Question: please summarize this paragraph as simple as possible but also contains the main point Option Strategies Risk Assessment Covered Call Risk Assessment Our 4 Key

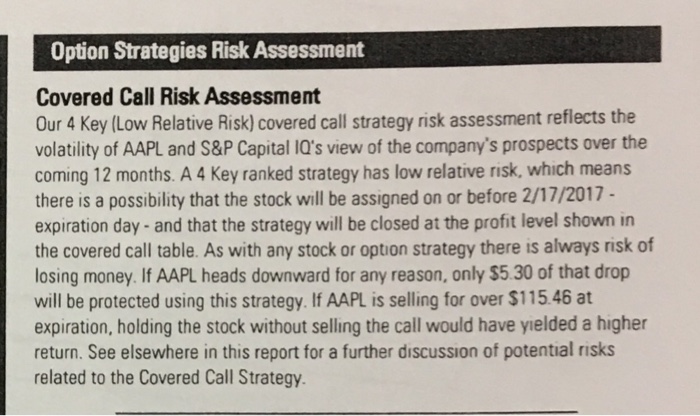

Option Strategies Risk Assessment Covered Call Risk Assessment Our 4 Key (Low Relative Risk) covered call strategy risk assessment reflects the volatility of AAPL and S&P Capital lo's view of the company's prospects over the coming 12 months. A 4 Key ranked strategy has low relative risk, which means there is a possibility that the stock will be assigned on or before 2/17/2017 expiration day and that the strategy will be closed at the profit level shown in the covered call table. As with any stock or option strategy there is always risk of losing money. If AAPL heads downward for any reason, only $5.30 of that drop will be protected using this strategy. If AAPL is selling for over $115.46 at expiration, holding the stock without selling the call would have yielded a higher return. See elsewhere in this report for a further discussion of potential risks related to the Covered Call Strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts