and could be impaired. Cupcakes -R- Us acquired the equipment 2 years ago at a cost of $500,000 and depreciated it using the straight-line method with an estimated residual value of $10,000 and a 7-year useful life. At the end of the second year, management estimates the following cash flows from the use of the asset: Cash-Flow Projection Cash-Flow Projection - Estimate 1 - Estimate 2 Future Period Year 1 $ $ 120,000 100,000 120,000 100,000 Year 2 Year 3 70,000 80,000 Year 4 35,000 30,000. 35,000 30,000 Year 5 er $ 355,000 $ 365,000 Total * The cash expected on the disposal of the asset at the end of its useful HE te te atol Requirement b. Compute the expected cash flows given the likelihood of Estimate 1 and Estimate 2. What is the present value of the expected cash flows? Assume the cost of capital is 8%. Begin by calculating the cash flow projection for each year, and in total, given the likelihood of Estimate 1 and Estimate 2. In the following step, calculate the present value (PV) of the cash flow projections given the likelihood of Estimate 1 and Estimate 2. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round intermediary calculations and your final answers to the nearest whole dollar.) Cash-Flow Cash-Flow Cash-Flow Projection Projection- Projection- Given Likelihood of PV of Cash-Flow Future Period Estimate 1 Estimate 2 Estimates 1 and 2 Projection Year 1 $ 120,000 $ 120,000 $ 120,000 100,000 100,000 100,000 Year 3 70,000 80,000 73,000 Year 4 35,000 35,000 35,000 30,000 Year 5 30,000 30,000 355,000 $ 365,000 $ 358,000 Total Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts