Question: please submit the answer in text (Without image ) it is easy to copy Question two Peter Ltd acquired 80% of preference shares of Sue

please submit the answer in text (Without image ) it is easy to copy

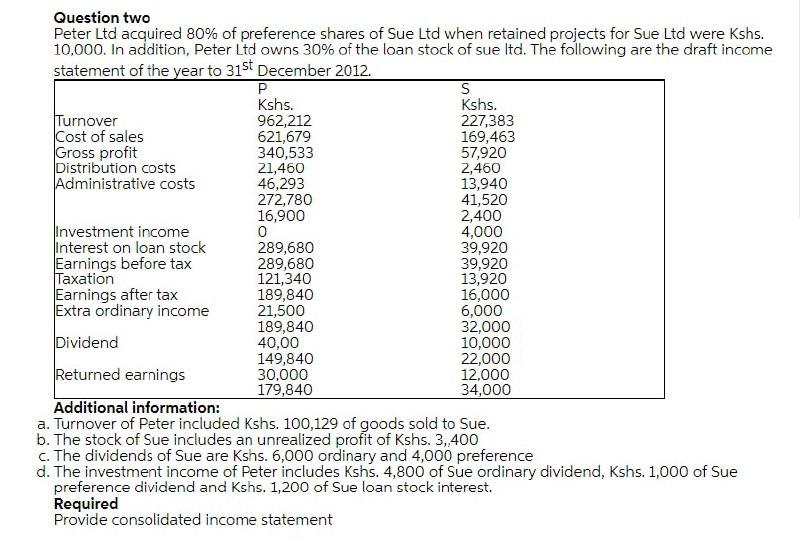

Question two Peter Ltd acquired 80% of preference shares of Sue Ltd when retained projects for Sue Ltd were Kshs. 10,000. In addition, Peter Ltd owns 30% of the loan stock of sue Itd. The following are the draft income statement of the year to 31st December 2012. P S Kshs. Kshs. Turnover 962,212 227,383 Cost of sales 621,679 169,463 Gross profit 340,533 57,920 Distribution costs 21,460 2,460 Administrative costs 46,293 13,940 272,780 41,520 16,900 2,400 Investment income 0 4,000 Interest on loan stock 289,680 39,920 Earnings before tax 289,680 39,920 Taxation 121,340 13,920 Earnings after tax 189,840 16,000 Extra ordinary income 21,500 6,000 189,840 32,000 Dividend 40,00 10,000 149,840 22,000 Returned earnings 30,000 12.000 179,840 34,000 Additional information: a. Turnover of Peter included Kshs. 100,129 of goods sold to Sue. b. The stock of Sue includes an unrealized profit of Kshs. 3,400 c. The dividends of Sue are Kshs. 6,000 ordinary and 4,000 preference d. The investment income of Peter includes Kshs. 4,800 of Sue ordinary dividend, Kshs. 1,000 of Sue preference dividend and Kshs. 1,200 of Sue loan stock interest. Required Provide consolidated income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts