Question: please thoroughly solve problems 1-3 Extra Credit (10 total points) Calculate the cost of debt for a firm that can issue a 15-year, 10% semiannual

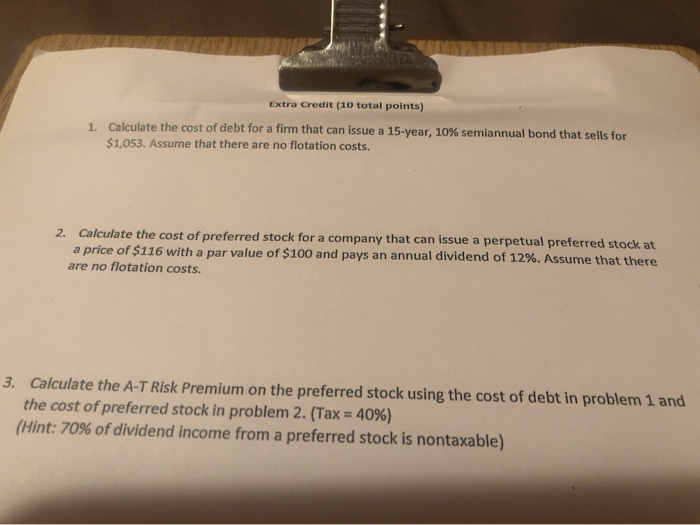

Extra Credit (10 total points) Calculate the cost of debt for a firm that can issue a 15-year, 10% semiannual bond that sells for $1,053. Assume that there are no flotation costs. I. 2. Calculate the cost of preferred stock for a company that can issue a perpetual preferred stock at a price of$116 with a par value of $100 and pays an annual dividend of 12%. Assume that ther are no flotation costs. 3. Calculate the A-T Risk Premium on the preferred stock using the cost of debt in problem 1 and the cost of preferred stock in problem 2 . (Tax 40%) (Hint: 70% of dividend income from a preferred stock is nontaxable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts