Question: Please to be as detailed with the solution to this problem. Thank you. d) Sam, your peer support representative, at Yours Investment Bank (YIB) congratulated

Please to be as detailed with the solution to this problem. Thank you.

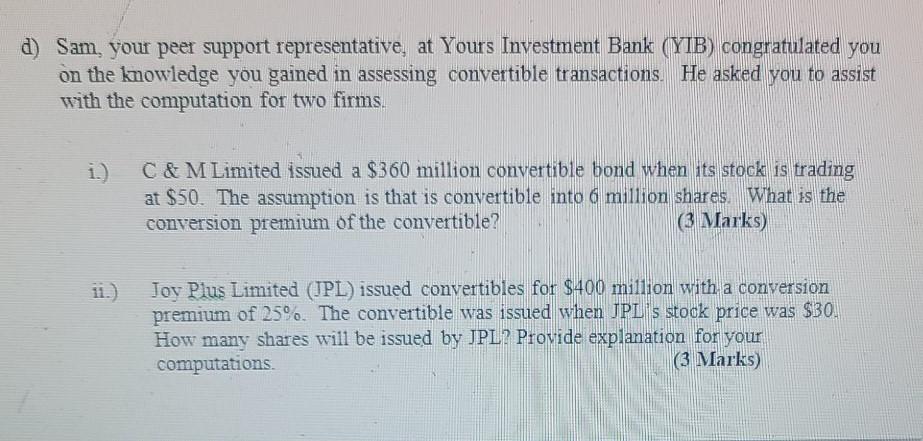

d) Sam, your peer support representative, at Yours Investment Bank (YIB) congratulated you on the knowledge you gained in assessing convertible transactions. He asked you to assist with the computation for two firms. i) C & M Limited issued a $360 million convertible bond when its stock is trading at $50. The assumption is that is convertible into 6 million shares. What is the conversion premium of the convertible? (3 Marks Joy Plus Limited (JPL issued convertibles for $400 million with a conversion premium of 25%. The convertible was issued when JPuis stock price was $30. How many shares will be issued by JPL? Provide explanation for your computations (3 Marks) d) Sam, your peer support representative, at Yours Investment Bank (YIB) congratulated you on the knowledge you gained in assessing convertible transactions. He asked you to assist with the computation for two firms. i) C & M Limited issued a $360 million convertible bond when its stock is trading at $50. The assumption is that is convertible into 6 million shares. What is the conversion premium of the convertible? (3 Marks Joy Plus Limited (JPL issued convertibles for $400 million with a conversion premium of 25%. The convertible was issued when JPuis stock price was $30. How many shares will be issued by JPL? Provide explanation for your computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts