Question: please this is the third time i post the same question and still wrong answers help please Problem 7-18 Credit policy decision-receivables and inventory (L07-4,

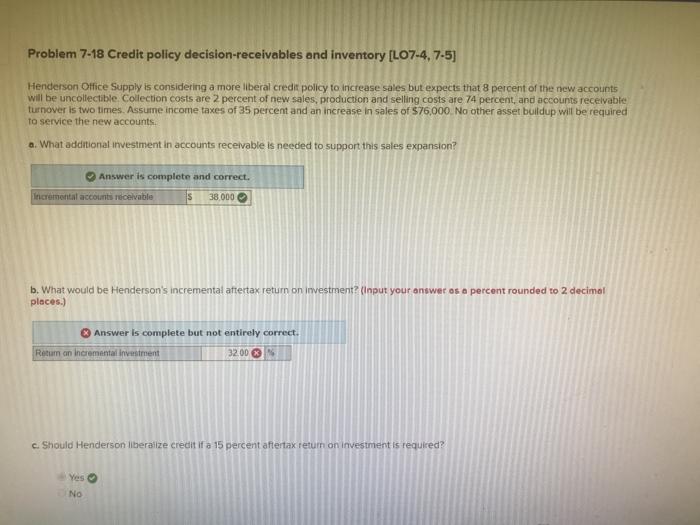

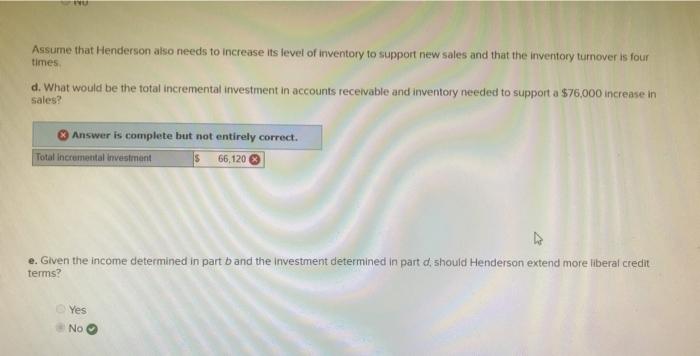

Problem 7-18 Credit policy decision-receivables and inventory (L07-4, 7-5) Henderson Office Supply is considering a more liberal credit policy to increase sales but expects that 8 percent of the new accounts will be uncollectible Collection costs are 2 percent of new sales, production and selling costs are 74 percent, and accounts receivable turnover is two times. Assume income taxes of 35 percent and an increase in sales of $76,000 No other asset buildup will be required to service the new accounts a. What additional investment in accounts receivable is needed to support this sales expansion? Answer is complete and correct. Incremental accounts receivable is 38.000 b. What would be Henderson's incremental aftertax return on investment? (Input your answer as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Return an incremental investment 3200 X c. Should Henderson liberalize credit If a 15 percent aftertax return on investment is required? Yes No Assume that Henderson also needs to increase its level of inventory to support new sales and that the inventory turnover is four times d. What would be the total incremental investment in accounts receivable and inventory needed to support a $76,000 increase in sales? Answer is complete but not entirely correct. Total incremental investment $ 66,120 e. Given the income determined in part band the investment determined in part d should Henderson extend more liberal credit terms? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts