Question: Please submit a report of your models in . pdf format and your Python code in . py (Python file) or . ipynb (Jupyter Notebook

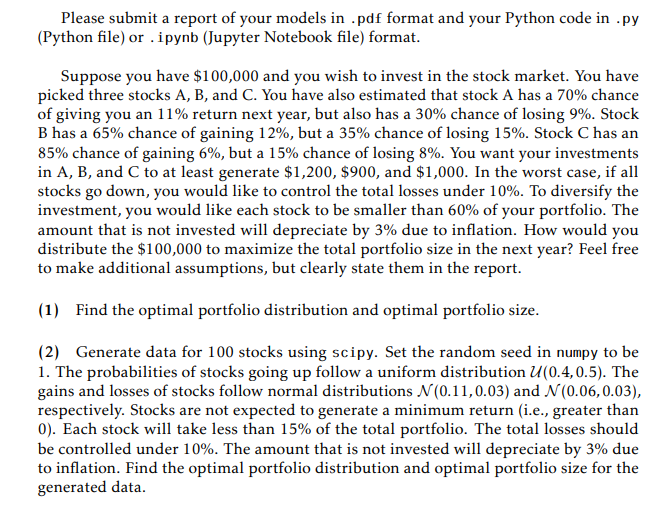

Please submit a report of your models in . pdf format and your Python code in . py (Python file) or . ipynb (Jupyter Notebook file) format. Suppose you have $100,000 and you wish to invest in the stock market. You have picked three stocks A, B, and C. You have also estimated that stock A has a 70% chance of giving you an 11% return next year, but also has a 30% chance of losing 9%. Stock B has a 65% chance of gaining 12%, but a 35% chance of losing 15%. Stock C has an 85% chance of gaining 6%, but a 15% chance of losing 8%. You want your investments in A,B, and C to at least generate $1,200,$900, and $1,000. In the worst case, if all stocks go down, you would like to control the total losses under 10%. To diversify the investment, you would like each stock to be smaller than 60% of your portfolio. The amount that is not invested will depreciate by 3% due to inflation. How would you distribute the $100,000 to maximize the total portfolio size in the next year? Feel free to make additional assumptions, but clearly state them in the report. (1) Find the optimal portfolio distribution and optimal portfolio size. (2) Generate data for 100 stocks using scipy. Set the random seed in numpy to be 1. The probabilities of stocks going up follow a uniform distribution U(0.4,0.5). The gains and losses of stocks follow normal distributions N(0.11,0.03) and N(0.06,0.03), respectively. Stocks are not expected to generate a minimum return (i.e., greater than 0 ). Each stock will take less than 15% of the total portfolio. The total losses should be controlled under 10%. The amount that is not invested will depreciate by 3% due to inflation. Find the optimal portfolio distribution and optimal portfolio size for the generated data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts