Question: Please try to answer within 30 minutes not 3 days later. 1 2 ART has come out with a new and improved product. As a

Please try to answer within 30 minutes not 3 days later.

1

2

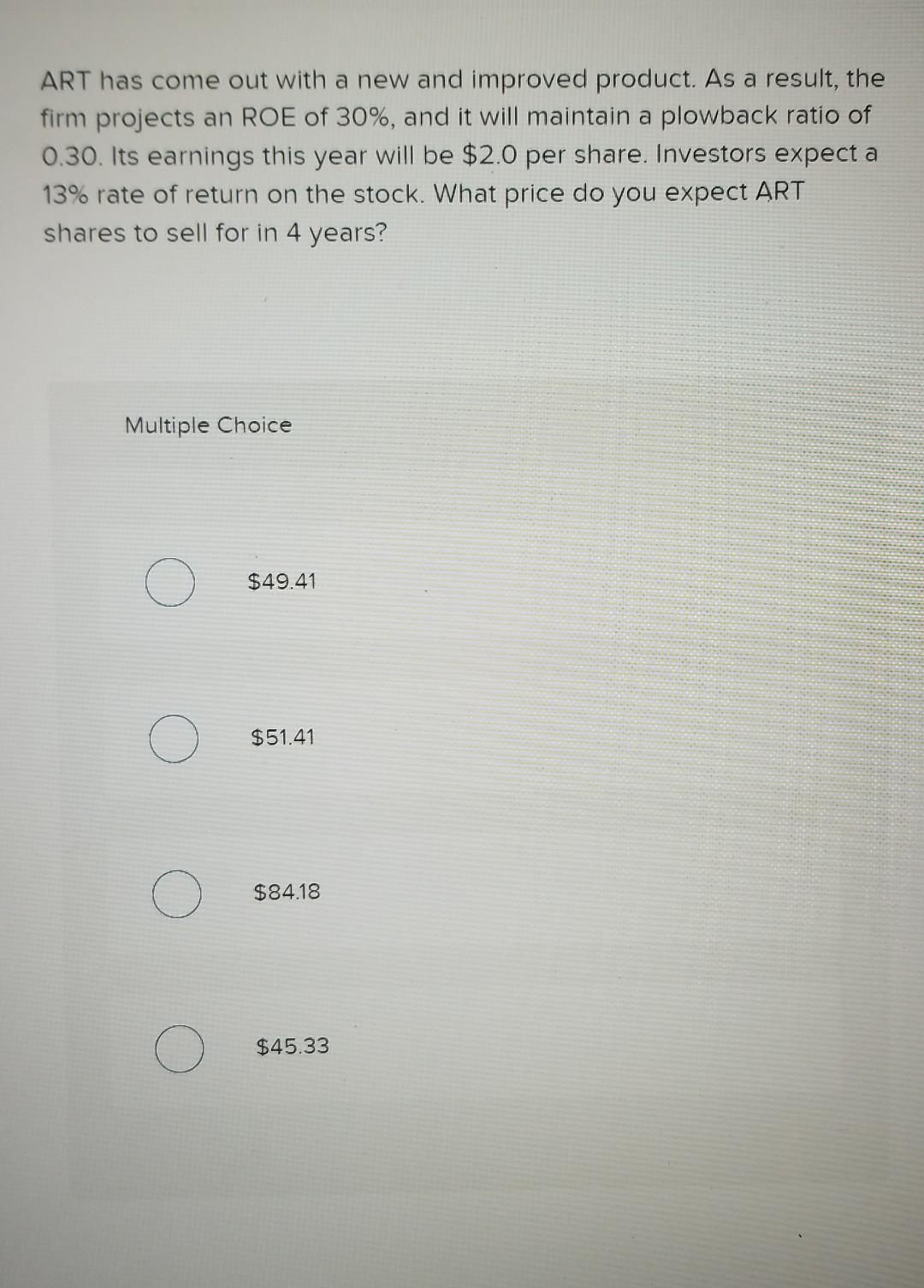

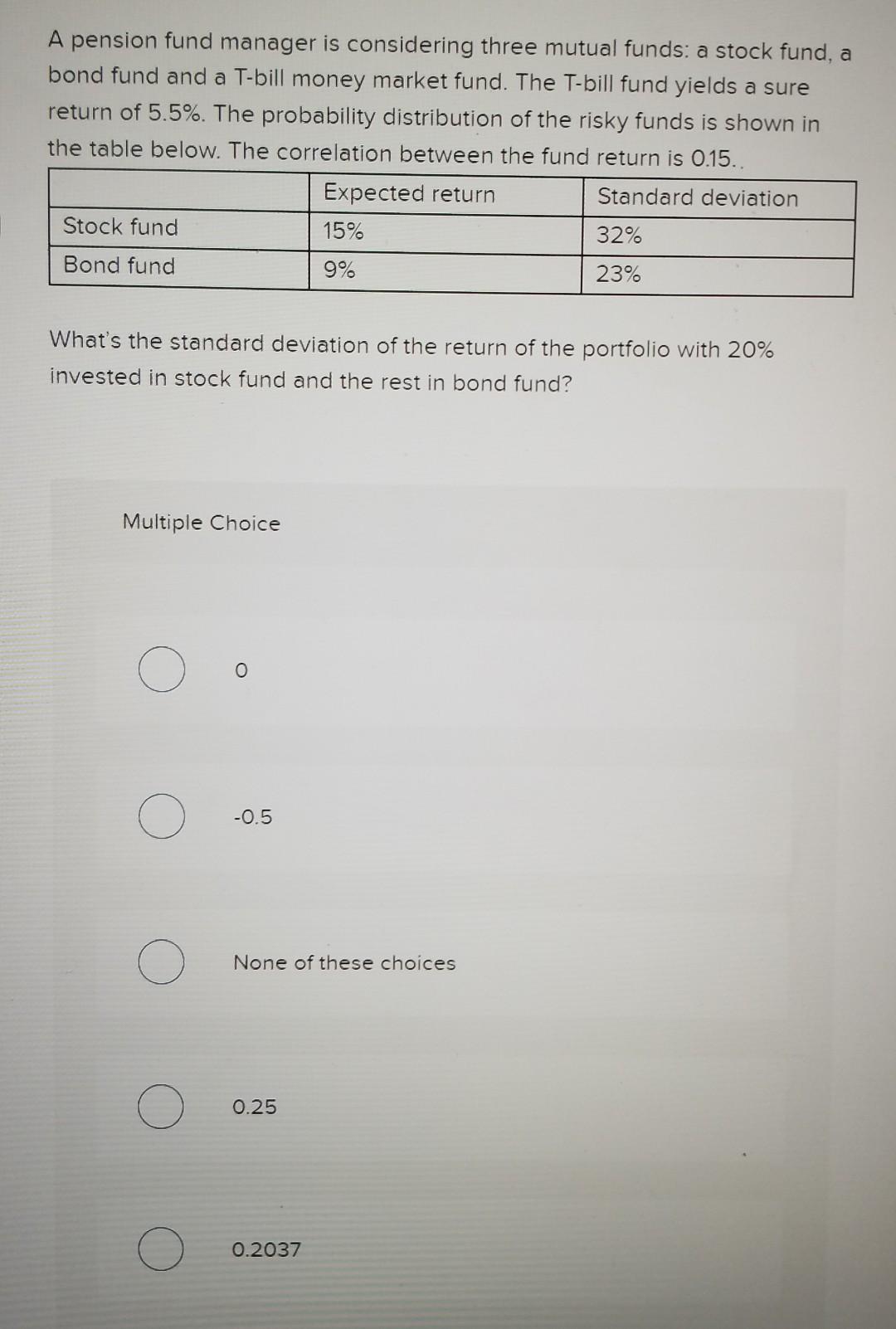

ART has come out with a new and improved product. As a result, the firm projects an ROE of 30%, and it will maintain a plowback ratio of 0.30. Its earnings this year will be $2.0 per share. Investors expect a 13% rate of return on the stock. What price do you expect ART shares to sell for in 4 years? Multiple Choice O $49.41 $51.41 O $84.18 $45.33 A pension fund manager is considering three mutual funds: a stock fund, a bond fund and a T-bill money market fund. The T-bill fund yields a sure return of 5.5%. The probability distribution of the risky funds is shown in the table below. The correlation between the fund return is 0.15.. Expected return Standard deviation Stock fund 15% 32% Bond fund 9% 23% What's the standard deviation of the return of the portfolio with 20% invested in stock fund and the rest in bond fund? Multiple Choice 0 O -0.5 None of these choices 0.25 0.2037

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts