Question: Please submit your work online. Round your answer to whole number 1. An intangible asset is when a company is not able to recover the

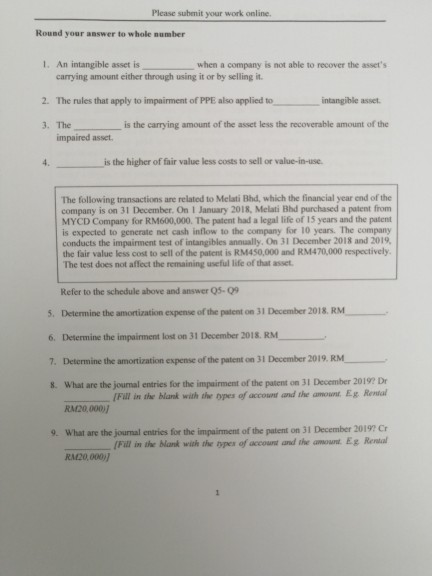

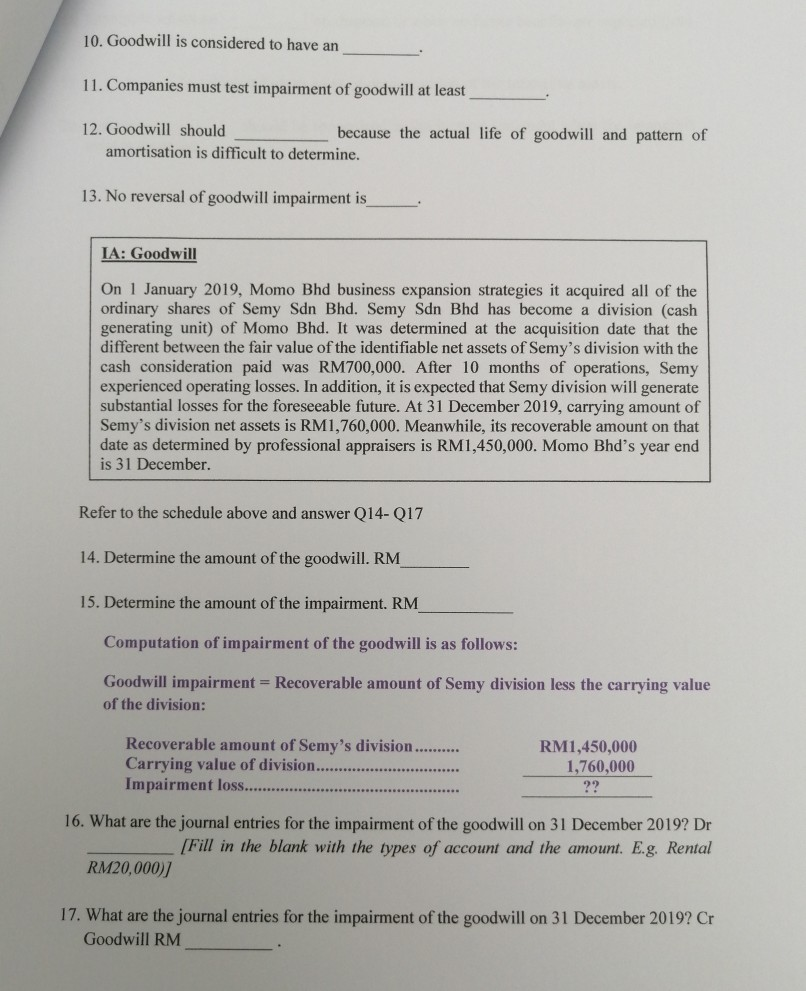

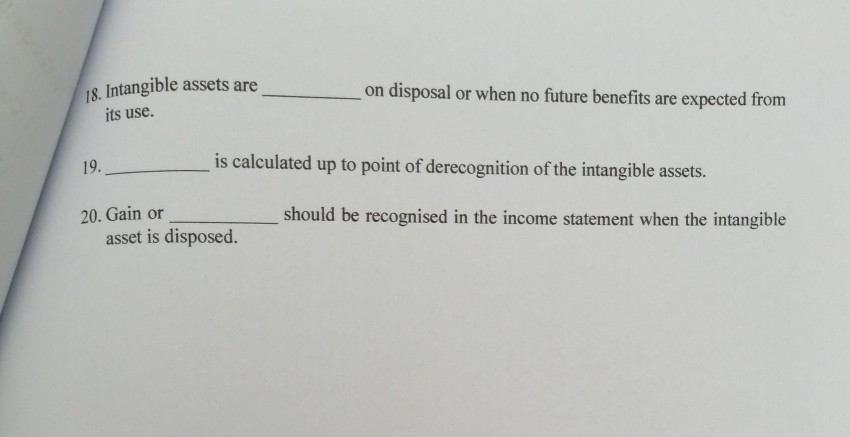

Please submit your work online. Round your answer to whole number 1. An intangible asset is when a company is not able to recover the asset's carrying amount either through using it or by selling it. 2. The rules that apply to impairment of PPE also applied to intangible asset 3. The is the carrying amount of the asset less the recoverable amount of the impaired asset is the higher of fair value less costs to sell or value-in-use. 4. The following transactions are related to Melati Bhd, which the financial year end of the company is on 31 December. On January 2018, Melati Bhd purchased a patent from MYCD Company for RM600,000. The patent had a legal life of 15 years and the patent is expected to generate net cash inflow to the company for 10 years. The company conducts the impairment test of intangibles annually. On 31 December 2018 and 2019, the fair value less cost to sell of the patent is RM450,000 and RM470,000 respectively, The test does not affect the remaining useful life of that asset Refer to the schedule above and answer 05-09 5. Determine the amortization expense of the patent on 31 December 2018, RM 6. Determine the impairment lost on 31 December 2018. RM 7. Determine the amortization expense of the patent on 31 December 2019. RM 8. What are the journal entries for the impairment of the patent on 31 December 2019? Dr [Fill in the blank with the types of account and the amour. Eg Rental RM20,000) 9. What are the journal entries for the impairment of the patent on 31 December 20197 C Fill in the Bank with the spex of account and the amount. Eg Rental RM20,00017 1 10. Goodwill is considered to have an 11. Companies must test impairment of goodwill at least 12. Goodwill should because the actual life of goodwill and pattern of amortisation is difficult to determine. 13. No reversal of goodwill impairment is IA: Goodwill On 1 January 2019, Momo Bhd business expansion strategies it acquired all of the ordinary shares of Semy Sdn Bhd. Semy Sdn Bhd has become a division (cash generating unit) of Momo Bhd. It was determined at the acquisition date that the different between the fair value of the identifiable net assets of Semy's division with the cash consideration paid was RM700,000. After 10 months of operations, Semy experienced operating losses. In addition, it is expected that Semy division will generate substantial losses for the foreseeable future. At 31 December 2019, carrying amount of Semy's division net assets is RM1,760,000. Meanwhile, its recoverable amount on that date as determined by professional appraisers is RM1,450,000. Momo Bhd's year end is 31 December Refer to the schedule above and answer Q14-017 14. Determine the amount of the goodwill. RM 15. Determine the amount of the impairment. RM Computation of impairment of the goodwill is as follows: Goodwill impairment = Recoverable amount of Semy division less the carrying value of the division: Recoverable amount of Semy's division.......... Carrying value of division. Impairment loss....... RM1,450,000 1,760,000 ?? 16. What are the journal entries for the impairment of the goodwill on 31 December 2019? Dr [Fill in the blank with the types of account and the amount. E.g. Rental RM20,000) 17. What are the journal entries for the impairment of the goodwill on 31 December 2019? Cr Goodwill RM 18. Intangible assets are its use. on disposal or when no future benefits are expected from 19. is calculated up to point of derecognition of the intangible assets. should be recognised in the income statement when the intangible 20. Gain or asset is disposed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts