Question: please TEXT response and be descriptive with answer. Hard to read some cursive answers so if you oerfer to write okease write clear what? A

please TEXT response and be descriptive with answer. Hard to read some cursive answers so if you oerfer to write okease write clear

what?

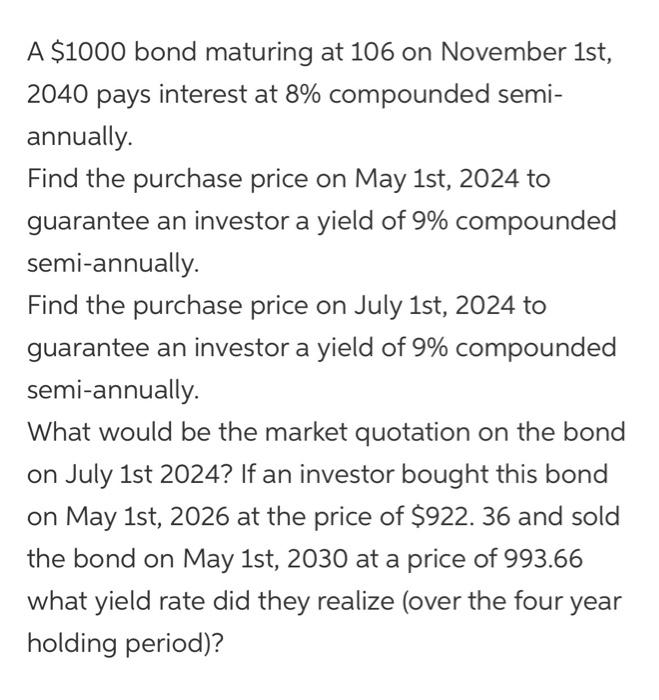

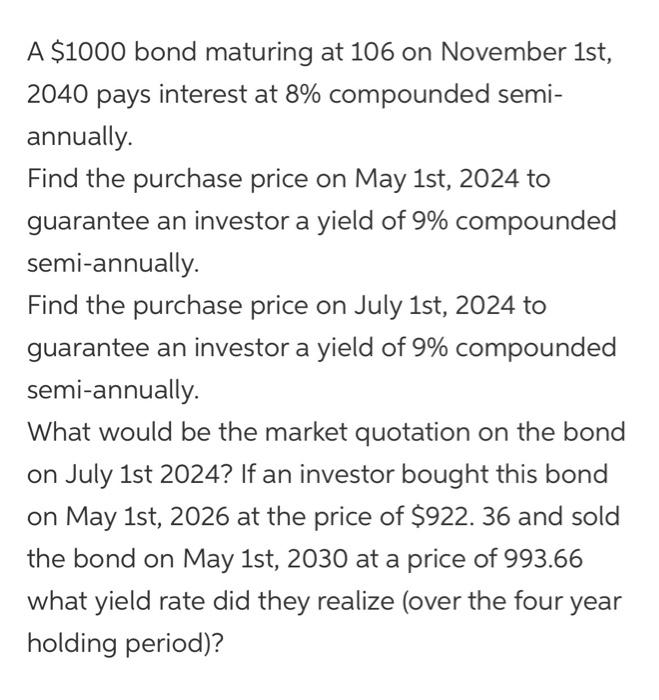

A $1000 bond maturing at 106 on November 1st, 2040 pays interest at 8% compounded semi- annually. Find the purchase price on May 1st, 2024 to guarantee an investor a yield of 9% compounded semi-annually. Find the purchase price on July 1st, 2024 to guarantee an investor a yield of 9% compounded semi-annually. What would be the market quotation on the bond on July 1st 2024? If an investor bought this bond on May 1st, 2026 at the price of $922. 36 and sold the bond on May 1st, 2030 at a price of 993.66 what yield rate did they realize (over the four year holding period)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock