Question: Please to be as detailed as possible with the solution. Assume zero transactions costs and the following information: Spot rate of the Japanese yen =

Please to be as detailed as possible with the solution.

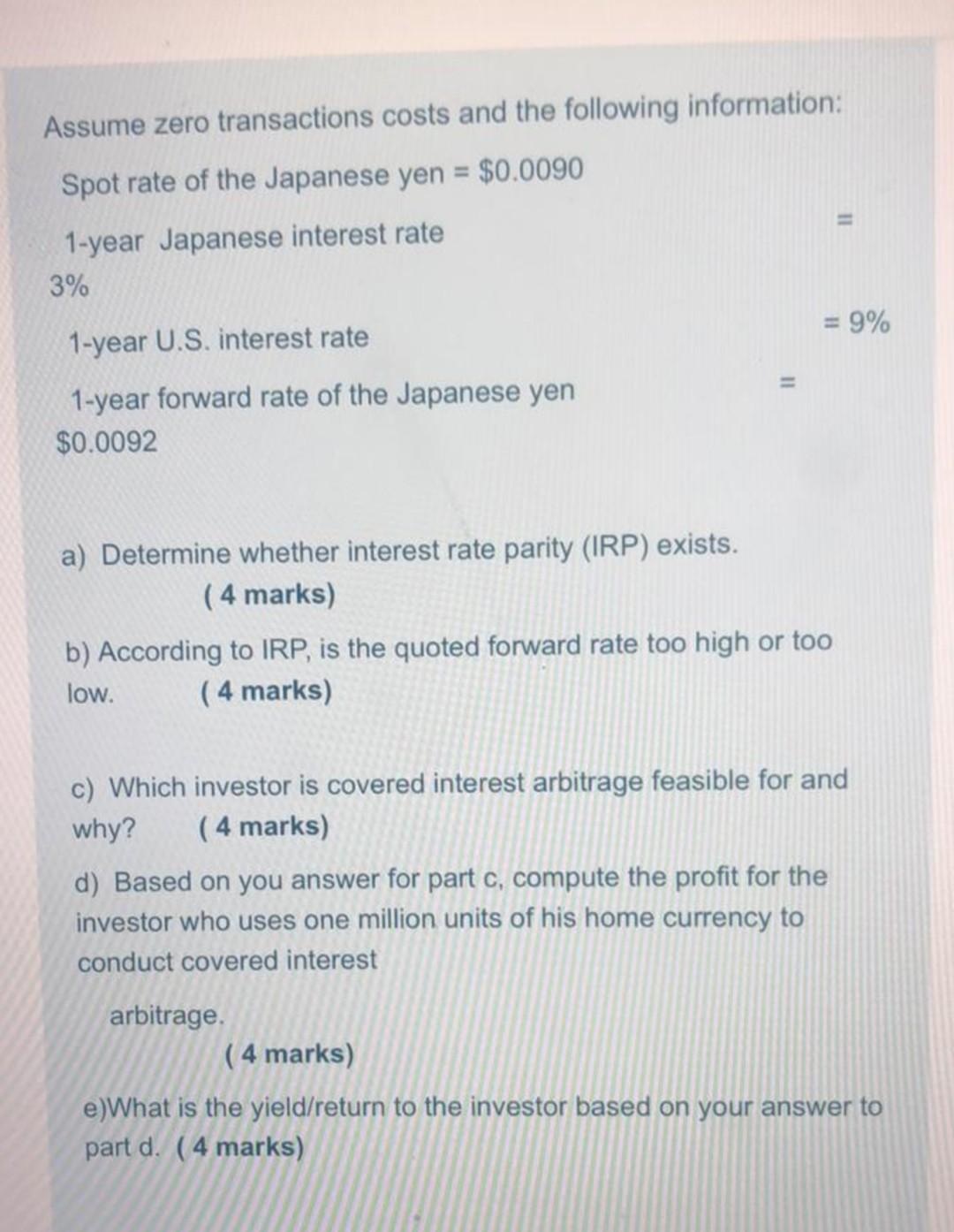

Assume zero transactions costs and the following information: Spot rate of the Japanese yen = $0.0090 1-year Japanese interest rate 3% 11 = 9% 1-year U.S. interest rate 1-year forward rate of the Japanese yen $0.0092 a) Determine whether interest rate parity (IRP) exists. (4 marks) b) According to IRP, is the quoted forward rate too high or too low. (4 marks) c) Which investor is covered interest arbitrage feasible for and why? (4 marks) d) Based on you answer for part c, compute the profit for the investor who uses one million units of his home currency to conduct covered interest arbitrage. (4 marks) e)What is the yield/return to the investor based on your answer to part d. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts