Question: Please take your time and make sure you answer to the best of your ability. Thanks! 1. Quarles Industries had the following operating results for

Please take your time and make sure you answer to the best of your ability. Thanks!

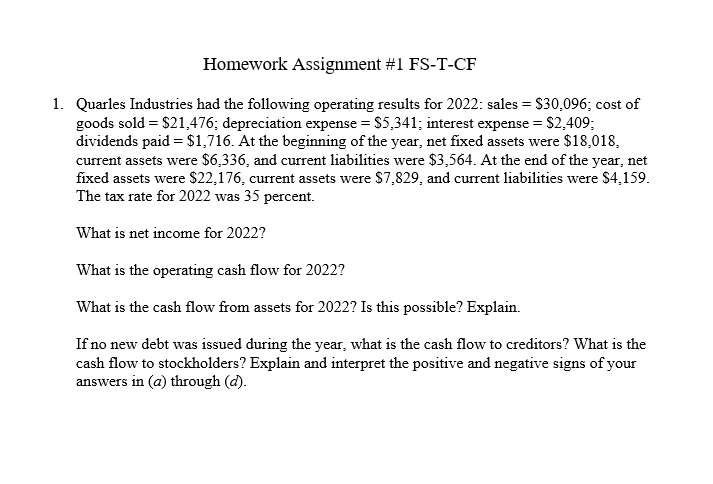

1. Quarles Industries had the following operating results for 2022: sales =$30,096; cost of goods sold =$21,476; depreciation expense =$5,341; interest expense =$2,409; dividends paid =$1,716. At the beginning of the year, net fixed assets were $18,018, current assets were $6,336, and current liabilities were $3,564. At the end of the year, net fixed assets were $22,176, current assets were $7,829, and current liabilities were $4,159. The tax rate for 2022 was 35 percent. What is net income for 2022 ? What is the operating cash flow for 2022 ? What is the cash flow from assets for 2022? Is this possible? Explain. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to stockholders? Explain and interpret the positive and negative signs of your answers in (a) through (d). 1. Quarles Industries had the following operating results for 2022: sales =$30,096; cost of goods sold =$21,476; depreciation expense =$5,341; interest expense =$2,409; dividends paid =$1,716. At the beginning of the year, net fixed assets were $18,018, current assets were $6,336, and current liabilities were $3,564. At the end of the year, net fixed assets were $22,176, current assets were $7,829, and current liabilities were $4,159. The tax rate for 2022 was 35 percent. What is net income for 2022 ? What is the operating cash flow for 2022 ? What is the cash flow from assets for 2022? Is this possible? Explain. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to stockholders? Explain and interpret the positive and negative signs of your answers in (a) through (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts