Question: Please try to give the answer in understandable and readable as much as possible. such answer will be rewarded Question 1: Luther Company's selected transactions

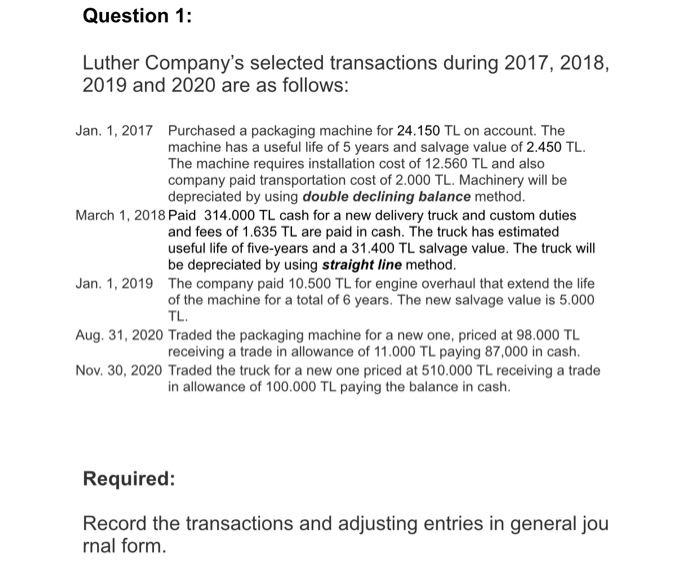

Question 1: Luther Company's selected transactions during 2017, 2018, 2019 and 2020 are as follows: Jan. 1, 2017 Purchased a packaging machine for 24.150 TL on account. The machine has a useful life of 5 years and salvage value of 2.450 TL. The machine requires installation cost of 12.560 TL and also company paid transportation cost of 2.000 TL. Machinery will be depreciated by using double declining balance method. March 1, 2018 Paid 314.000 TL cash for a new delivery truck and custom duties and fees of 1.635 TL are paid in cash. The truck has estimated useful life of five-years and a 31.400 TL salvage value. The truck will be depreciated by using straight line method. Jan. 1, 2019 The company paid 10.500 TL for engine overhaul that extend the life of the machine for a total of 6 years. The new salvage value is 5.000 TL. Aug. 31, 2020 Traded the packaging machine for a new one, priced at 98.000 TL receiving a trade in allowance of 11.000 TL paying 87,000 in cash. Nov. 30, 2020 Traded the truck for a new one priced at 510.000 TL receiving a trade in allowance of 100.000 TL paying the balance in cash. Required: Record the transactions and adjusting entries in general jou rnal form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts