Question: Please try to answer all in 30 minute just need final answer Investor Elliot buys shares of stock A for $10,000, while investor Michael takes

Please try to answer all in 30 minute just need final answer

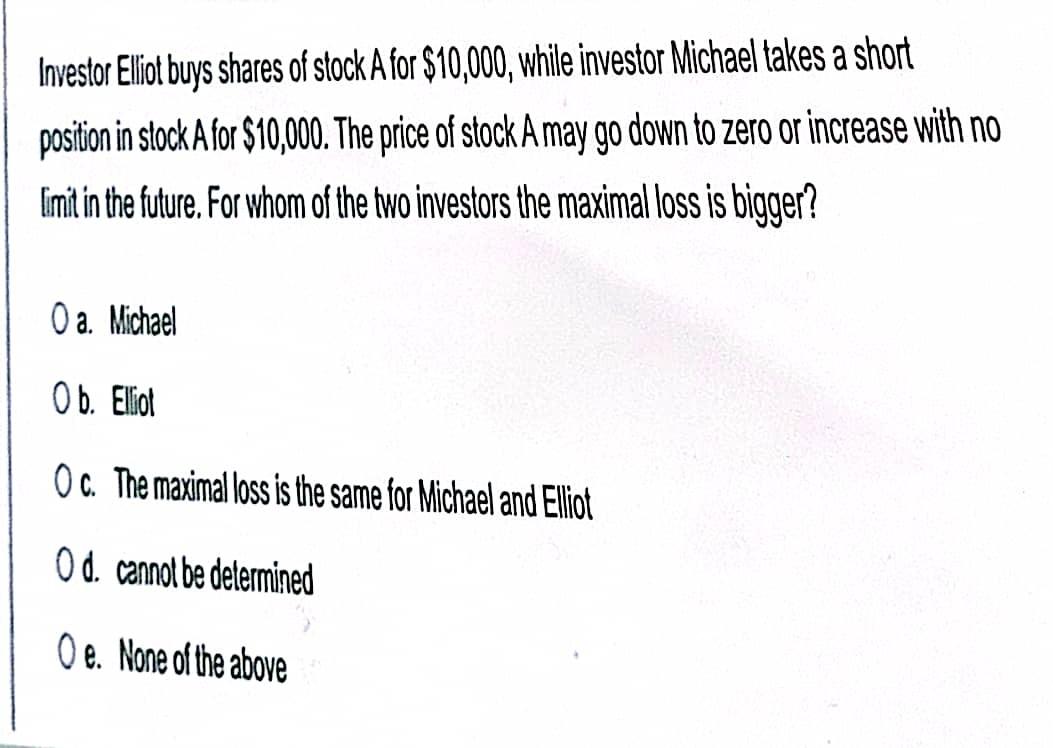

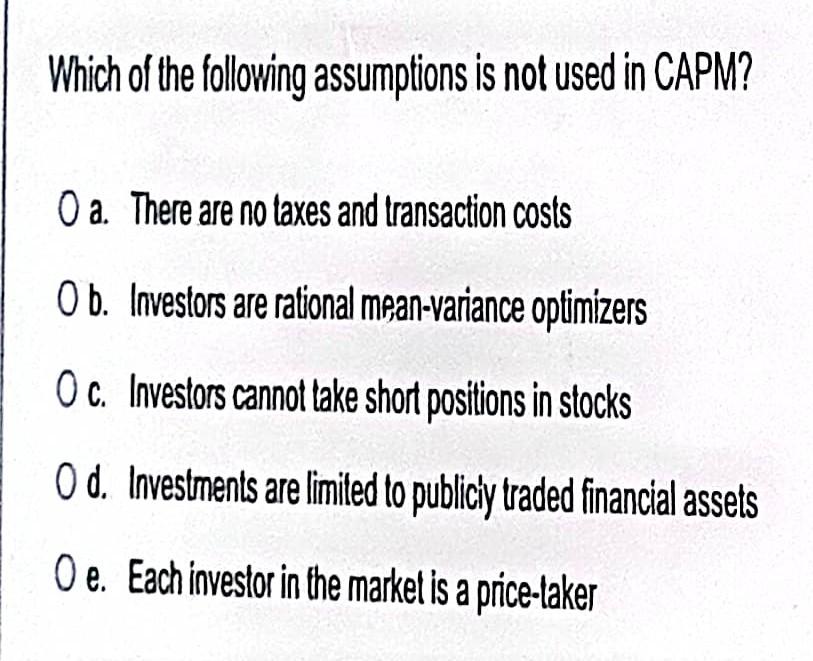

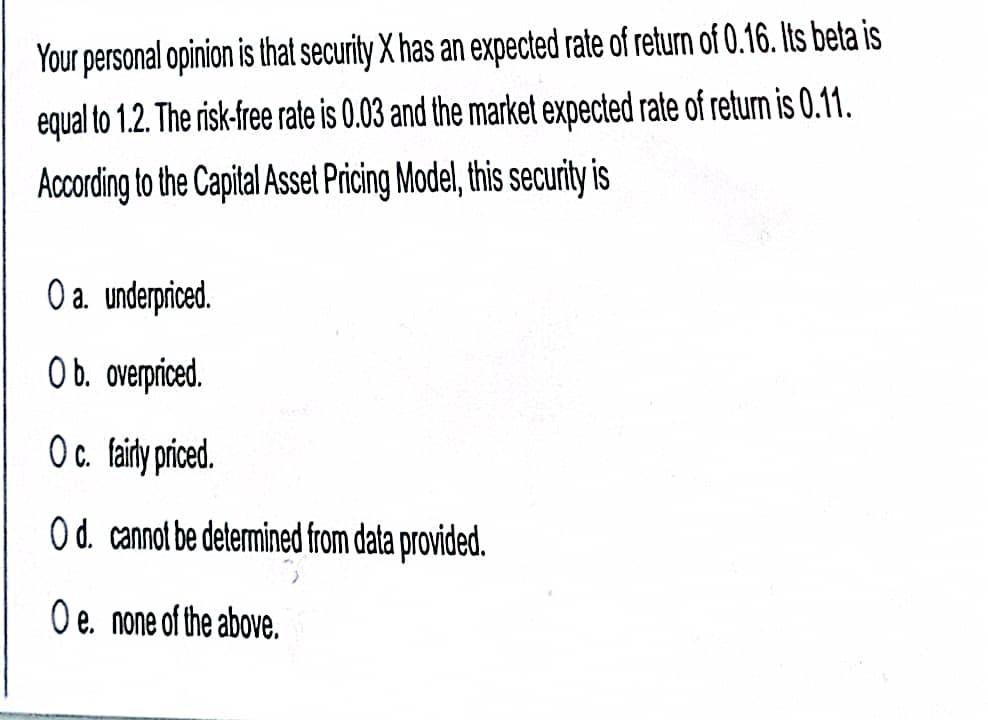

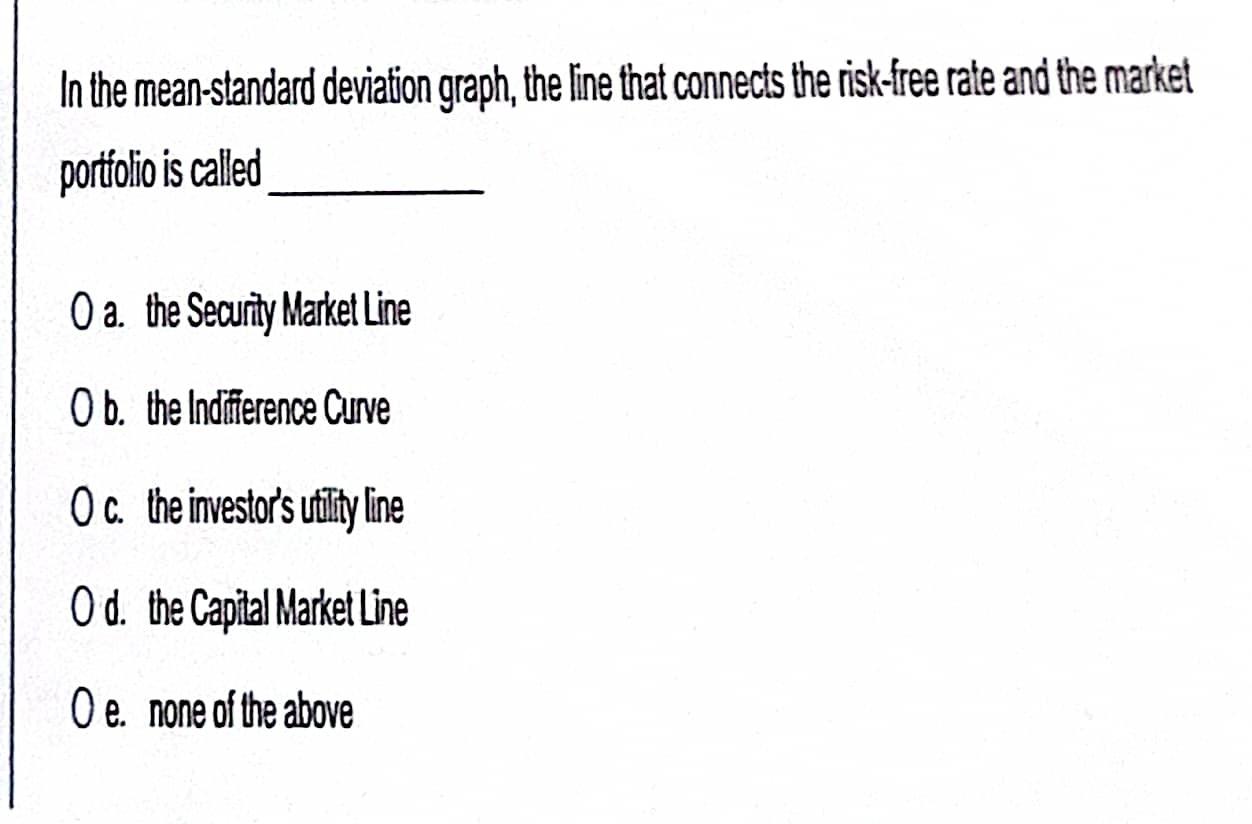

Investor Elliot buys shares of stock A for $10,000, while investor Michael takes a short position in stock A for $10,000. The price of stock A may go down to zero or increase with no Imit in the future. For whom of the two investors the maximal loss is bigger? O a Michael Ob. Elliot O c. The maximal loss is the same for Michael and Elliot Od cannot be determined Oe. None of the above Which of the following assumptions is not used in CAPM? O a. There are no taxes and transaction costs O b. Investors are rational mean-variance optimizers Oc. Investors cannot take short positions in stocks Od. Investments are limited to publicly traded financial assets Oe. Each investor in the market is a price-taker Your personal opinion is that security X has an expected rate of return of 0.16. Its beta is equal to 1.2. The risk-free rate is 0.03 and the market expected rate of return is 0.11. According to the Capital Asset Pricing Model , this security is 0 a. underpriced. Ob. overpriced. Oc. fairly priced. Od cannot be determined from data provided. Oe. none of the above. In the mean-standard deviation graph, the line that connects the risk-free rate and the market portfolio is called O a. the Security Market Line Ob the Indifference Curve O c. the investor's utility line Od the Capital Market Line O e none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts