Question: please take your time to make sure this question is answered correctly Assume that. Sunland completed the office and warehouse building on December 31,2025 ,

please take your time to make sure this question is answered correctly

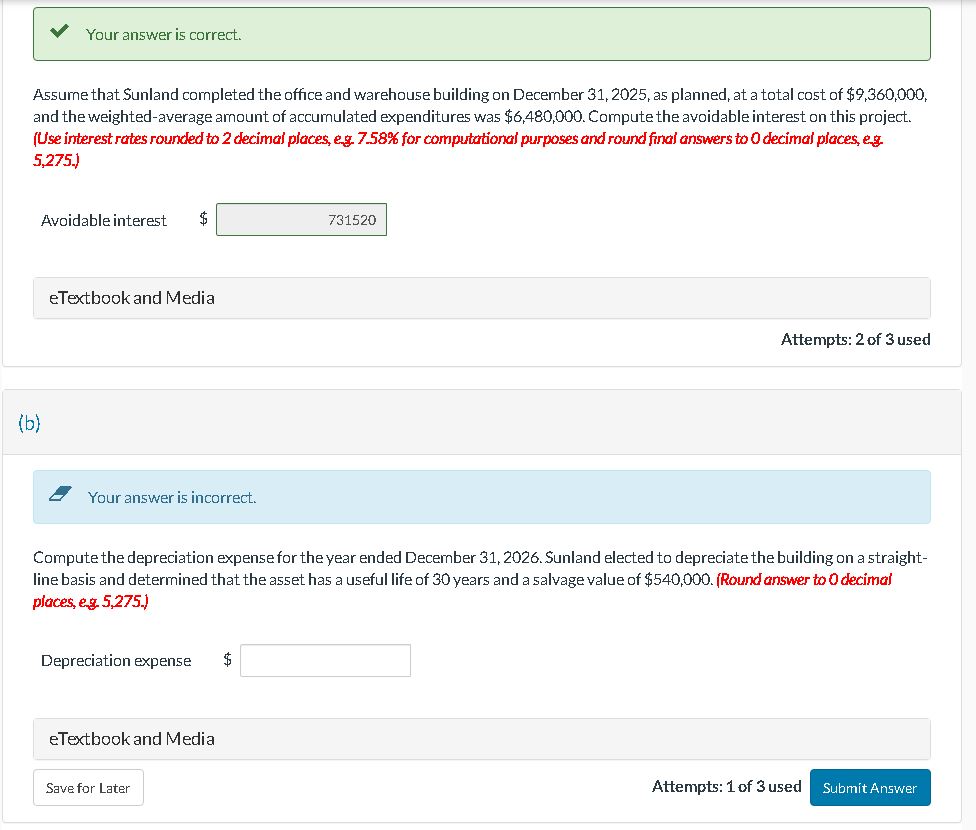

Assume that. Sunland completed the office and warehouse building on December 31,2025 , as planned, at a total cost of $9,360,000, and the weighted-average arnount of accumulated expenditures was $6,480,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, es 7.58% for computational purposes and round final answers to 0 decimal places, eg 5,275. Avoidable interest eTextbook and Media Attempts: 2 of 3 used (b) - Your answer is incorrect. Compute the depreciation expense for the year ended December 31, 2026. Sunland elected to depreciate the building on a straightline basis and determined that the asset has a useful life of 30 years and a salvage value of $540,000. (Round answer to 0 decimal places, eg 5,275. Depreciation expense $ eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts