Question: please take time, I got wrong answers before Maple Enterprises Ltd. has always claimed maximum CCA. Maple had the net income of $100,000 excluding the

please take time, I got wrong answers before

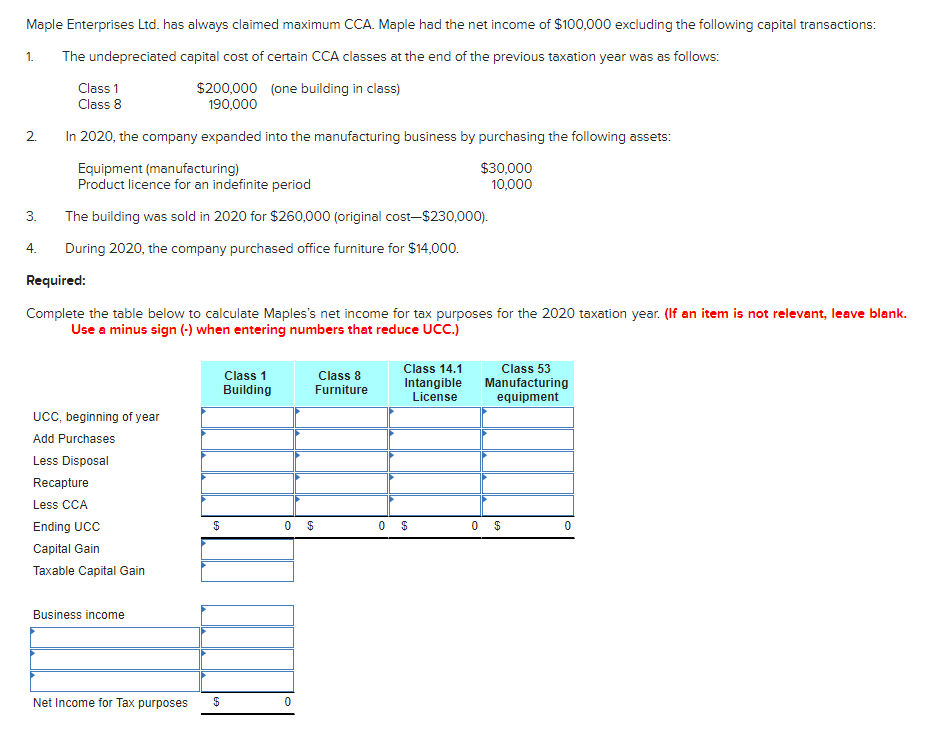

Maple Enterprises Ltd. has always claimed maximum CCA. Maple had the net income of $100,000 excluding the following capital transactions: 1. The undepreciated capital cost of certain CCA classes at the end of the previous taxation year was as follows: Class 1 $200,000 (one building in class) Class 8 190,000 In 2020, the company expanded into the manufacturing business by purchasing the following assets: Equipment (manufacturing) $30,000 Product licence for an indefinite period 10,000 3. The building was sold in 2020 for $260,000 (original cost-$230,000). 4. During 2020, the company purchased office furniture for $14,000. 2 Required: Complete the table below to calculate Maples's net income for tax purposes for the 2020 taxation year. (If an item is not relevant, leave blank. Use a minus sign (-) when entering numbers that reduce UCC.) Class 1 Building Class 8 Furniture Class 14.1 Intangible License Class 53 Manufacturing equipment UCC, beginning of year Add Purchases Less Disposal Recapture Less CCA Ending UCC Capital Gain Taxable Capital Gain $ 0 0 $ 0 $ Business income Net Income for Tax purposes GA 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts