Question: Please try to do all the questions. Chapter 6 Non-current Assets 1. Mark acquired a new computer on 1 October X4 for $57,500 including recoverable

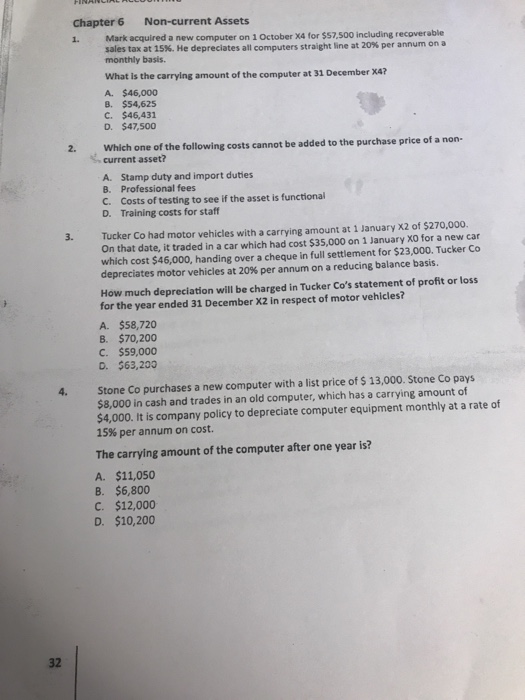

Chapter 6 Non-current Assets 1. Mark acquired a new computer on 1 October X4 for $57,500 including recoverable sales tax at 15%. He depreciates all computers straight line at 20% per annum on a monthly basis. What is the carrying amount of the computer at 31 December X4? A. $46,000 8. $54,625 C. $46,431 D. $47,500 2. one of the following costs cannot be added to the purchase price of a non- Which current asset? Stamp duty and import duties B. A. Professional fees C. Costs of testing to see if the asset is functional Training costs for staff D. Tucker Co had motor vehicles with a carrying amount at 1 January x2 of $270,000. On that date, it traded in a car which had cost $35,000 on 1 January X0 for a new car which cost $46,000, handing over a cheque in full settlement for $23,000. Tucker Co depreciates motor vehicles at 20% per annum on a reducing balance basis. 3. How much depreciation will be charged in Tucker Co's statement of profit or loss for the year ended 31 December X2 in respect of motor vehicles? A. $58,720 B. $70,200 C. $59,000 D. $63,200 4. Stone Co purchases a new computer with a list price of $ 13,000. Stone Co pays $8,000 in cash and trades in an old computer, which has a carrying amount of $4,000. It is company policy to depreciate computer equipment monthly at a rate of 15% per annum on cost. The carrying amount of the computer after one year is? A. $11,050 B. $6,800 C. $12,000 D. $10,200 32

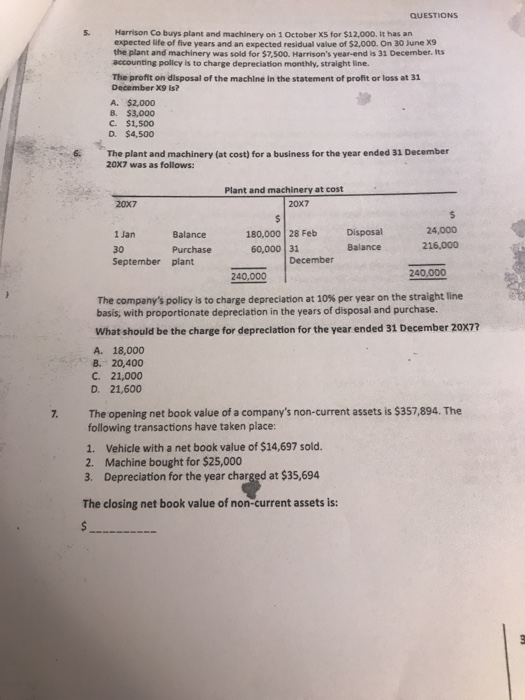

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts