Question: Please, try not to use Excel or any Computer to solve this problem. Use formulas, math and written explanation to solve the problem. Make sure

Please, try not to use Excel or any Computer to solve this problem. Use formulas, math and written explanation to solve the problem. Make sure the answers are well written, clear, and easy to understand. Thanks.

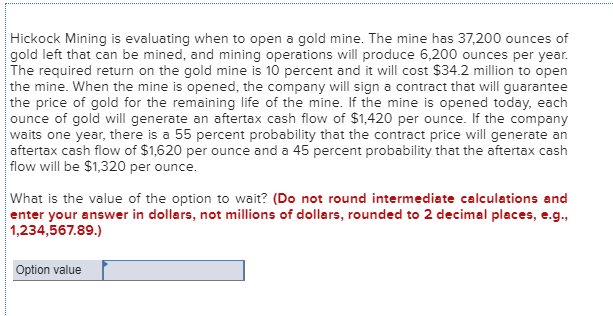

Hickock Mining is evaluating when to open a gold mine. The mine has 37,200 ounces of gold left that can be mined, and mining operations will produce 6,200 ounces per year. The required return on the gold mine is 10 percent and it will cost $34.2 million to open the mine. When the mine is opened, the company will sign a contract that will guarantee the price of gold for the remaining life of the mine. If the mine is opened today, each ounce of gold will generate an aftertax cash flow of $1,420 per ounce. If the company waits one year, there is a 55 percent probability that the contract price will generate an aftertax cash flow of $1,620 per ounce and a 45 percent probability that the aftertax cash flow will be $1,320 per ounce. What is the value of the option to wait? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Option value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts