Question: please tell me how to get the right answer . will upvote Nash inc. a manufacturer of steel school lockers, pians to purchase a new

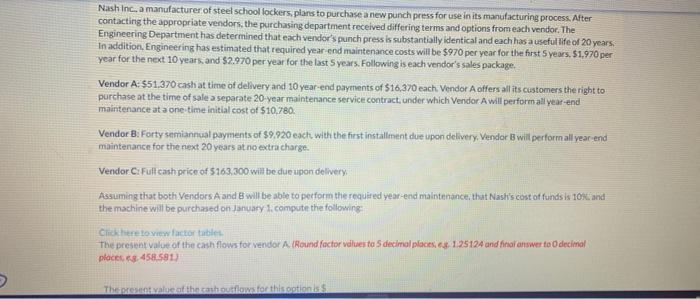

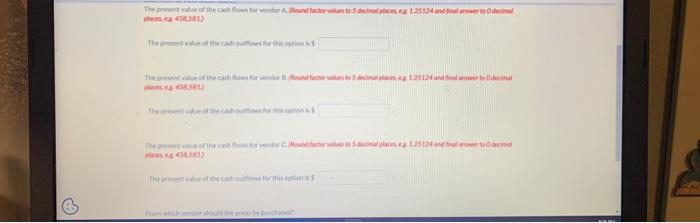

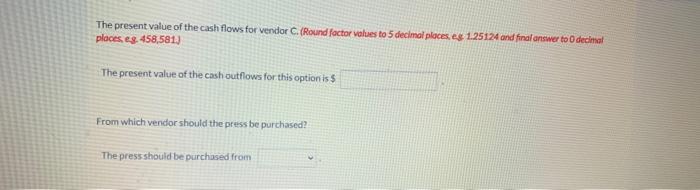

Nash inc. a manufacturer of steel school lockers, pians to purchase a new punch press for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor, The Engineering Department has determined that each vendor's punch press is substantially identical and each has a usefulife of 20 years. In addition. Engineering has estimated that required year-end mairtenance costs will be $970 per year for the frst $ years, $1,970 per year for the next 10 years; and $2.970 per year for the last 5 years. Following is each vendor's sales package. Vendor A: $51.370 cash at time of delivery and 10 year-end payments of $16,370 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 20 -year maintenance service contract, under which Vendor A will perform all year end maintenance at a one time initial cost of $10,780. Vendor B: Forty semiannual payments of $9,920 each, with the first installiment due upon delivery, Vendor B will perform all vear end maintenance for the next 20 years at no extra charge. Vendor C.Fulf cash price of $163,300 will be due upon delivery: Assuming thot both. Vendors A and B will be able to perform the requifed year-end maintenance, that Nashis cost of funds is 10 in and the machine will be purchased on january li compute the following: Clicktiereloview factor tubles. The present value of the cash flows for vendor A. (Round foctor vilues to 5 decimal plocesi es. 1.25124 and finar answer to 0 decinal phocec ess.458:591) darce a dyest? The present value of the cash flows for vendor C. (Round foctor velues to 5 decimal ploces, es. 1.25124 and final answer to 0 decitat ploces, e. 458,581. The present value of the cash outflows for this optionis $ From which vendor should the press be purchased? The press should be purchased from Nash inc. a manufacturer of steel school lockers, pians to purchase a new punch press for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor, The Engineering Department has determined that each vendor's punch press is substantially identical and each has a usefulife of 20 years. In addition. Engineering has estimated that required year-end mairtenance costs will be $970 per year for the frst $ years, $1,970 per year for the next 10 years; and $2.970 per year for the last 5 years. Following is each vendor's sales package. Vendor A: $51.370 cash at time of delivery and 10 year-end payments of $16,370 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 20 -year maintenance service contract, under which Vendor A will perform all year end maintenance at a one time initial cost of $10,780. Vendor B: Forty semiannual payments of $9,920 each, with the first installiment due upon delivery, Vendor B will perform all vear end maintenance for the next 20 years at no extra charge. Vendor C.Fulf cash price of $163,300 will be due upon delivery: Assuming thot both. Vendors A and B will be able to perform the requifed year-end maintenance, that Nashis cost of funds is 10 in and the machine will be purchased on january li compute the following: Clicktiereloview factor tubles. The present value of the cash flows for vendor A. (Round foctor vilues to 5 decimal plocesi es. 1.25124 and finar answer to 0 decinal phocec ess.458:591) darce a dyest? The present value of the cash flows for vendor C. (Round foctor velues to 5 decimal ploces, es. 1.25124 and final answer to 0 decitat ploces, e. 458,581. The present value of the cash outflows for this optionis $ From which vendor should the press be purchased? The press should be purchased from

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts