Question: please the answers and explain the answer ore on Assunce on agiven day that cash register tapes $600 and mail receipts opened by the lapper

please the answers and explain the answer

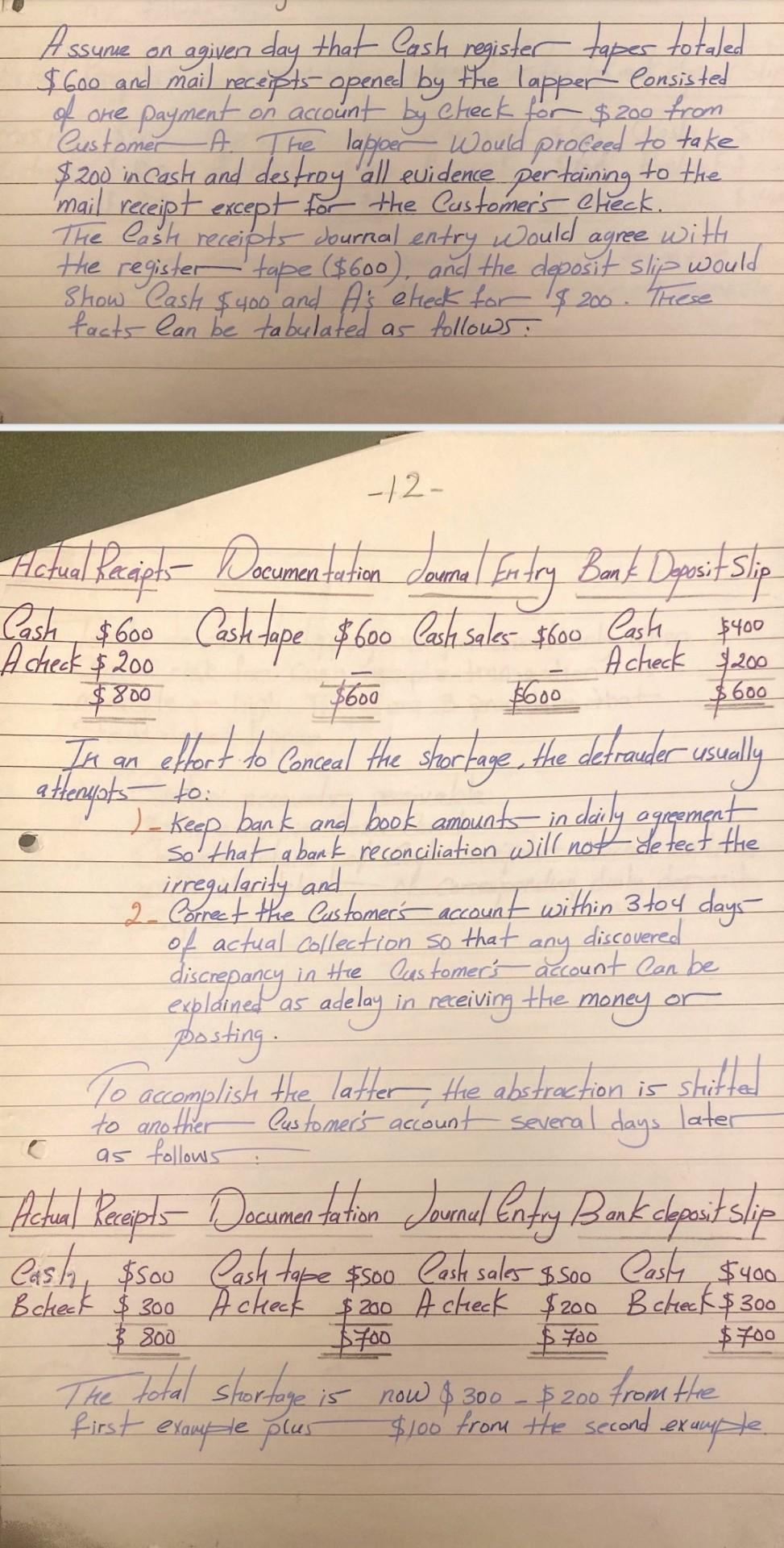

ore on Assunce on agiven day that cash register tapes $600 and mail receipts opened by the lapper Consisted payment account by Check for $200 from Customer A. The lapper $200 in cash and destroy all evidence pertaining to the A. The lapper would proceed to take mail receipt except for the Customer's eleck. The lit receipts Journal entry would agree with He register tape ($600) and the deposit slip would Show Cash $400 and A's check for 1900. These facts can be tabulated as follows: Actual Recapt> $ $400 Acheck $200 $800 $600 $600 an a -12- ilchul Kraph Decumentation dowels Documentation Coural Section Bank Deposit slip Cash $600 Cask tape $600 Cash sales $500 Cash $ $ $600 In effort to Conceal the storkage, the detrouder - usually a terysts to: he keep bank and book amounts in dezily agrements so that a bank reconciliation will not detect the 2 Correct the Customer's account within 3 to 4 days irregularity and of actual collection so that any count can be discovered discrepancy in the Customer's explained as adelay in receiving the money posting. To acomplish the latter, Hae abstraction is shitted to another Customer's account several as follows Actual Repods Documentation Jovenel Cintoy Bank alopsit slip Cash, $500 Cash tape $500 Caste sales 8500 Cash $400 $ Bcheck $300 A check $2 $200 A check $200 B check $300 $ 800 1700 The total shortage is now $ 300 - $200. $100 from the second example or days later $ 700 $ 700 from the first examy le plus - Tests to detect lapping are performed only when Control risk for cash receipts transactions is Moderate or high. There are 3 procedures that Should detect lapping 2 Confirme accounts receivable 2. Make a a suprise Cash Count 3. Compare details of Cashe receipts Journal entries . with the details of Corresponding daily deposit Slips. 10 ore on Assunce on agiven day that cash register tapes $600 and mail receipts opened by the lapper Consisted payment account by Check for $200 from Customer A. The lapper $200 in cash and destroy all evidence pertaining to the A. The lapper would proceed to take mail receipt except for the Customer's eleck. The lit receipts Journal entry would agree with He register tape ($600) and the deposit slip would Show Cash $400 and A's check for 1900. These facts can be tabulated as follows: Actual Recapt> $ $400 Acheck $200 $800 $600 $600 an a -12- ilchul Kraph Decumentation dowels Documentation Coural Section Bank Deposit slip Cash $600 Cask tape $600 Cash sales $500 Cash $ $ $600 In effort to Conceal the storkage, the detrouder - usually a terysts to: he keep bank and book amounts in dezily agrements so that a bank reconciliation will not detect the 2 Correct the Customer's account within 3 to 4 days irregularity and of actual collection so that any count can be discovered discrepancy in the Customer's explained as adelay in receiving the money posting. To acomplish the latter, Hae abstraction is shitted to another Customer's account several as follows Actual Repods Documentation Jovenel Cintoy Bank alopsit slip Cash, $500 Cash tape $500 Caste sales 8500 Cash $400 $ Bcheck $300 A check $2 $200 A check $200 B check $300 $ 800 1700 The total shortage is now $ 300 - $200. $100 from the second example or days later $ 700 $ 700 from the first examy le plus - Tests to detect lapping are performed only when Control risk for cash receipts transactions is Moderate or high. There are 3 procedures that Should detect lapping 2 Confirme accounts receivable 2. Make a a suprise Cash Count 3. Compare details of Cashe receipts Journal entries . with the details of Corresponding daily deposit Slips. 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts